Release 3.86 2023-10-05

We are pleased to announce the release of the Platform on 5 October 2023.

New features

Calculation logic:

we have made changes to how Fee transactions are accounted for:

Previous Approach: Commissions debited from the bank account were previously considered in the Realized PnL of the cash position, impacting its profitability metric.

New Approach: Now, such fees will be counted in the Closed Realized PnL of the cash position. This means that the profitability of the open part of the cash position will remain unchanged, but these fees will be reflected in the overall profit of your portfolio.

This adjustment will provide a more accurate representation of your portfolio's actual profitability, taking into account that commissions are charged for overall portfolio management, not for an individual position.

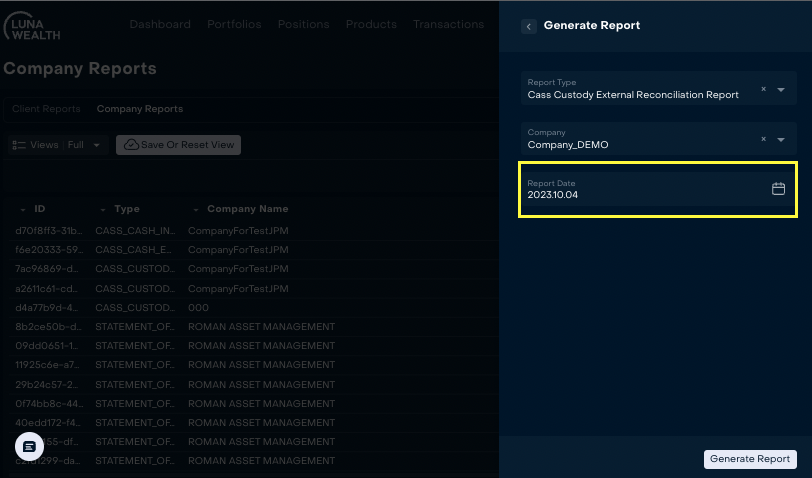

for Back Office:

Switched to one obligatory Report date to request the Cass reports

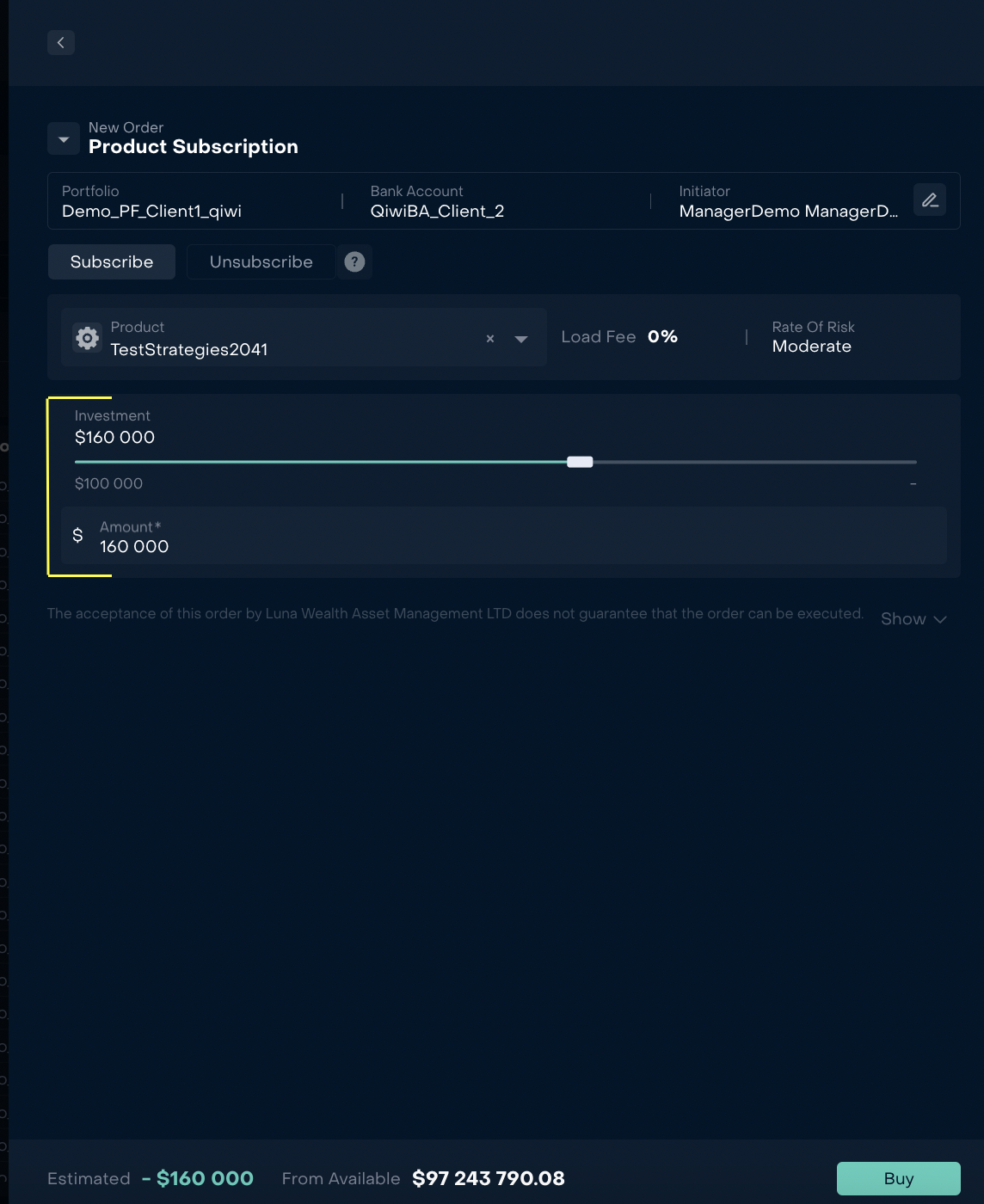

for Traders and Investment Department:

Updated form of Product Subscription order

Renamed “Increment” → “Investment”

Redesigned field “Amount”

Value from Slider is automatically duplicated to field “Amount”

Updated influence of Product orders on Positions' available quantity

New Brokerage Solutions

Enhanced Bank Account Designation and Broker-side Account Determination

To offer you more versatility and control over your trading and cash holding processes, we've introduced a series of improvements:

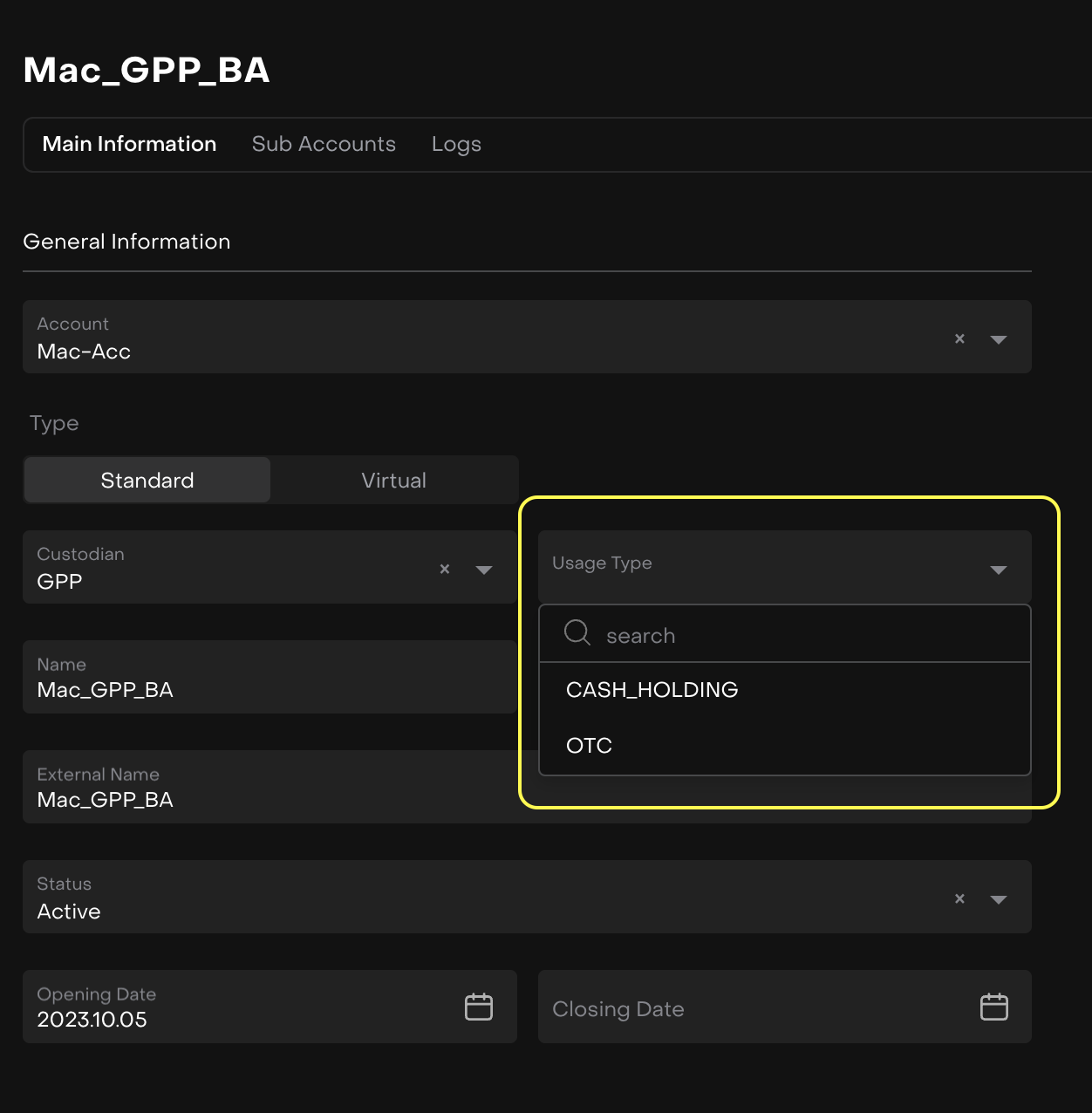

Bank Account Designation:

We've introduced a new

Usage Typefield at the Bank Account level.

You can now specify the type of bank account—whether it's for trading (DMA/OTC) or for cash holding (Cash Holding).

Multiple selections are allowed, streamlining your trading processes.

However, the choice of DMA/OTC is dependent on the

DMAandOTCfield option on the Custodian level. IfDMAis not set orOTCis not set on the linked Custodian, the corresponding option cannot be selected on the Bank Account.

EOMS Trading - Broker-side Account Determination Logic Update:

When order was places using integration between Reluna Spaces the system will only consider accounts designated for trading (DMA and/or OTC). Cash Holding accounts will be excluded.

For Buy/Sell/FX orders:

Strictly designate the order to the bank account where the asset is located.

If multiple accounts are found, the system will:

Opt for the bank account (any suitable one) where the number of securities equals or surpasses the order's

Quantityfor sale.If securities on each account are fewer than the order's

Quantity, no Bank Account will be automatically designated.

If only one Bank Account is found:

But the securities on it aren't enough (position

Quantity< orderQuantity), no Banj Account will be automatically designated.If there are sufficient securities for sale, that Bank Account will be chosen.

This update aims to optimize your trading processes, ensuring that trades are aligned with the most appropriate bank accounts and conditions.

Technical information

Fixed automatic update of the Instrument Asset Type on internal strategy position

Filled in automatically field “Deal date” for all late trades& Fields keeps information about exact timing of late trades

Fixed logic for calculations block of the system: when field value was deleted the system will make recalculation of data

Disabled "+" button in Account’s Contacts when a user who does not have access to change Account

Fixed FX_Product order form: available values in the SubType field are BUY or SELL.

Please note that some features may require additional setup steps. For more information, please refer to the updated user guide(s).

We hope you enjoy the new features and changes in this release. As always, please let us know if you encounter any issues or have any feedback.