Personal Assets Management

Key Terminologies

High Net Worth Individuals (HNWI) possess a variety of assets, some managed by professional companies or managers through management contracts, and others, private assets, managed directly by the clients and/or their assistants. These clients express a clear need for a unified platform—a personal dashboard—that allows them to monitor all their assets, irrespective of the management type. They desire comprehensive visibility over their movable (yachts, cars, planes, etc.) and immovable properties (residential and commercial spaces), track the income and expenses generated by these assets, observe the valuation changes over the period of ownership, and monitor the movements in their bank cards and cryptocurrency wallets. This introduction outlines the sophisticated financial tracking and management requirements of HNWIs, underscoring the necessity for a bespoke, integrated solution that caters to their diverse and dynamic portfolio.

Private Asset | Virtual Portfolio |

|---|---|

A private asset refers to investments or properties not listed or traded on public markets. These can include real estate, private equity, and direct business investments, managed privately by individuals or entities. | Collection of investments tracked and managed through the platforms without agreement with management firm. |

Tangible Asset | Intangible Asset |

Tangible assets are physical and measurable properties owned by a person or company. These include buildings, land, machinery, vehicles, and inventory - assets that have a physical form and value. | Intangible assets are non-physical assets with value based on their intellectual or legal rights and qualities. Examples include patents, copyrights, trademarks, software, and brand recognition, which contribute to a company's value but are not physical objects. |

Key Functionality

Allow your Clients manage tangible and intangible assets separately from the assets managed by the company.

Within Personal Asset Management module they can:

Create different types of tangible and intangible assets,

Store documents,

Add incomes and outcomes related to assets,

Share access to the assets to assistant and personal manager.

Asset Creation

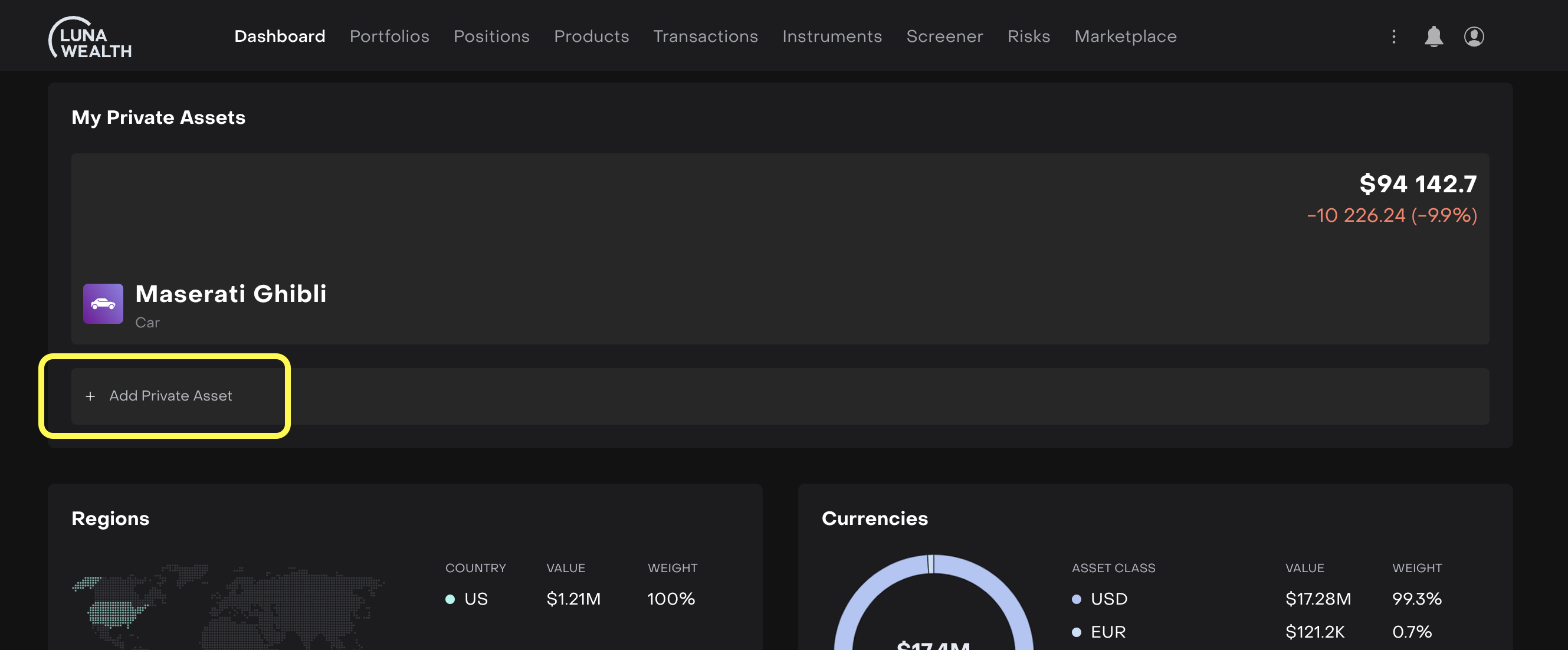

Asset creation from the widget

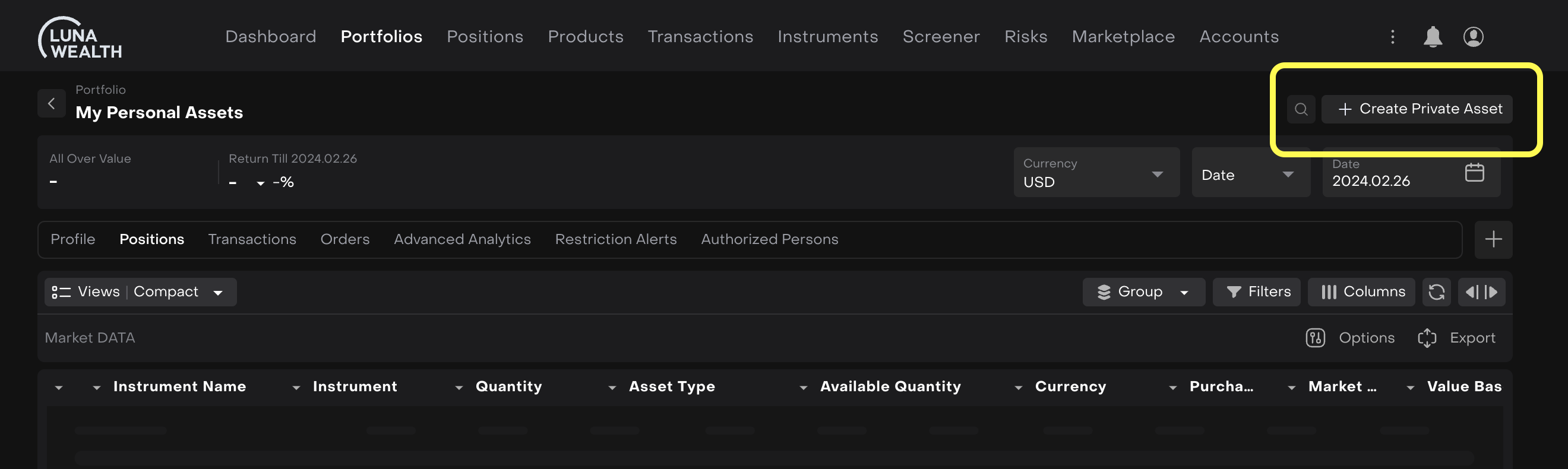

Asset Creation from the Portfolio

To Create Assets:

a. Asset creation is allowed from the “My Private Assets” widget available on the Dashboard.

b. When you already have Virtual Portfolio, it is possible to create asset directly to the Portfolio

While creating Asset:

Define its type and parameters,

Identify it’s current price and add price history,

Upload Documents

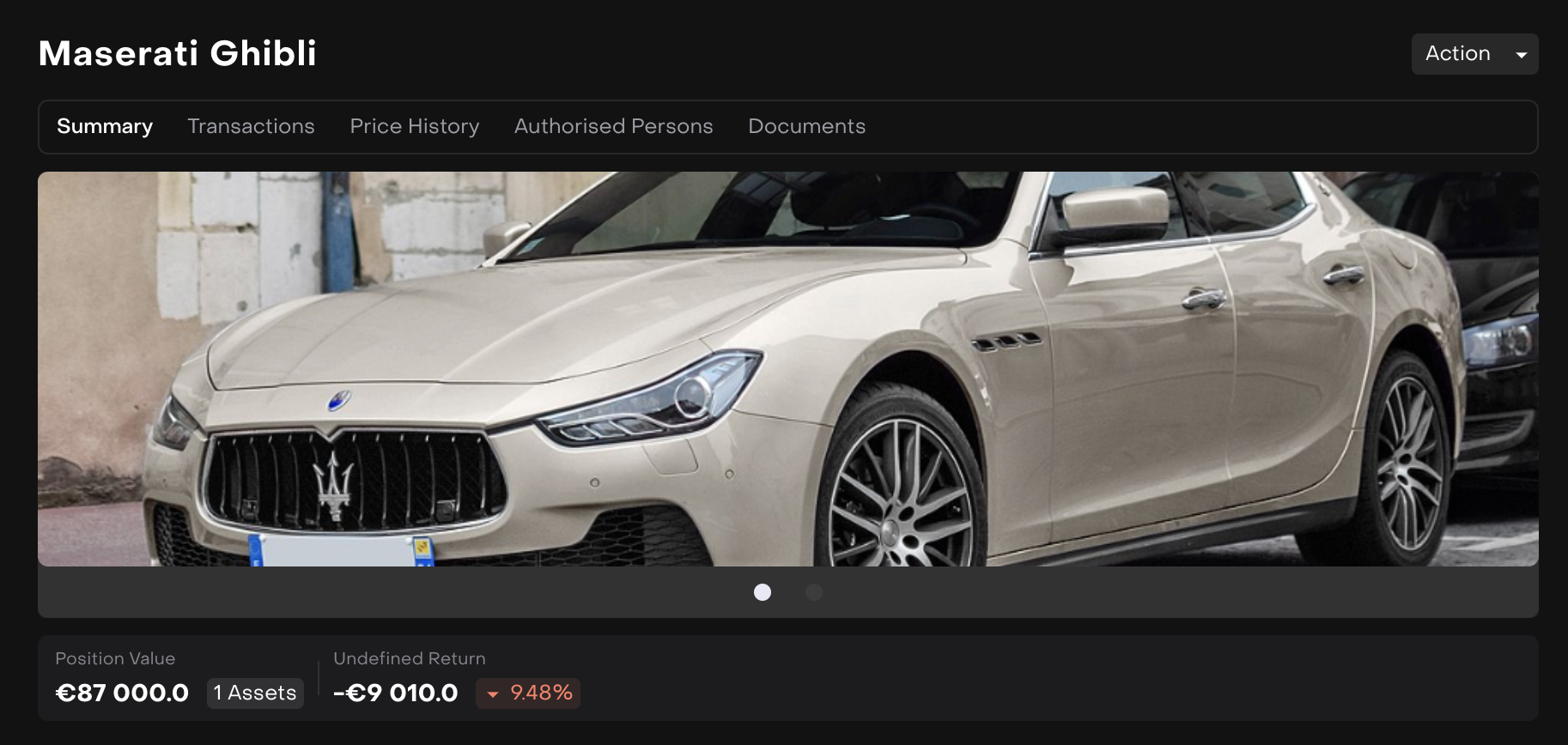

Asset Management

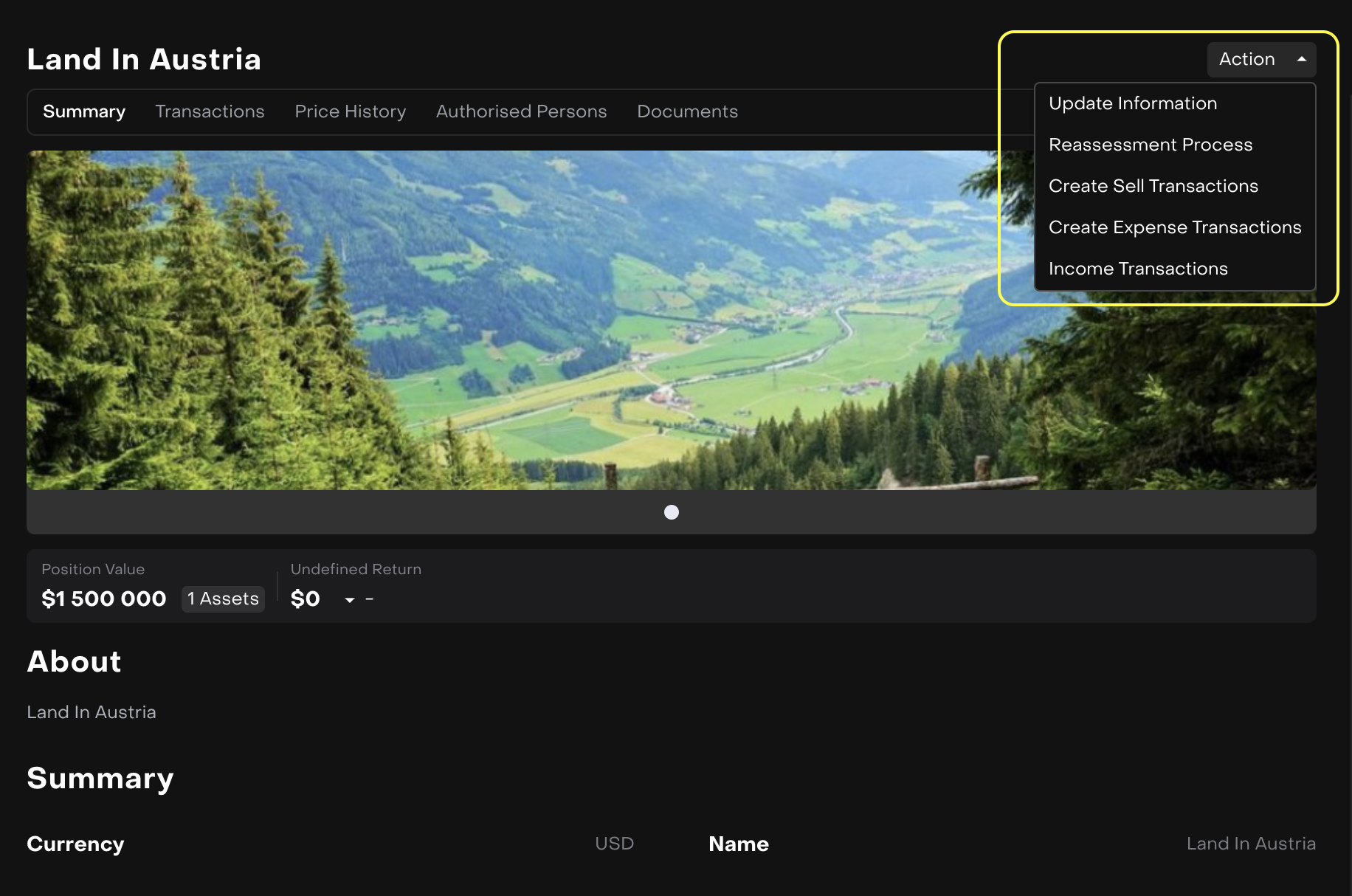

Action Panel

When Asset is created, you can:

Update its information,

Update its current price using “Reassessment Process”,

Create income and expenses related to the asset,

Sell assets

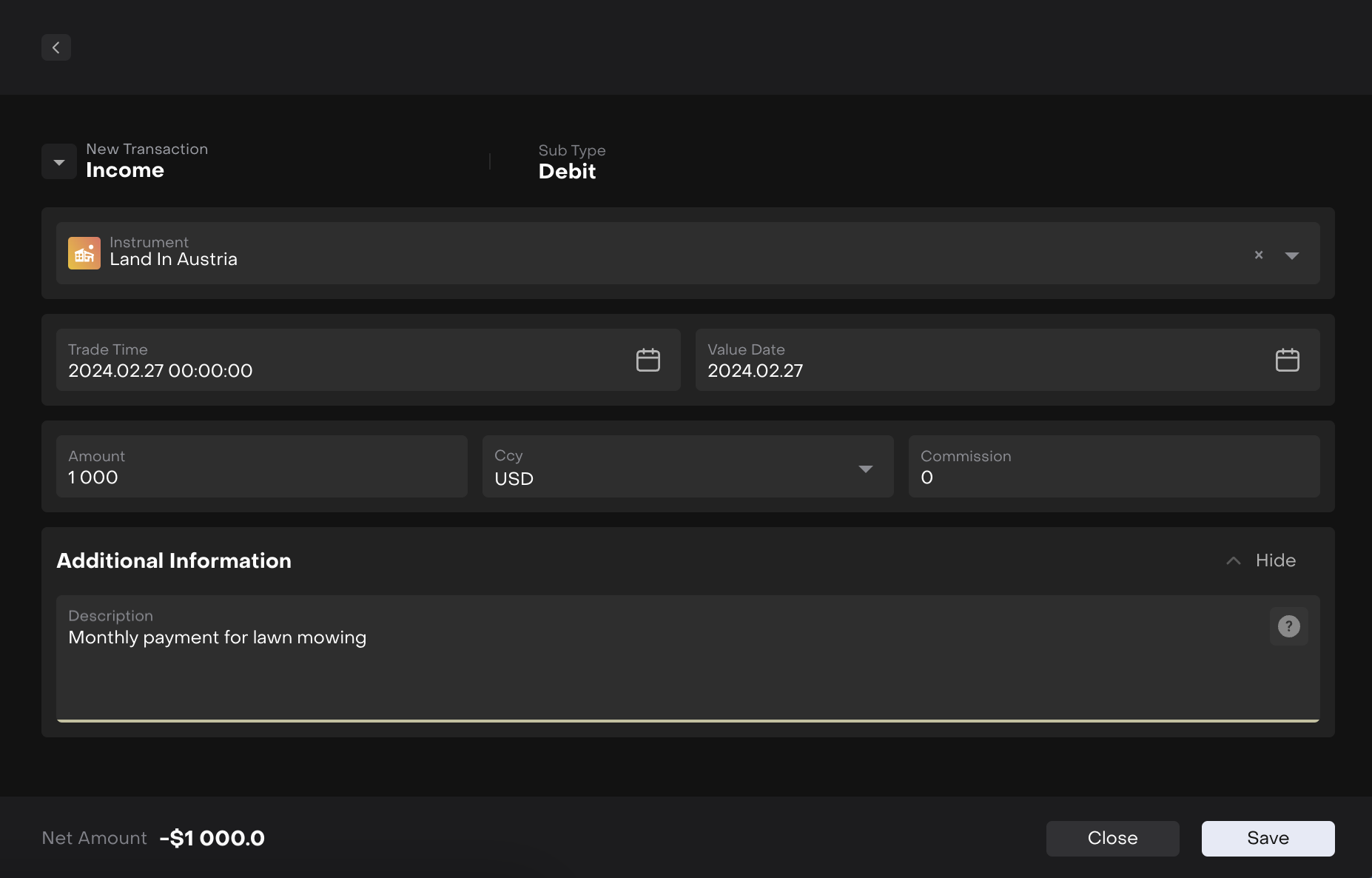

Creating Expense

Using “Personal Asset Management” it is easy to add incomes and expenses.

Create Income or Expense,

Approve Operation,

Track your Gain and Loss

Access Management

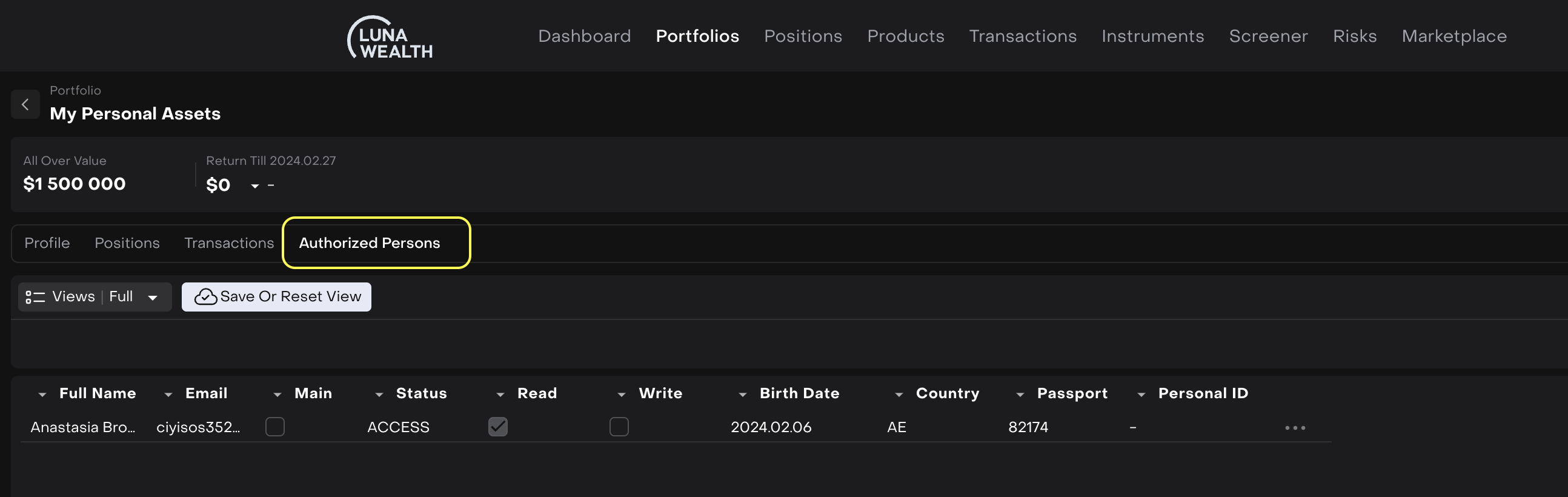

Authorized Person list

Virtual Portfolios created by Clients are always private.

Clients can adds Personal manager(s) to the Portfolio with “View only“ access, so the personal manager can only see Portfolio, Positions, Transactions, Authorized Persons.

Client can add Personal manager(s) to the Portfolio with “Manage“ access, so the personal manager can: update Portfolio details, create new Assets, update an Asset details, create and update Transactions.