General information on Structured Products (Notes)

Introduction

Luna Wealth Platforms has Instrument service which contains information about all instruments used in the system, including Structured Products (Notes).

Key Terminologies

Structured Note | Term Sheet |

|---|---|

Debt security issued by financial institutions. Its return is based on equity indexes, a single equity, a basket of equities, interest rates, commodities, or foreign currencies. The performance of a structured note is linked to the return on an underlying asset, group of assets, or index. | Non-binding agreement that shows the basic terms and conditions of Structured Note |

Autocallable Note | Note Type |

Note is automatically called prior to maturity, generally after a predetermined period of time, and if the underliers meet certain predefined performance criteria at specific times throughout the investment. | Type of Note which affect calculations |

Coupon Barrier | Geared Put |

Offers investors the potential for a coupon payment if the performance of the underlier is at or above a predetermined level, on a specific observation date. | Type of put offers the investor protection down until x level at maturity. After x, the investor participates in the losses with a gearing equal to 100/x calculated from the initial 100% at inception |

Stepdown | Start Date |

Subsequent targets for auto-call | Date when Structured Note was issued |

Coupon | Maturity |

Annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity | Date on which the life of financial instrument ends, after which it must either be renewed or it will cease to exist |

Coupon Frequency | Observation Dates |

Established dates for the interest payment on a bond | Agreed dates on which market prices are used to determine the performance of a structured note |

Strike Price | Autocall level |

Price at which a call or put option is exercised | Note is automatically called prior to maturity, generally after a predetermined period of time, and if the underliers meet certain predefined performance criteria at specific times throughout the investment. |

How Structured notes appear in LWP and who is responsible for managing them ?

There are 2 (two) ways how Structured Products appear in LWP:

Structured Note is transferred to Bank Account of LWP Client. Back Office is responsible for Structured Notes monitoring if it appears in Client Portfolio.

Structured Note is bought under control of Investment and Sales Departments. All necessary information about Structured Note is filled in by Investment Department.

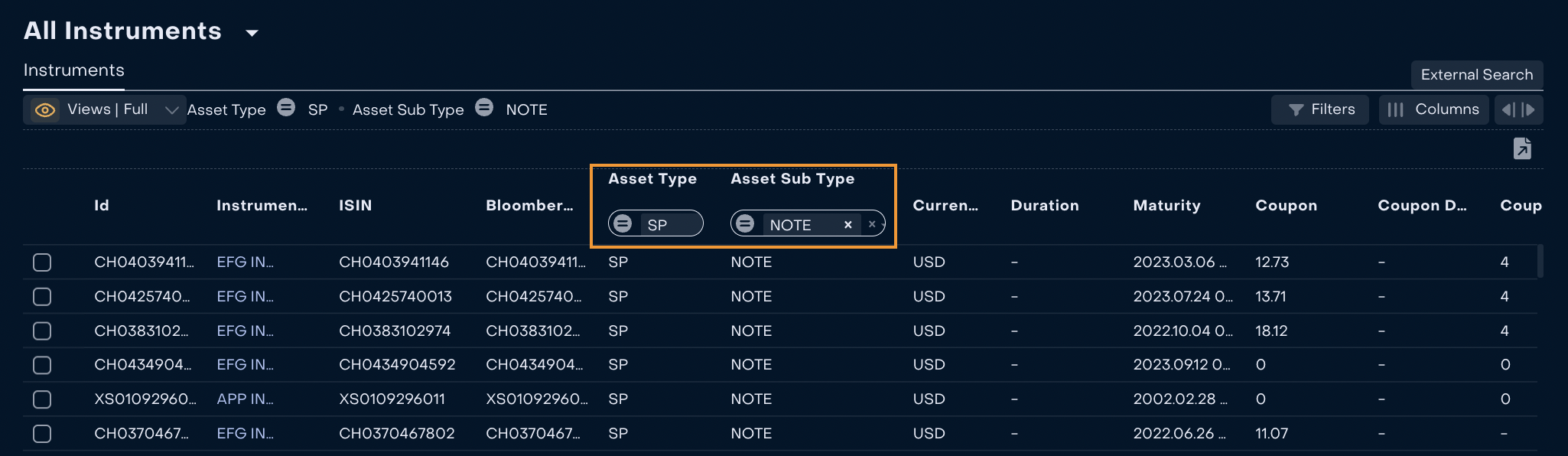

How Structured notes are stored in LWP?

To find Structured Notes, open “All instruments” and set filters: Asset Type= SP and Asset Sub Type=Note.

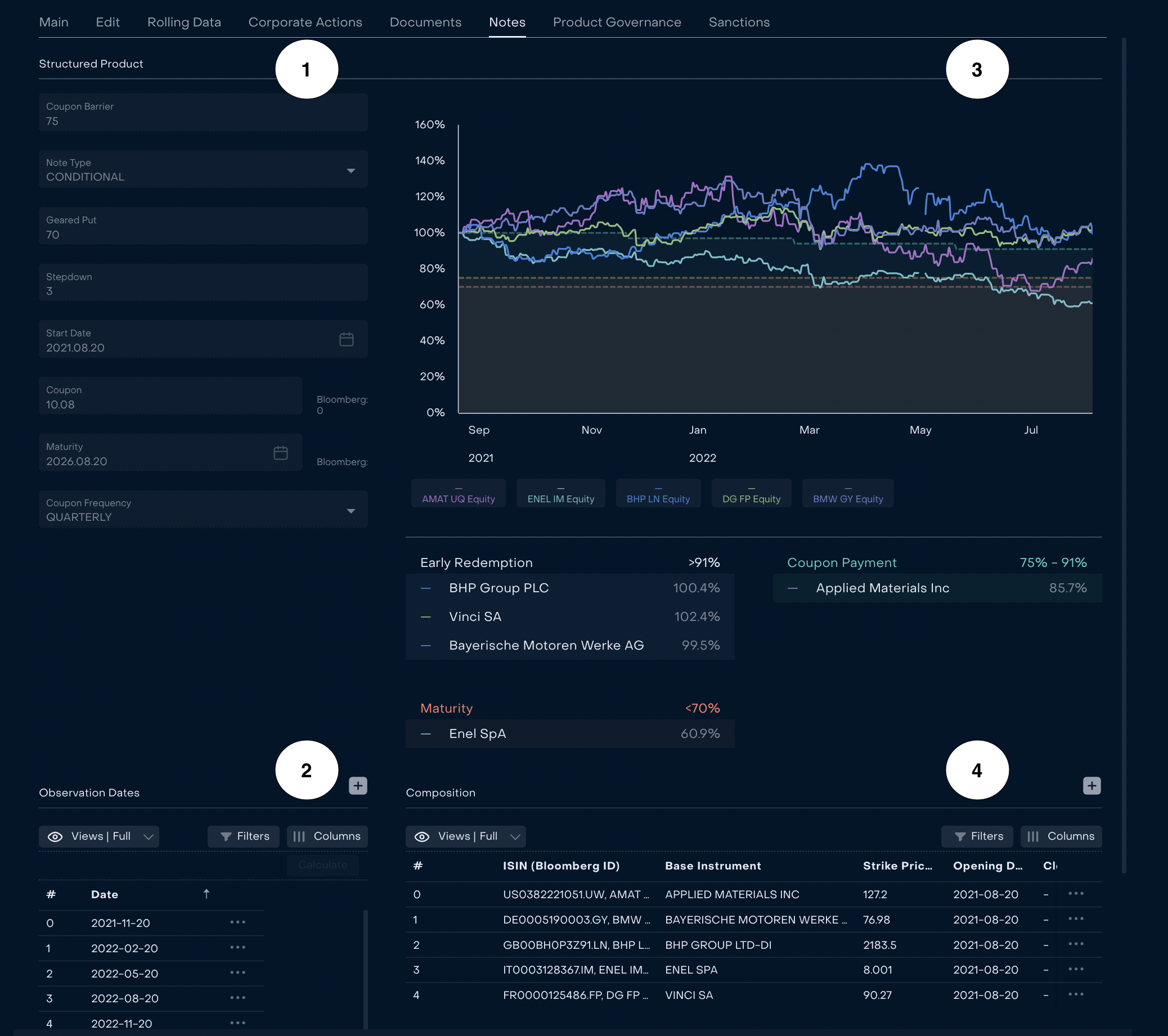

Main information about Structured Note is displayed in tab “Note”

№ | Field | Comments |

|---|---|---|

| Coupon Barrier | Percentage (% ) |

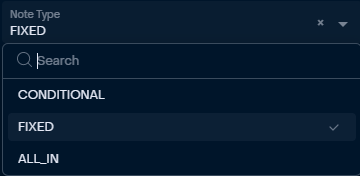

Note Type | There ate 3 (three) types of notes:

| |

Geared Put | Percentage (% ). Doesn’t change after initial fulfilment. | |

Stepdown | Number | |

Start Date | Date | |

Coupon | Regular coupon payments to the investor regardless of market conditions | |

Maturity | Date | |

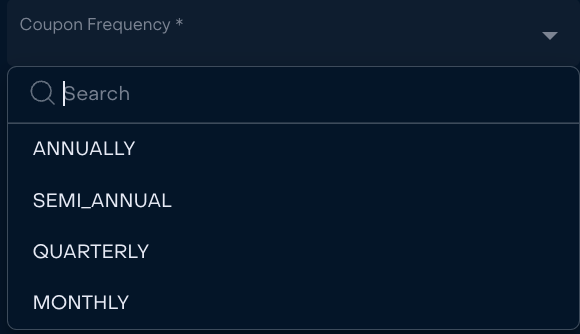

Coupon Frequency | Period  | |

| Observation Dates | Date(s) |

| Сhart | Chart displays general information about Note on certain Observation Date  Autocall level starts from 100% and every observation date decrease by stepdown percentage. If there was an Early Redemption on Structured Note then LWP will display a table with information instead of chart.  |

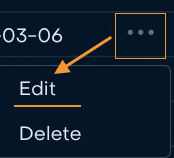

| Composition | Table aggregates instruments that are included in Structured Note with information on ISIN (Bloomberg Id); Base Instrument; Strike Price; Opening Date; Closing Date. Information is editable by click on “…”  |

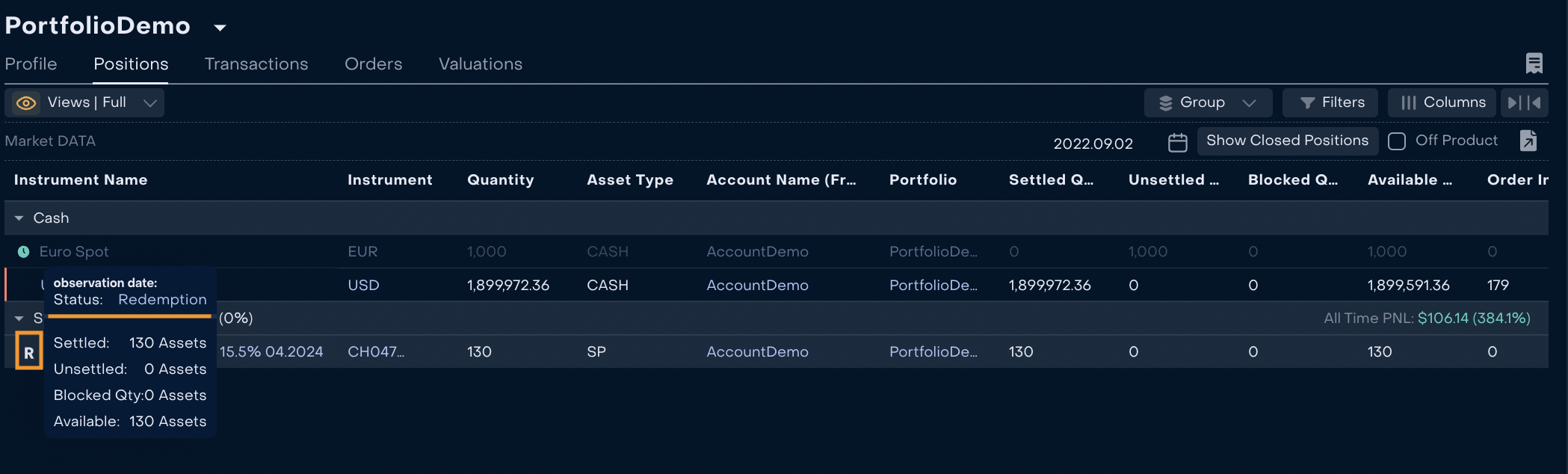

How Structured Product (Note) is displayed in Client Portfolio?

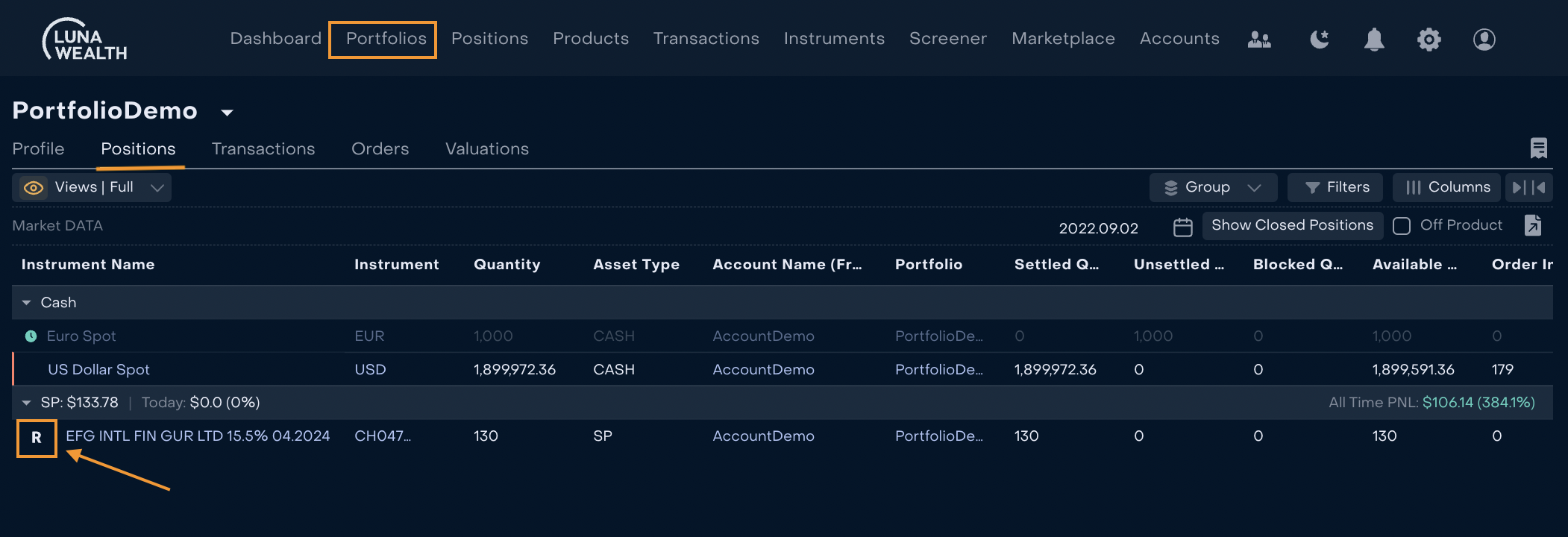

LWP has a feature to indicate most possible status of a Structured Product.

The system monitors Market Prices of products in Structured Product (Note) and displays the following indicators on position in Client Portfolio:

"A"- Accumulation

"ER"- Early Redemption

"P"- Payment

Status | Description |

|---|---|

Accumulation | Price of the lowest equity is lower than Coupon Barrier |

Early Redemption | Price of the lowest equity is higher than current Autocall level |

Payment | Price of the lowest equity is higher than Coupon Barrier |

To check status of Structured Product (Note):

Open Portfolio → Positions

2. Hover over sign of status to see main information.