PNL methodology

Introduction

The Profit and Loss (PNL) calculation helps to measure and evaluate performance of Portfolio (s) or particular position in a Portfolio. This document introduces the key components and principles of the PNL methodology of the Reluna Platform.

Key Terminology

Portfolio | Quantity (Qty) | Market Price | Purchase Price |

|---|---|---|---|

A collection of financial investments like stocks, bonds, commodities, cash, and cash equivalents, including closed-end funds and exchange traded funds (ETFs). | The current total quantity of the asset / cash on the position | Current price of the instrument in the market (in the asset currency) | The average cost price (in the asset currency) |

Weighted average price (WAP) | Exchange rate (FX) | Currency (Ccy) | Assets Under Management (AUM ) |

Average cost of a security based on the various prices at which securities were purchased and the quantity of securities bought at each price | FX rate of the instrument Ccy to Portfolio Ccy | Currency of the Instrument or Portfolio( PF) in which system calculates all data | The total market value of the investments that a person or entity manages on behalf of clients. |

Performance | Daily PnL | Unrealized PnL | Realized PnL |

Sum of all Value of PF positions | Daily profit which the holder can get or loss in case of position closure on the current moment | The profit which the holder can get or loss in case of position closure on the current moment | The gain or loss which was actually happened by the open part of the position |

Closed Realized PnL | Total PnL | Total PnL, % | Time-Weighted Return (TWR) |

The gain or loss which was actually happened by the closed part of the position | The total profit of the position sum of Unrealized PnL and Realized PnL | The total profit percent of the position regarding starting position | Performance calculation method that presumes multiplying the returns for each sub-period (holding-period and sums up them to showing how the returns are compounded over time. The method helps to eliminate the effects of inflows and outflows of cash. |

1. Client Portfolio Valuation

A Portfolio Profile page displays performance data and AUM

AUM - PF value by positions

PNL - percentage income indicator.

PNL can be positive (indicating a profit, marked as “green”) or negative (indicating a loss, marked as “red”), depending on whether the sale price is higher or lower than the purchase price.

2. General PNL methodology

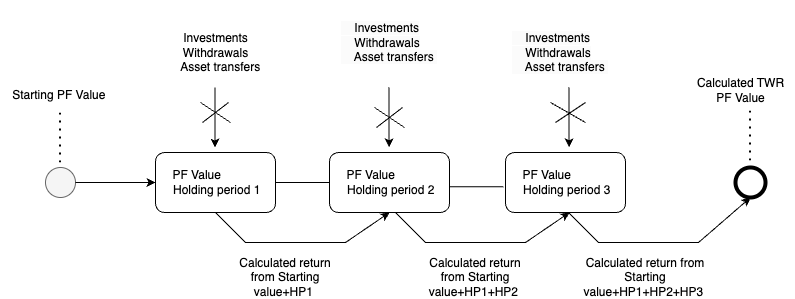

Reluna Platform is based on Time-Weighted Return method for calculation of Profit and losses.

The formula for Time-Weighted Return (TWR) is as follows:

TWR = [(1 + HPR1) * (1 + HPR2) * ... * (1 + HPRn)] - 1

Where:

HPR1, HPR2, ..., HPRn are the holding period returns for each sub-period.

Process of calculating Time-Weighted Return (TWR):

The platform calculates the holding period return (HPR) for each sub-period between investments/withdrawals. During each period there are no investments/withdrawals of cash or asset transfers.

The HPR for each sub-period is calculated as:HPR = (Ending Value / Starting Value) - 1

Multiply the individual HPRs for each sub-period together:

TWR = (1 + HPR1) * (1 + HPR2) * ... * (1 + HPRn) - 1

The result is the Time-Weighted Return, which represents the compounded return over the evaluation period, factoring out the impact of cash inflows and outflows.

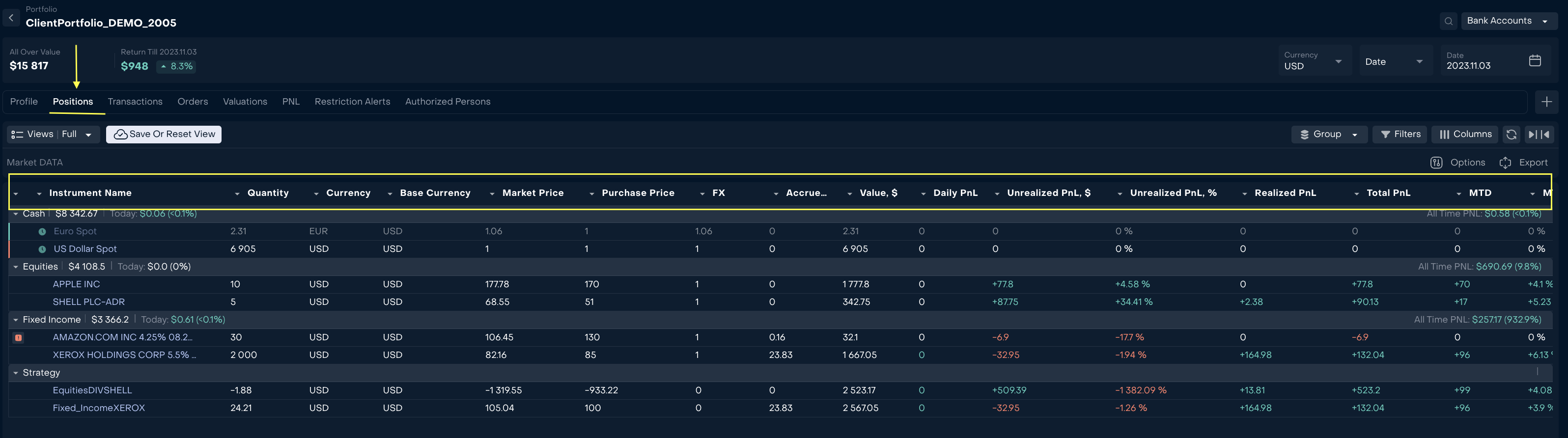

3. Portfolio position information

The platform displays all information for PNL calculations and results of calculations.

Open Portfolio ->Positions → Open position view=Full

Every instrument has automatically calculated Quantity, Prices, Value, PNL etc.

Portfolio Cash, AUM and PNL (daily, realized, unrealized, total etc) are available in USD, EUR, RUB, GBP, CHF on selected date.

By default Portfolio Cash, AUM and PNL are displayed in PF Ccy for today. See more How to see Portfolio Cash,AUM, PNL in different currencies?

To set up necessary filters and columns see more https://help.lunawealth.com/kb/How-can-I-manage-views-and-set-groups,-filters-and-columns-in-the-system-%3F.3305242641.html

3. 1. Position Quantity

Position Quantity is based on the retrieved transactions that are summed up by the “Quantity” field for securities and summed up by the “Net Amount PF Ccy” (cash in transaction execution ccy) field for cash.

3.2. Price

3.2.1 Weighted average price

For performance calculations the platform uses the Weighted average price (WAP)

Process of calculating the weighted average price (WAP) for securities:

The Platform multiplies the number of securities acquired at each price by that price. This calculates the total value of securities acquired at each price.

The Platform adds the values obtained in step 1 for all different prices. This gives the total value of all the securities acquired.

The Platform divides the total value from step 2 by the total number of securities acquired. This calculates the weighted average price per security.

Transaction’s fields used for calculations: “Purchase Price” , “Quantity”.

The calculation process is the same for cash transaction, but calculations are based of “FX rate” and and field “Net Amount PF Ccy”

WAP is calculated as WAP= Σ (Qty*Price)/Σ(Qty)

N.B. In case of Transfer, Purchase Price will be calculated as Final Market Price of the Asset on the day of Transfer.

3.2.2 Market price

Market prices are loaded from different pricing sources.

All instruments are grouped by asset type and pricing sources are linked to a group. Market price is loaded when there is an open position for this instrument on any Portfolio.

After end-of-day the platform automatically loads close prices for previous day.

When a new market price is loaded or final market price is loaded the platform automatically recalculates the positions of Portfolios and accordingly PNL.

3.3. Position Value and Portfolio Value (AUM)

A general formula for calculating the Position Value in a portfolio:

Position Value = Σ (Qty × Price)

Qty: qty of assets of specific security held in the portfolio.

Price: market price per asset of the Security

Σ: sum up of values

This formula for calculation of the Position Value for that specific security within the portfolio.

A general formula for calculating the Value of a portfolio (AUM):

Total PF Value = Σ (Qty * Market Price)

Qty: qty of assets of each security that is held in portfolio.

Market Price: current market price of one unit or share of each security.

Σ: sum up of values for each security

3.4. Calculations of PNL

PnL of positions is calculated in accordance with the instrument type. All instruments are classified as Cash, Equity / ETF, Structured Products / Fixed Incomes, Options / Futures.

Position’s PNL is calculated on the basis of transactions. If transaction is multileg, please follow additional notes below.

3.4.1. Cash PNL

Calculated transactions: FX, Fee

Fee transactions affect only Closed Realized PnL of cash position.

FX PNL appears when Porfolio Ccy differs from cash position Ccy.

Formulas for calculation:

Realized Pnl = (Sell Price - Purchase Price) * Qty - Commissions

Closed Realized PnL=(Sell Price - Purchase Price) * Qty - Commissions

N.B. Closed Realized PnL is calculated only on closed positions

Unrealized Pnl = (Market price - Purchase price) * Qty

Total Pnl = Unrealized Pnl + Realized Pnl

Total Pnl (%) = Total Pnl / (Qty * Purchase price)

3.4.2. Equity/ETF PNL

Formulas for calculation:

Realized Pnl =(Sell Price - Purchase Price) * Qty - Commissions+ Received Incomes

Closed Realized PnL=(Sell Price - Purchase Price) * Qty - Commissions+ Received Incomes

N.B. Closed Realized PnL is calculated only on closed positions

Unrealized Pnl = (Market price - Purchase price) * Qty

Total Pnl = Unrealized Pnl + Realized Pnl

Total Pnl (%) = Total Pnl / (Qty * Purchase price)

3.4.3. Structured Products / Fixed Incomes PNL

Formulas for calculation:

Realized PnL = ((Sell Price - Purchase price)) * Qty -Commissions - Accrued from transaction + Received Incomes

Closed Realized PNL=(Sell Price - Purchase Price) * Qty -Commissions - Accrued from transaction + Received Incomes

N.B. Closed Realized PnL is calculated only on closed positions

Unrealized Pnl = (Market price - Purchase price) * Qty/ 100+ Accrued from instrument

Total Pnl = Unrealized Pnl + Realized Pnl

Total Pnl (%) = Total Pnl / (Qty * Purchase price)

3.4.4. Options / Futures PNL

Formulas for calculation:

Realized Pnl = Commissions + ((Sell Price - Purchase price) * (N of contracts) * (contract size))

Closed Realized PNL= (Sell Price- Purchase Price) * Qty -Commissions - Accrued from transaction + Received Incomes

N.B. Closed Realized PnL is calculated only on closed positions

Unrealized Pnl = (Market price - Purchase price) * (N of contracts) * (contract size)

Total Pnl = Unrealized Pnl + Realized Pnl

Total Pnl (%) = Total Pnl / ((Qty * Purchase price) *Contract Size)