Portfolio Management

Key Terminologies

In any asset management environment, there are terms such as Portfolio, Bank Account, Performance, etc. Following are the list of such terms and their definitions as used in Reluna Platform.

Portfolio | Bank Account |

|---|---|

A portfolio is a collection of financial investments like stocks, bonds, commodities, cash, and cash equivalents, including closed-end funds and exchange traded funds (ETFs). | Account opened by the Bank / Custody where financial investments are actually held. |

Performance | Position |

Gain or loss of an investment or of a portfolio. | Position is the reflection of the amount and performance of a security, asset, or property that is owned or been owned by some individual or other entity. |

Omnibus Account | Prop Account |

Account where it’s possible to hold and Manage assets of more than one person, it saves the anonymity of the persons in the account. | Account with Company own positions |

Market Value | Assets Under Management (AUM) |

Is the price an asset would fetch in the marketplace. | The total market value of the investments that a person or entity Manages on behalf of Clients. |

Key Functionality

Take a functions tour to know Portfolio Management better.

Portfolio overview

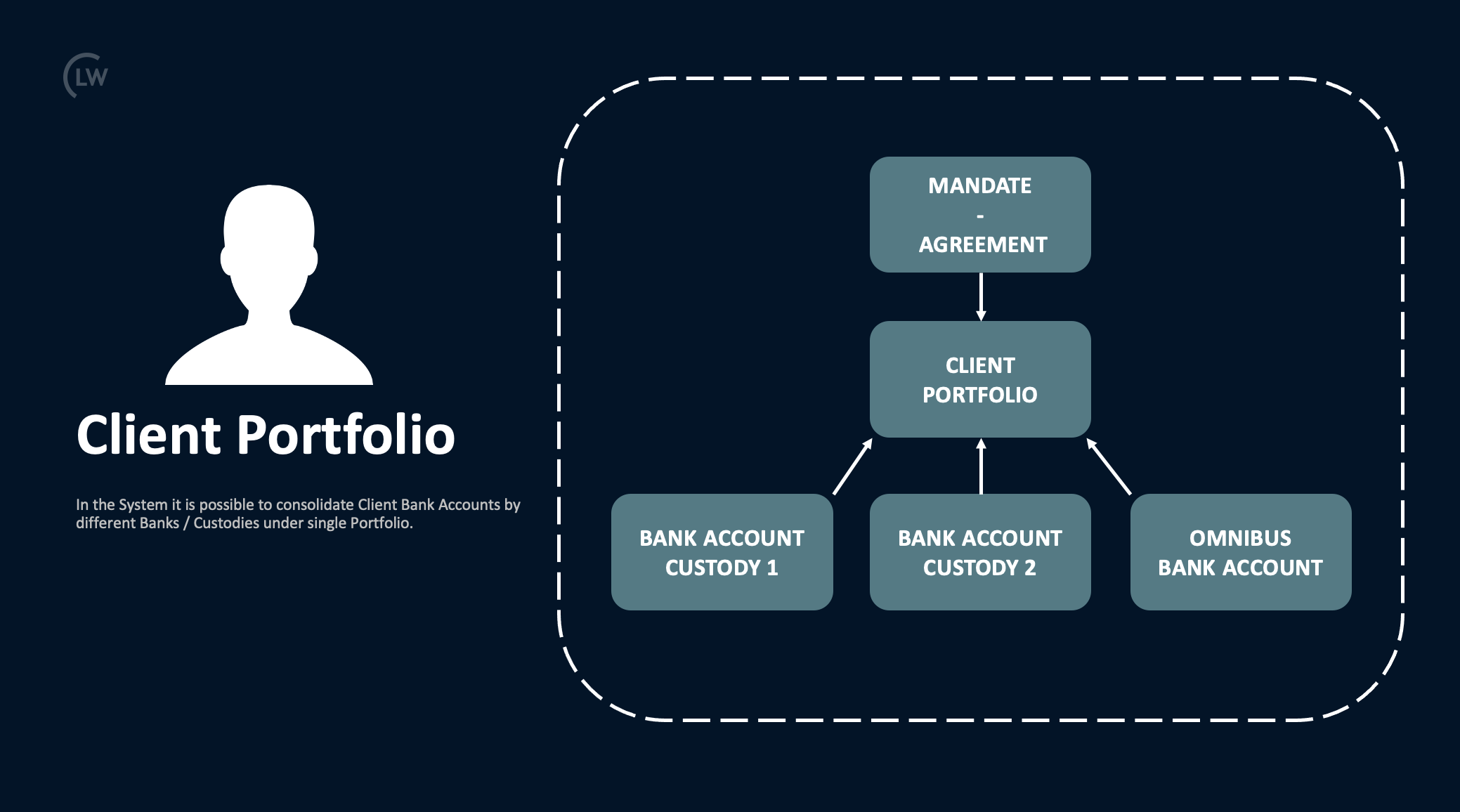

In the Reluna Platform Portfolio consolidates data by all Client Bank Accounts under one Agreement. It helps Company and their managers to have a global view of their investments. Also Platform allows to create and manage Company Prop Portfolio.

Portfolio Scheme

Dashboard

When you open Portfolio, the first screen that you see is Profile. Here, you can take a quick glance at the performance of the current Portfolio and its structure. It is a dashboard that contains widgets with different data, and you can customize the dashboard page by specifying which widget to include.

Currency selector

Date or range selector

Dashboard Period selector with ability to select custom period

Widgets container

Positions

In the Positions table you can find Portfolio Positions. Such tools as view Manager, groups, filters, columns will help you to receive most relevant data for analysis.

Chose views to select most suitable data to see on positions

Select Group option, add filters and change columns in the table

Export the table to Excel

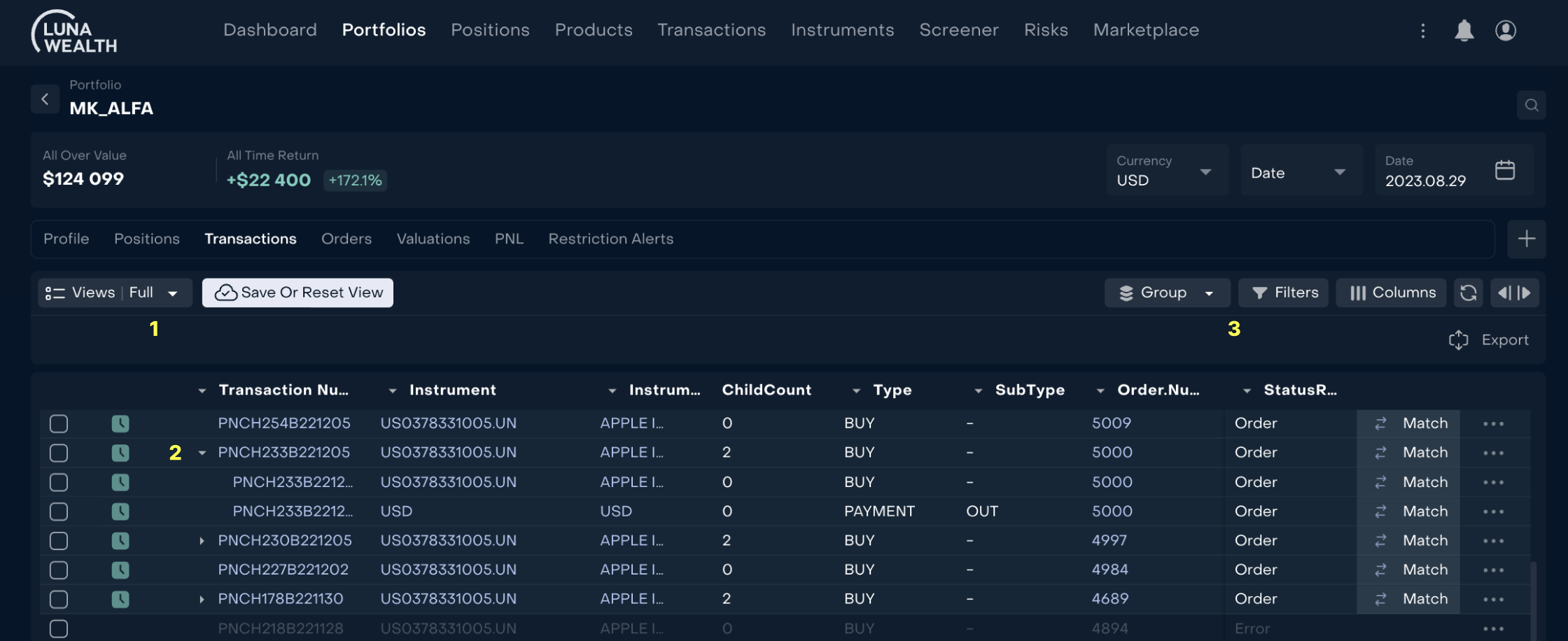

Transactions

Transaction tab display all transactions related to Portfolio Bank Account(s). Depending on the User permission table includes only active transactions or also deactivated.

Chose views to select most suitable data to see on transactions

Open transactions which have hierarchy such as FX, SPLITS, INFO and etc

Select Group option, add filters and change columns in the table and export data to Excel

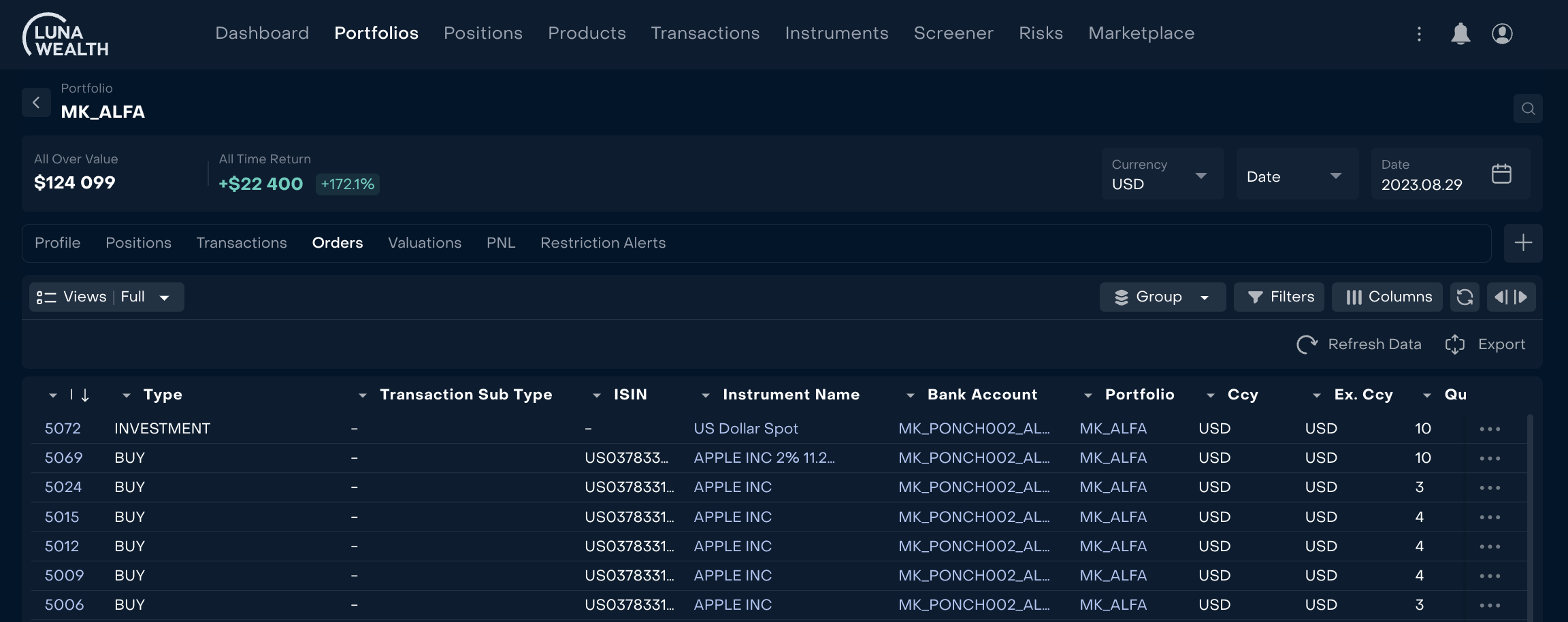

Orders

Order table contains all orders related to Portfolio Bank Account(s). It has as trading orders and non-trading. This table will help you to track order activity.

Status portfolio

Status | Description |

|---|---|

Active | The portfolio is active and undergoing management and investment processes. |

Closed | The portfolio has been closed and is no longer active. |

Deactivated | A portfolio that was started possibly by mistake and deactivated. This is a portfolio that was not relevant. |

Draft | The portfolio is in the process of being created or edited and has not yet been fully confirmed and activated. |

Portfolio Types

Status | Description |

|---|---|

Client | Client portfolio. |

Company | Portfolio owned by the AM / BR Company (prop., omnibus). |

Consolidated | Portfolio which consolidates a few Client portfolios. |

Virtual | Portfolio to store private assets. |

See Also

🔗 Dashboard & Widgets

🔗 Transaction Management

🔗 Position Calculations

🔗 Order Management