Order Management

Key Terminologies

An order management system (OMS) is an electronic system developed to execute securities orders in an efficient and cost-effective manner. Brokers and dealers use an OMS when filling orders for various types of securities and can track the progress of each order throughout the system.

Trading Orders | Non-trading Orders |

|---|---|

Instruction to a broker or brokerage firm to purchase or sell a security on an investor’s behalf including forex instructions | Instruction to back office managers to transfer cash or assets, write off the fees |

Corporate Action Orders | Product Subscription Orders |

Orders which causes security or cash movement due to Corporate Action | Order to subscribe / unsubscribe on the Investing Firm products such as recommendation or strategy |

Direct Market Access (DMA) | Over-the-counter (OTC) |

Electronic facility to place an order directly to financial market e xchanges | The process of trading securities via a broker-dealer network |

Execution | Order Initiator |

Order execution is the process of accepting and completing a buy or sell order in the market on behalf of a client | Person who made the decision to place an order |

Marginal Trading | Credit Risk |

Margin is the money borrowed from a broker to purchase an investment and is the difference between the total value of an investment and the loan amount | Credit risk is the possibility of losing a lender takes on due to the possibility of a borrower not paying back a loan |

Key Functionality

OMS facilitates and manages order execution. It is strongly integrated to the Platform and helps to monitor positions in real-time and prevent regulatory violations.

Take a function tour to better understand how to place orders and track their state.

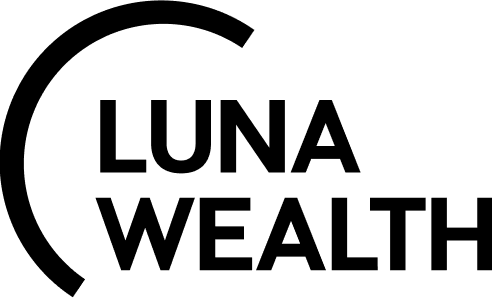

Order Lifecycle overview

In the Luna Wealth Platform all orders (as trading and non-trading and etc.) are integrated into single flow. Depending on the order type order can skip some stages but the common flow is explained below.

Order Types

Below is the list of order type implemented in the System:

Type | Description | |

|---|---|---|

| 1 | Trading Group | |

| 2 | BUY | Buy of the assets |

| 3 | SELL | Sell of the asset |

| 4 | INTERNAL_TRADE | Trade between different Portfolios within one company (sell the asset to Clients from the PROP Account) |

| 5 | FX | Forex Exchange |

| 6 | Non-trading Group | |

| 7 | SECURITY_TRANSFER | Transfer of the Securities |

| 8 | INTERNAL_SECURITY_TRANSFER | Transfer of the Security between Bank Accounts under the same Portfolio |

| 9 | FEE | Charges for a specific service (Success Fee, Management Fee, Custody Fee or other) |

| 10 | WITHDRAWAL | Cash withdrawal |

| 11 | INVESTMENT | Cash investment |

| 12 | CASH_TRANSFER | Transfer of the Cash |

| 13 | INTERNAL_PAYMENT | Transfer of the Cash between Bank Accounts under the same Portfolio |

| 14 | Deposit & Loans orders (also related to Non-trading Order Group) | |

| 15 | OPEN_DEPOSIT | Transfer Cash to the new Deposit |

| 16 | INCREASE_DEPOSIT | Transfer Cash to the existing Deposit |

| 17 | DECREASE_CLOSE_DEPOSIT | Transfer out cash from the existing Deposit |

| 18 | OPEN_LOAN | To receive Cash from the new Loan |

| 19 | INCREASE_LOAN | To increase existing Loan |

| 20 | DECREASE_CLOSE_LOAN | To close existing Loan |

| 21 | Corporate Action Orders | |

| 22 | BOND_REDEMPTION | Redemption of the Asset |

| 23 | SPLIT | Split or Reverse Split of Security |

| 24 | SPLIT_ISIN_CHANGE | When Split happened with ISIN Change |

| 25 | ISIN_CHANGE | Change of Security ISIN In that case initial instrument will be transferred out and new instrument will be transferred in |

| 26 | REPO | A repurchase agreements (RP) is a short-term loan where both parties agree to the sale and future repurchase of assets within a specified contract period |

| 27 | BLOCKED | Internal Block of securities or cash |

| 28 | INCOME | Any income by the asset (coupons and dividends, deposit incomes, loan charges) |

| 29 | EXERCISE_OPTION | Order to enter exercised option details |

| 30 | EXPIRE_OPTION | Order to enter expired option details |

Order Creation

If OMS is activated to your company plan Orders should be created for all operations. To create Order please unsure that all permissions are set up correctly - in the System it is necessary to grand “view”, “create” and “modify” permissions for each order group. See more about permissions in the Profile Configuration.

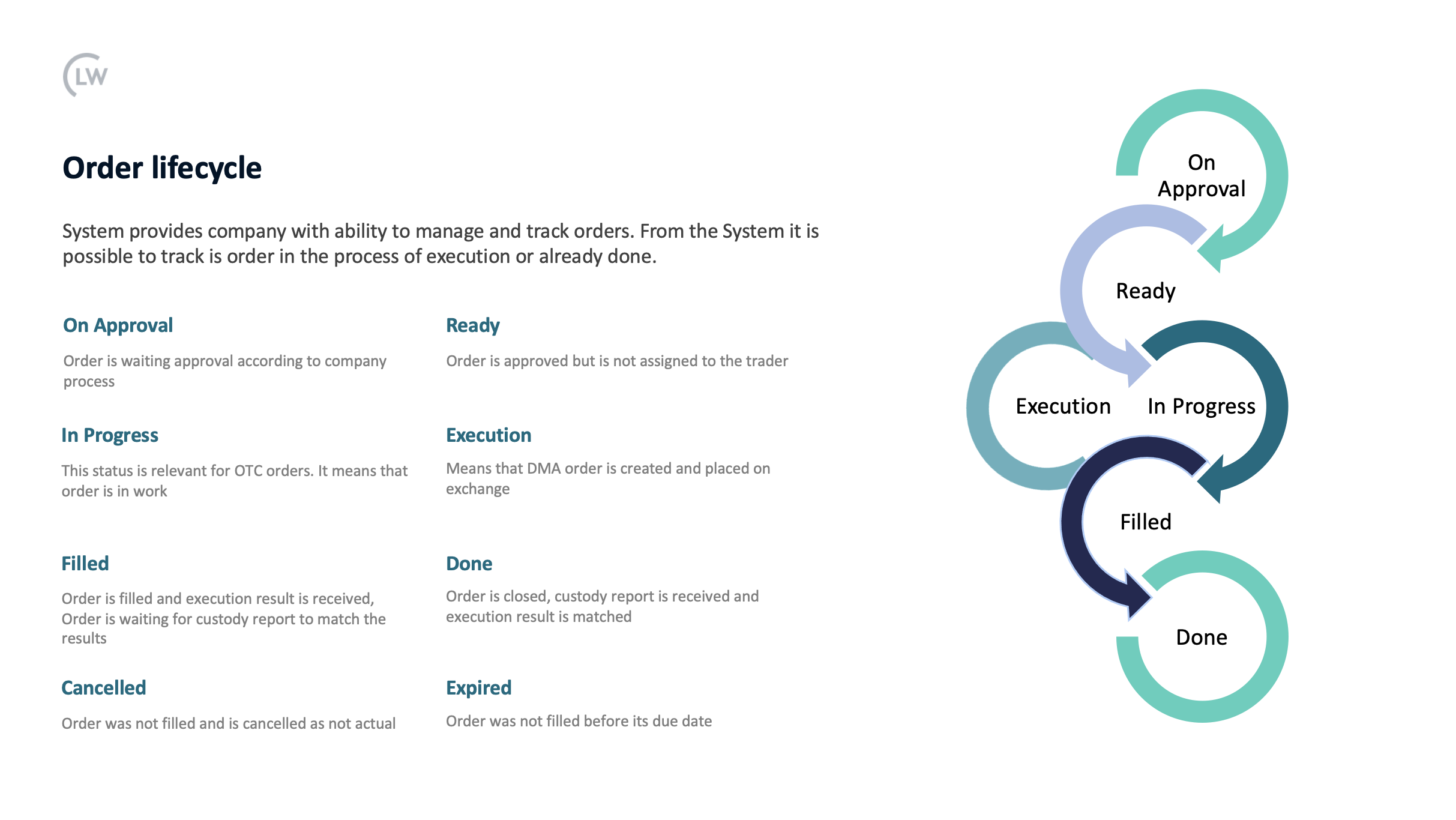

Order creation is allowed from the Portfolio Page by the order Icon (#1 on the screen below) and by the right mouse button on the position screen (#2 on screen bellow). Also it is always possible to create Order from the Order List.

To track Orders open “Orders” list from the Portfolio to see only orders related to Bank Accounts of the selected Portfolio or open global Order List from the Transactions → Orders menu.

To create specific order see the guides:

How to manage Trading Orders

How to manage Non-Trading Orders

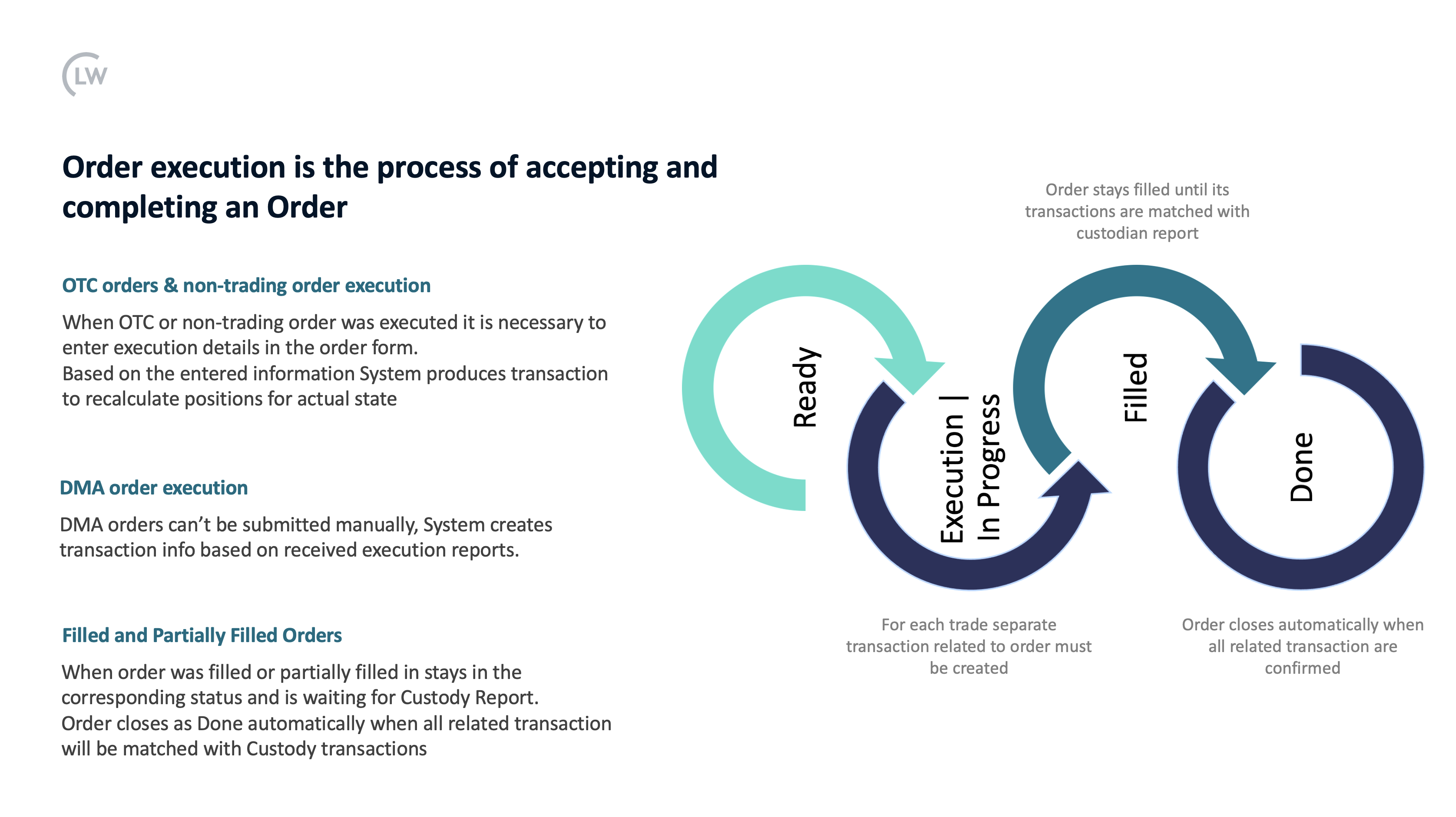

Order Execution

Order execution is the process of accepting and completing an Order. Technically it is required to enter execution result in the System to make Portfolio Position up-to-date. When Manager submits Order (for OTC trades) or Execution Report is received (for DMA trades), System creates Transaction(s) based on received information. Transaction(s) participate in the calculations, they have “Order” status reason and are calculated as Unsettled until Custody report is not received and actual Transaction(s) are not settled. More about order influence on positions here ![]() .

.

![]() See How to execute order manually here.

See How to execute order manually here.

Order Expiration

If Order is not GTC (good till cancel) and due date has passed System will automatically close Order as Expired (if it was not partially filled) or as Partially Filled (If Order was partially executed).

System has default Alert that Order will be expired soon. If due date should be reviewed Order Initiator can change the Due date.

Order Cancellation

Out of date Orders can be cancelled. See the guide how to cancel order.

Please note that order can be cancelled only if it was not filled. If order was filled by the mistake use Revert Function.

Order Revert

Revert function is useful when Order was filled by mistake and it’s necessary to deactivate related transactions and re-submit order or even cancel it.

See how revert function is working here.

Don’t try to deactivate transaction related to Order, after manual deactivation Order status won’t be changed to open state.

Order Changes

It is possible to edit order details such as order type (marker / limit order), limit price, quantity and due date. System allows to change order for its initiator or responsible person.

See hot to change order details in the guide.