Release 4.7

Release Version Number: 4.7

Date: 30 Aug, 2024

Platform: Re:Luna

We're excited to announce the latest update, designed to enhance the capabilities and user experience for our Clients. This release note provides a comprehensive overview of the new features, improvements, bug fixes included in this update.

New Enhancements and System Updates:

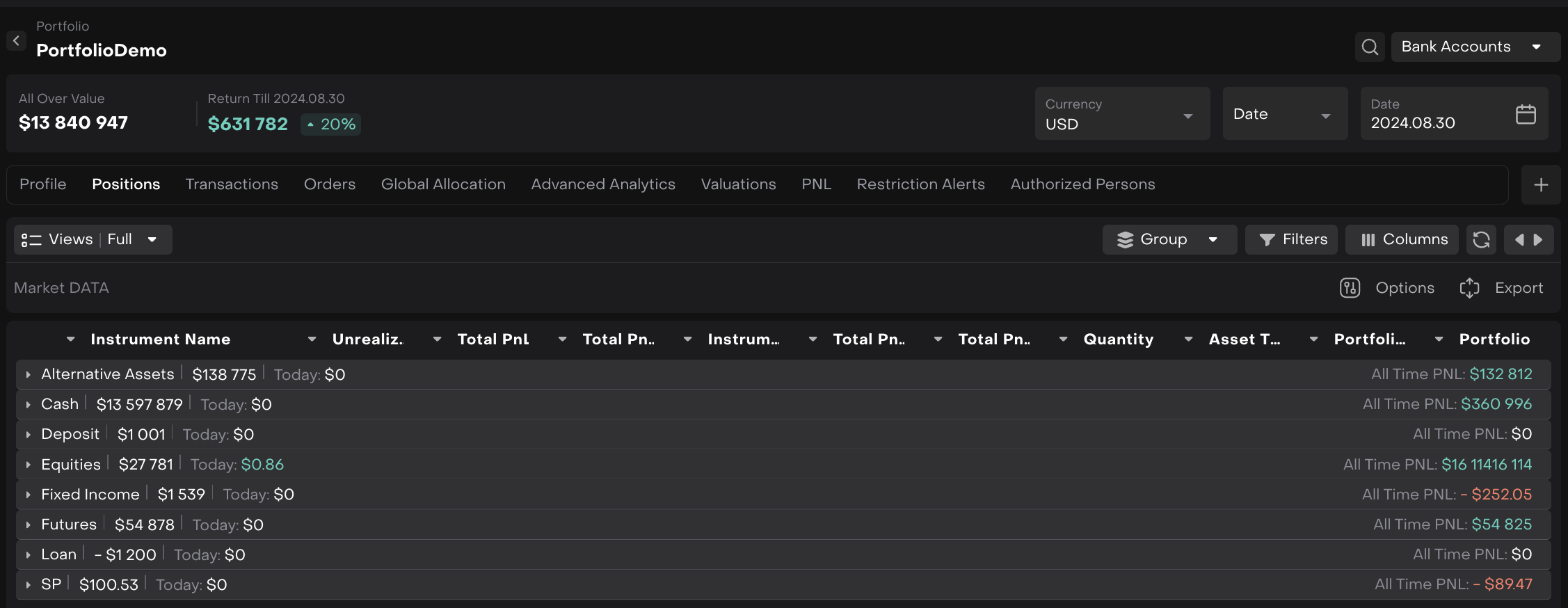

Default Collapsed Groupings for Tables

For Role(s): All Users

Table groupings for positions are now collapsed by default. This change ensures that all tables initially display groupings in a collapsed state, reducing clutter and improving navigation. Once a user expands or collapses any groupings and configures table settings, the table will remember these adjustments. The state of the groupings will remain as set by the user until the page is refreshed or the user navigates away or returns.

Feature Benefits:

Enhanced User Experience

Persistent Customization

Improved Navigation

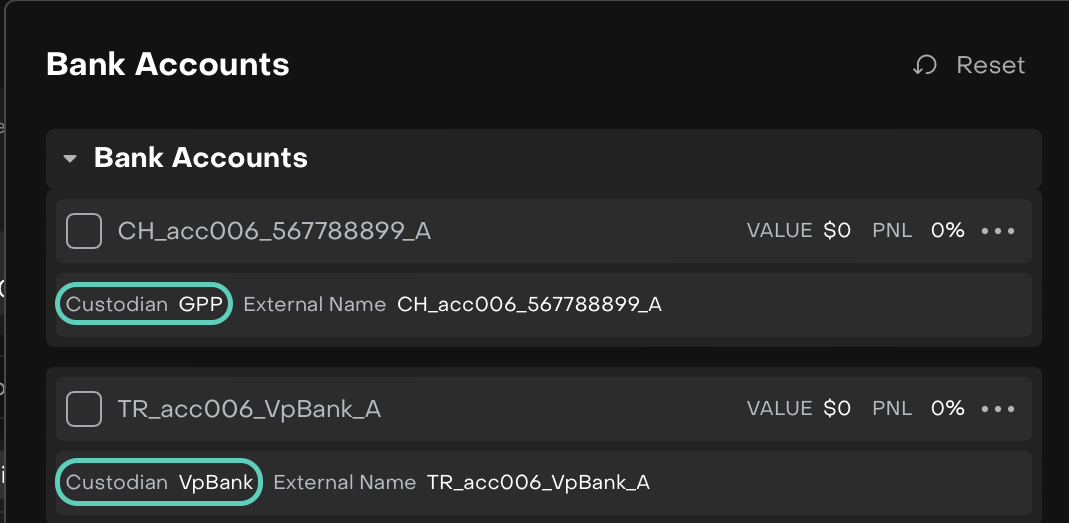

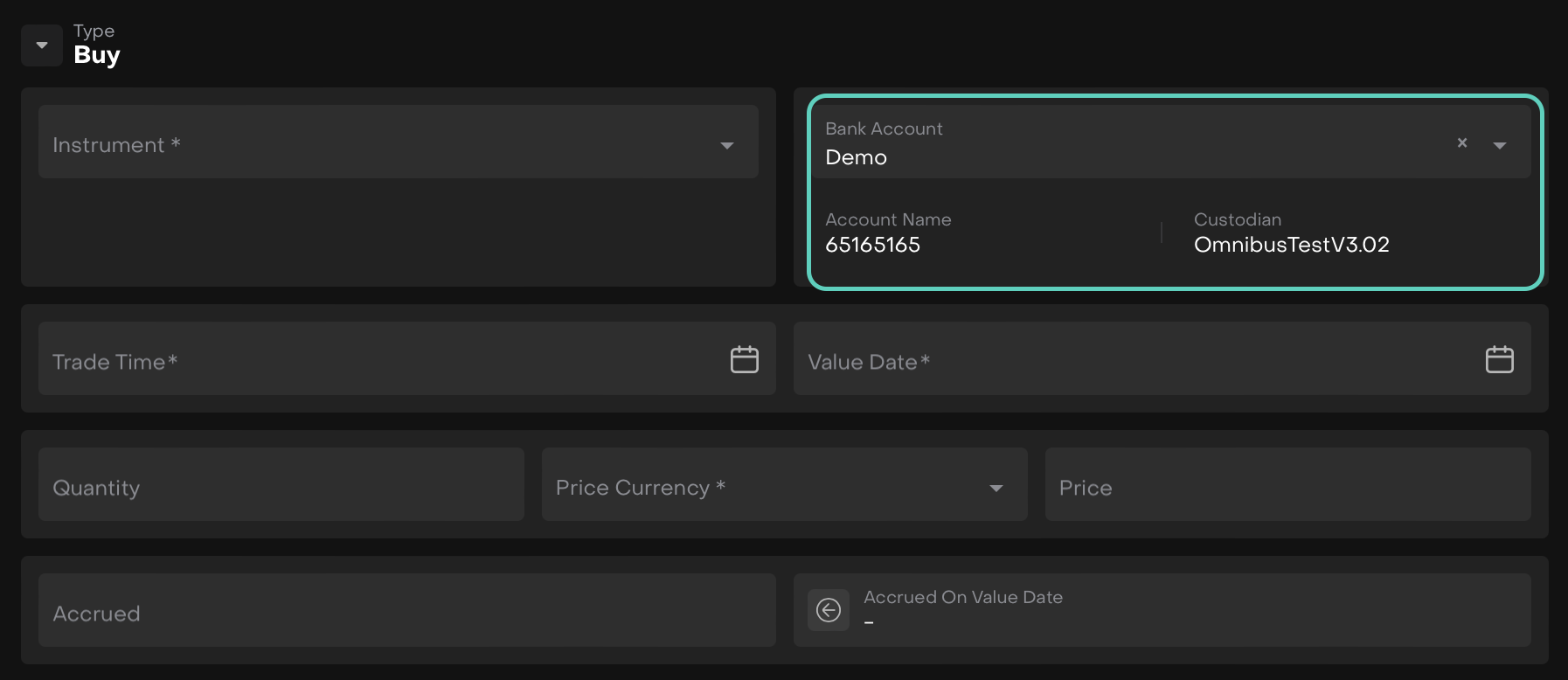

Custodian Name display on Bank Account Selector in Portfolio

For Role(s): All Users

The Bank Accounts selector in the Portfolio view now displays the Custodian Name instead of Custodian Bank Name.

Feature Benefits:

Enhanced Clarity

Improved Usability

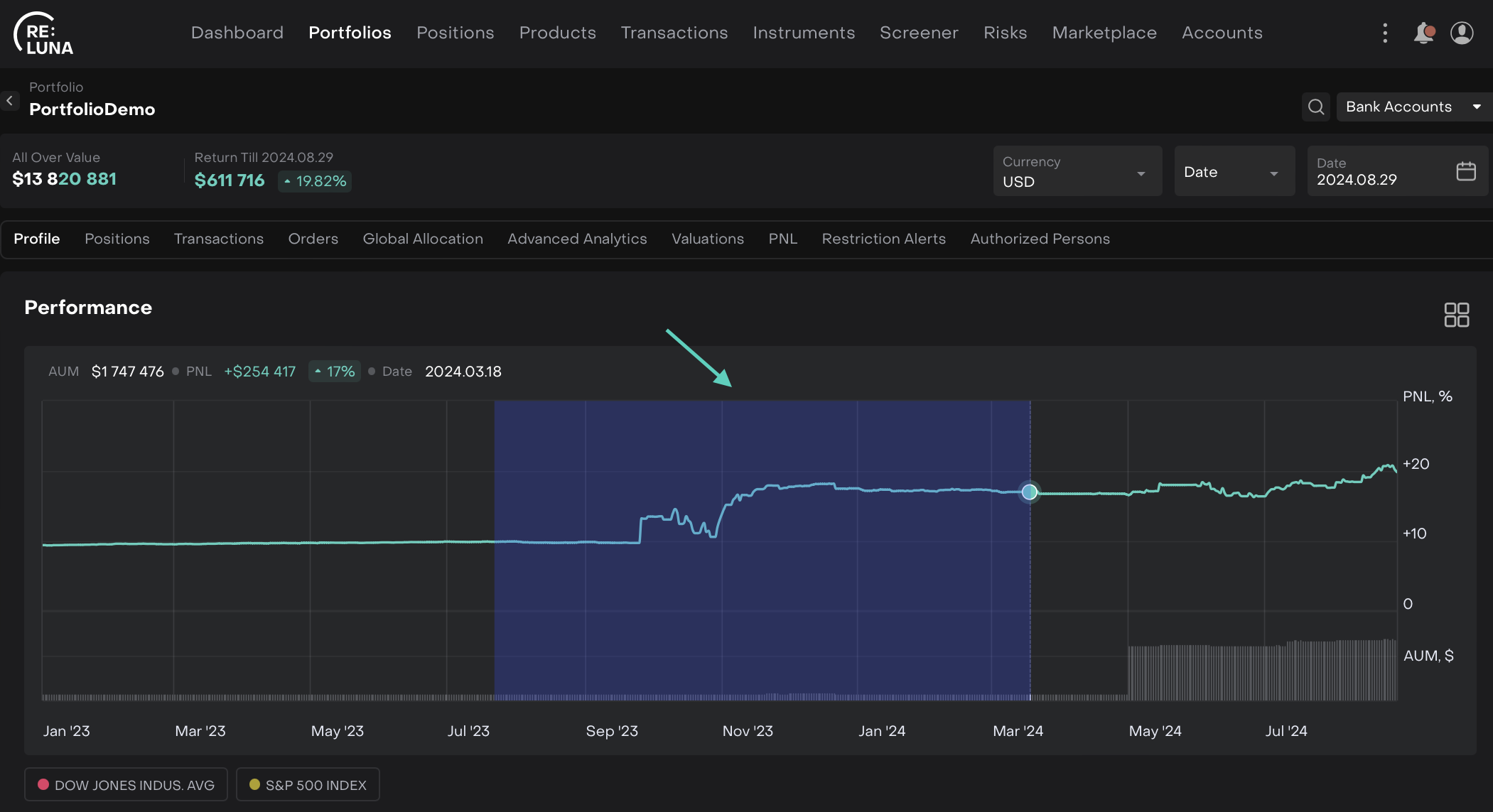

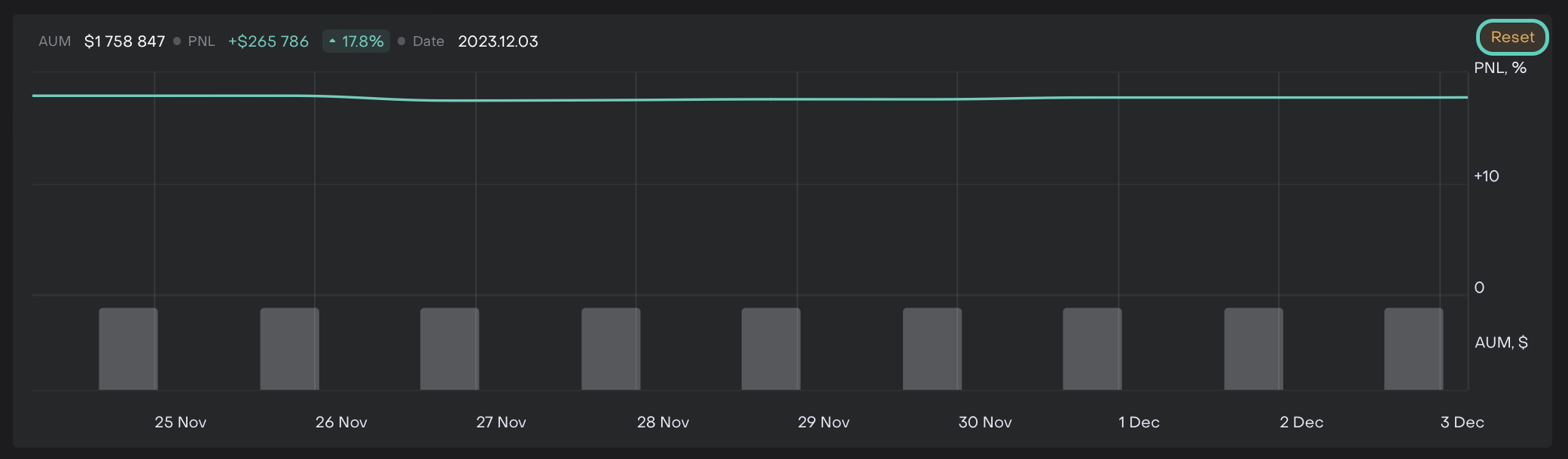

Zooming Functionality Enabled for Performance and Price Diagrams

For Role(s): All Users

Now, users can easily zoom- in into specific areas of Performance and Price diagrams to view detailed insights, enabling a more accurate and in-depth analysis. A Reset button has also been introduced, allowing to return to the normal view with a single click.

On Performance graph > Drag and Select the area (highlighted in Blue color).

Then, you can further select and zoom in, accordingly. The area selected continues to zoom in upon selection.

The same feature is also introduced for Price diagram.

Feature Benefits:

Improved Data Clarity

Enhanced User Experience

Customizable View

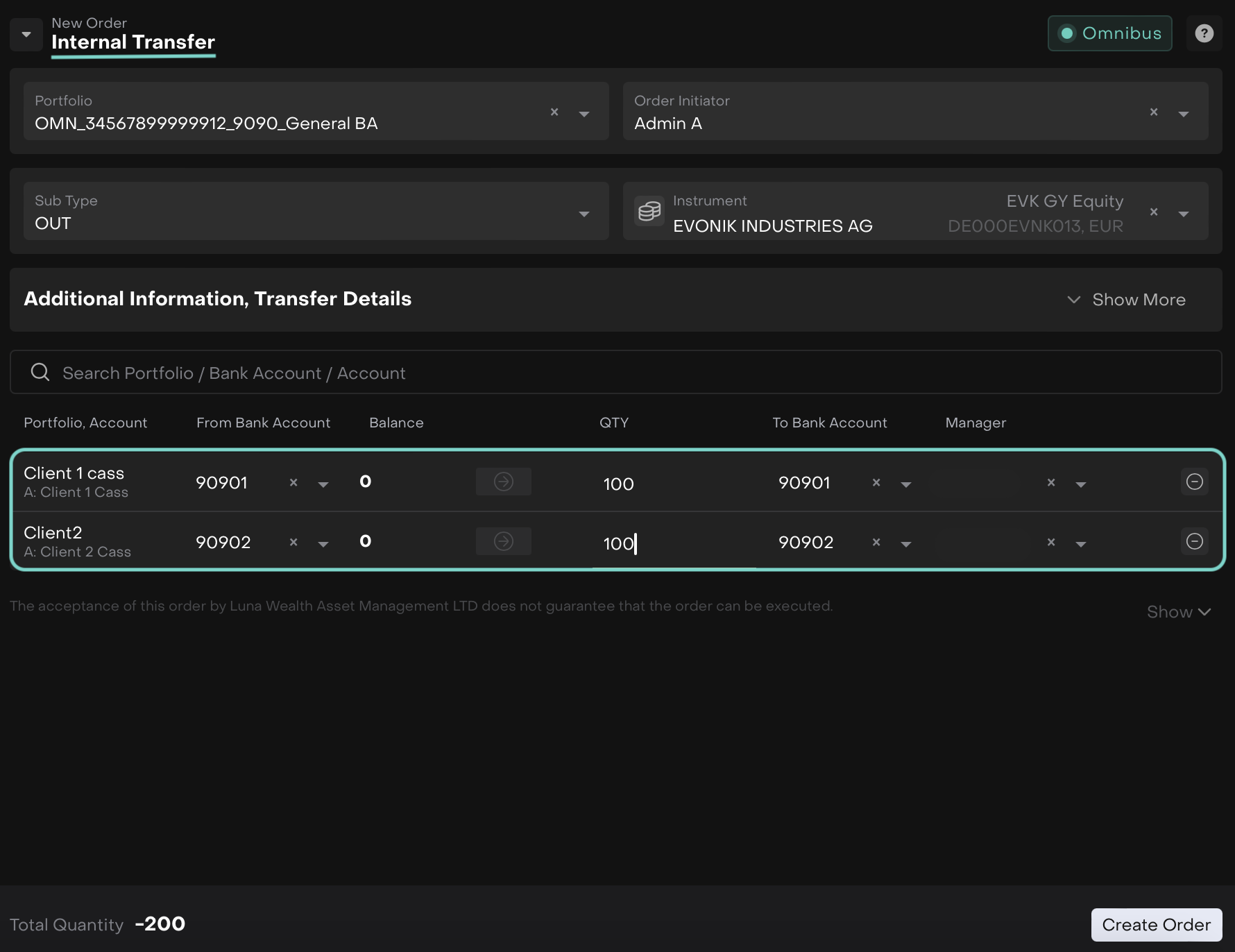

Internal Transfer and Internal Payment between Virtual Bank Accounts

For Role(s): Back Office

We've enhanced the system to support Internal Transfers and Payments between Virtual Bank Accounts associated with different Omnibus Bank Accounts within a single Client Portfolio. This update enables users to create orders for Internal Payments and Internal Transfers that will generate corresponding orders at both the Omnibus and Client levels.

Feature Benefits:

Streamlined Internal Transfers

Unified Order Creation

Improved Transaction Tracking

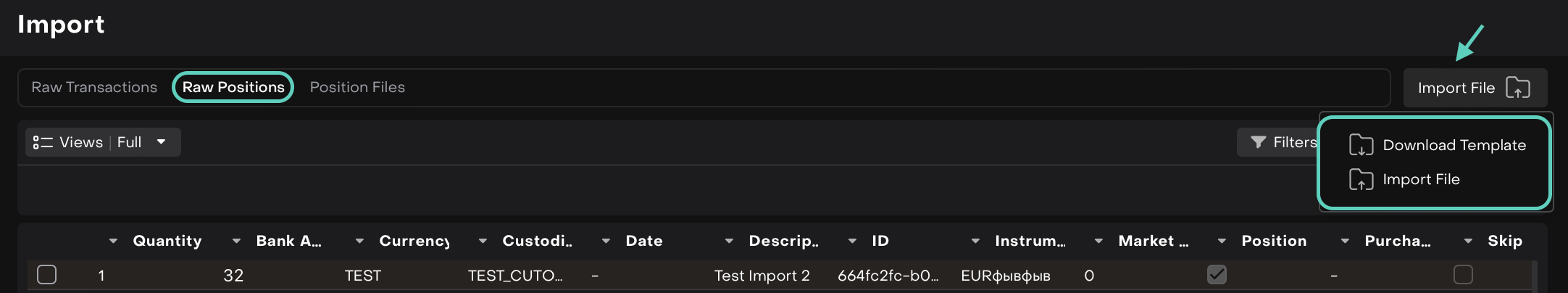

Import of Bank Positions

For Role(s): Users with permission for import of positions

Users can import raw bank position data manually via a CSV file, ensuring that raw positions are accurately recorded the platform even without automatic bank integration. The system processes the imported data and creates raw positions, which are then used for automatic reconciliation in connectors and in cass reports.

Feature Benefits:

Manual Data Import

Streamlined Reconciliation

Customizable Template

Enhanced Accuracy

Filtered Bank Accounts by Portfolio in New Transactions

For Role(s): Back Office

When creating a new transaction in the Portfolio tab, the list of available bank accounts is now filtered to show only those associated with the current portfolio. This ensures that users see only relevant bank accounts, streamlining the transaction process.

Feature Benefits:

Enhanced Relevance

Streamlined Workflow

Improved Accuracy

Better User Experience

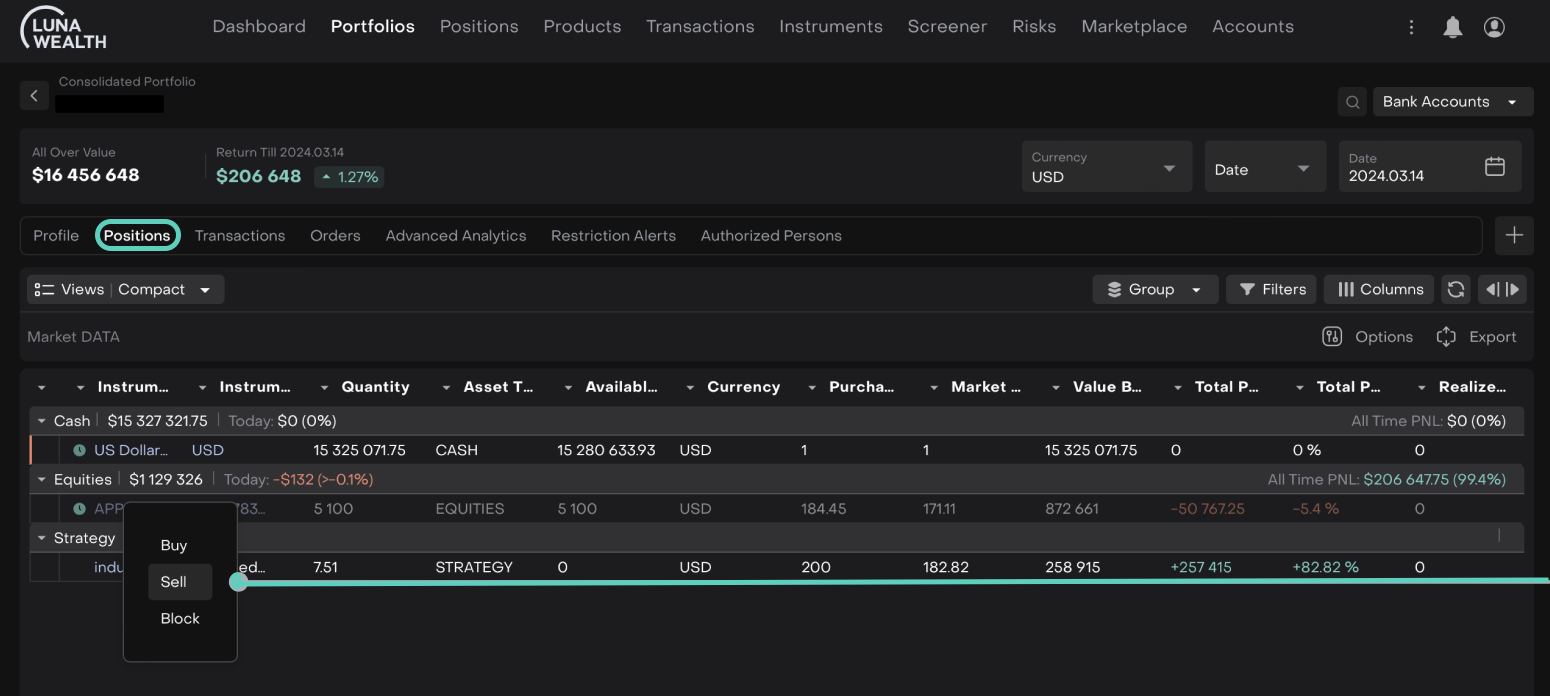

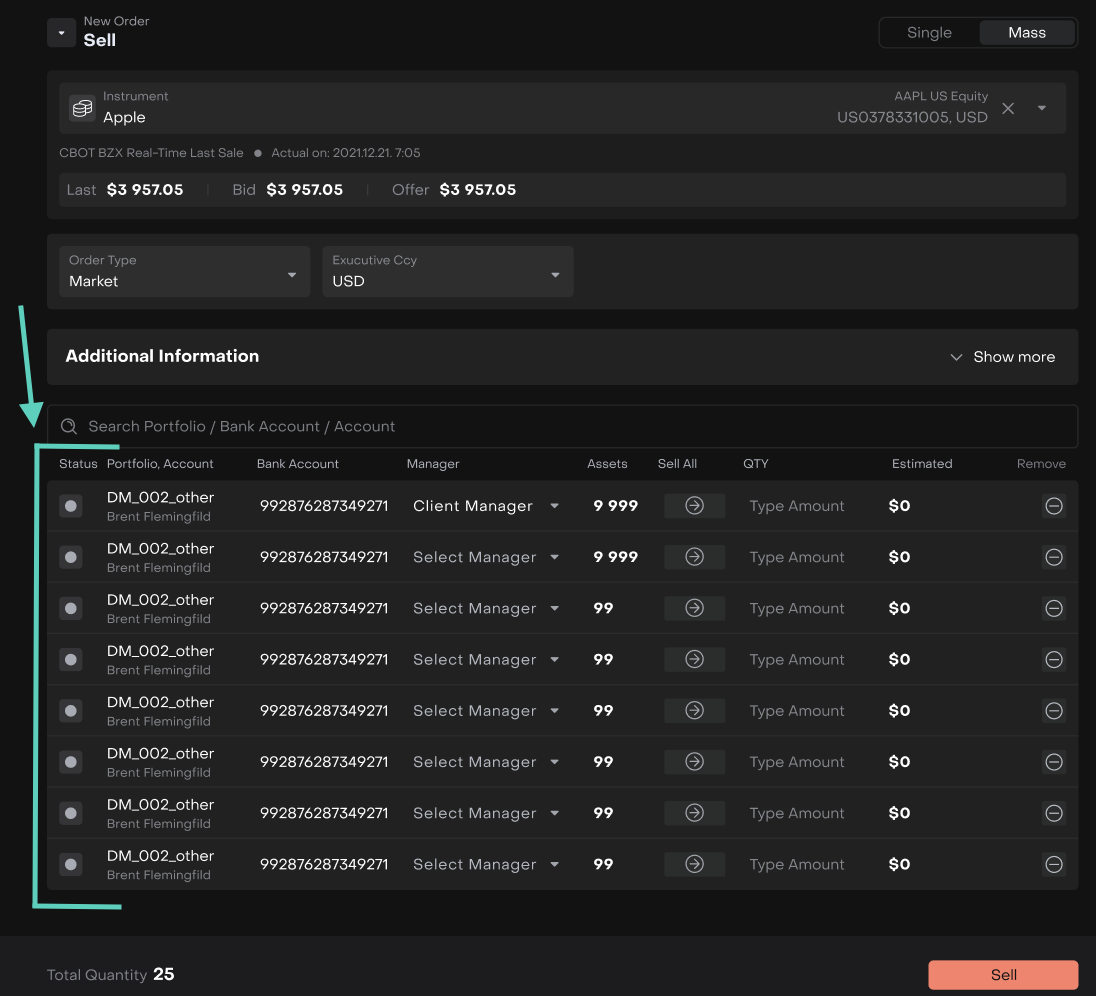

Enhanced Trading from Client Portfolio with Multiple Bank Accounts

For Role(s): Trader

We’ve enhanced the trading functionality. When placing an order on positions that span multiple bank accounts, you can now right-click on the position in the Portfolio → Positions Tab and select Buy/Sell order.

Feature Benefits:

Streamlined Order Placement

Efficient Trading

Time Savings

Improved Accuracy

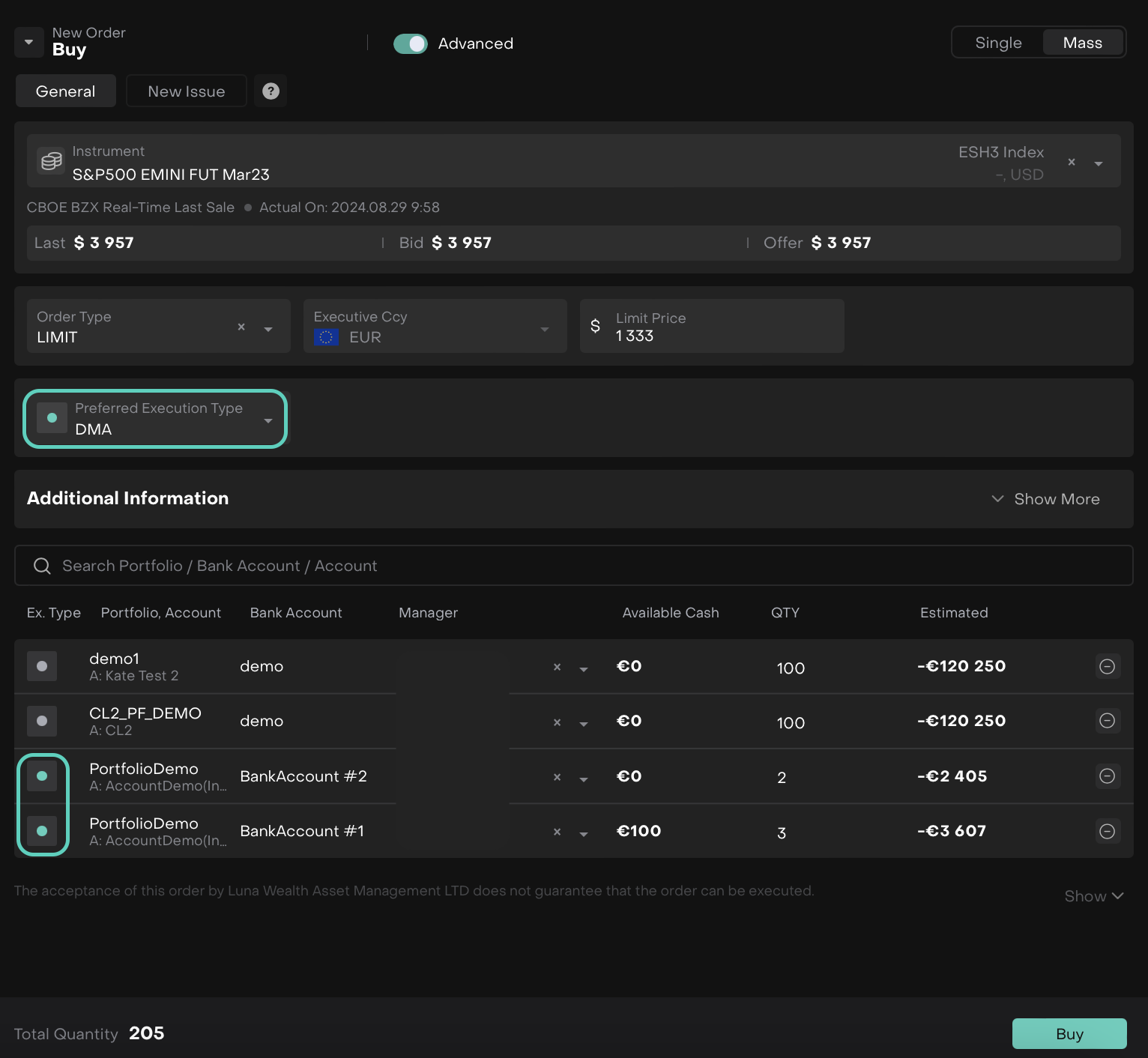

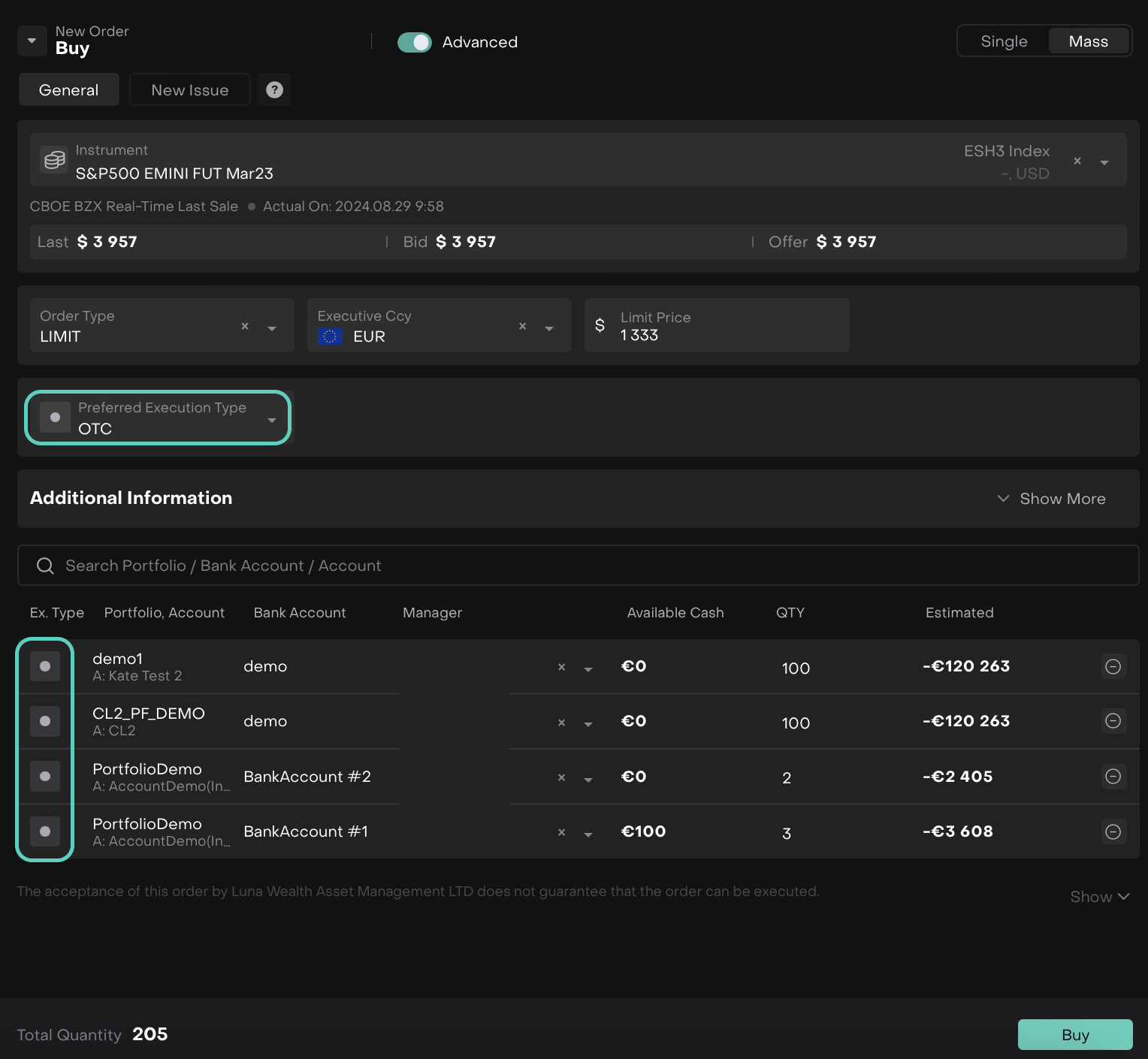

Updated Execution Type Selection on Mass and Consolidated Portfolio Orders

For Role(s): Trader, Client

The "Execution Type" instruction on the Mass and Consolidated Portfolio Order forms have been updated. The "Execution Type" selector now directly affects the "Status" field in the table and is renamed to reflect its function more clearly. If DMA is available for any selected account, it will be set by default for those accounts, while ensuring it cannot be selected if not applicable. Users can now set all instructions in OTC. Additionally, the "Time In Force" field has been removed.

Feature Benefits:

Accurate Instruction Setting

Simplified Options

Streamlined User Experience

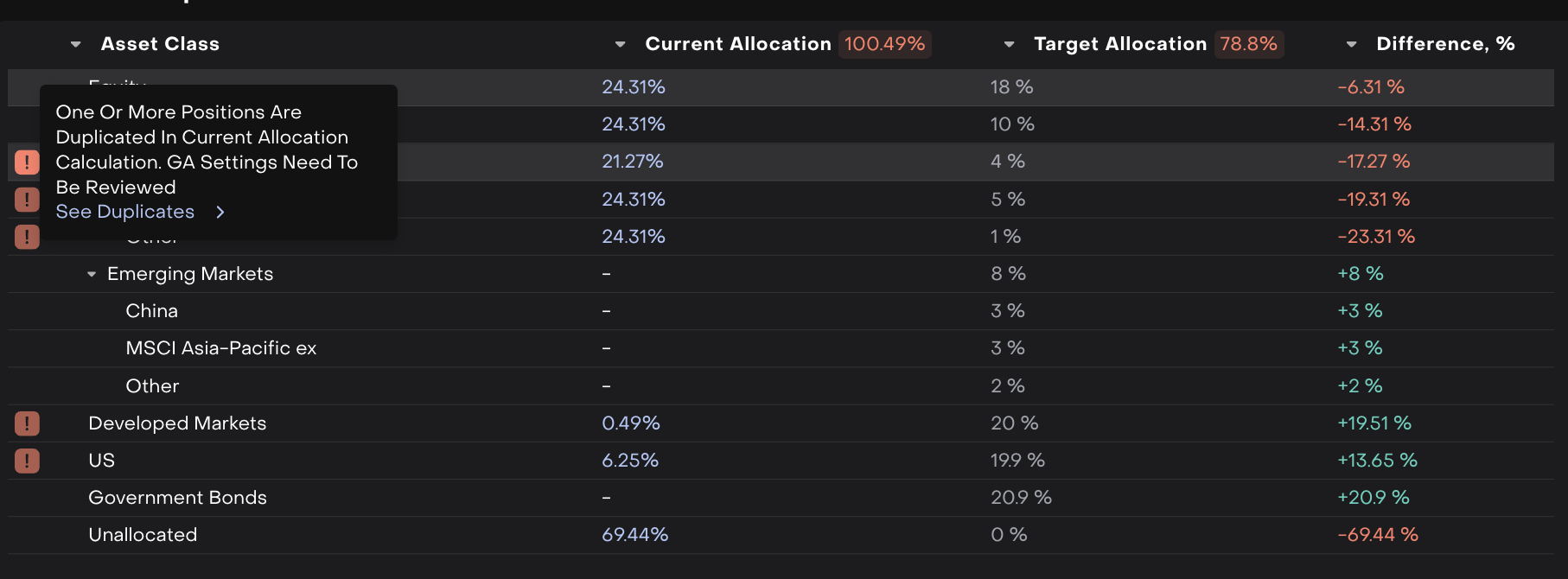

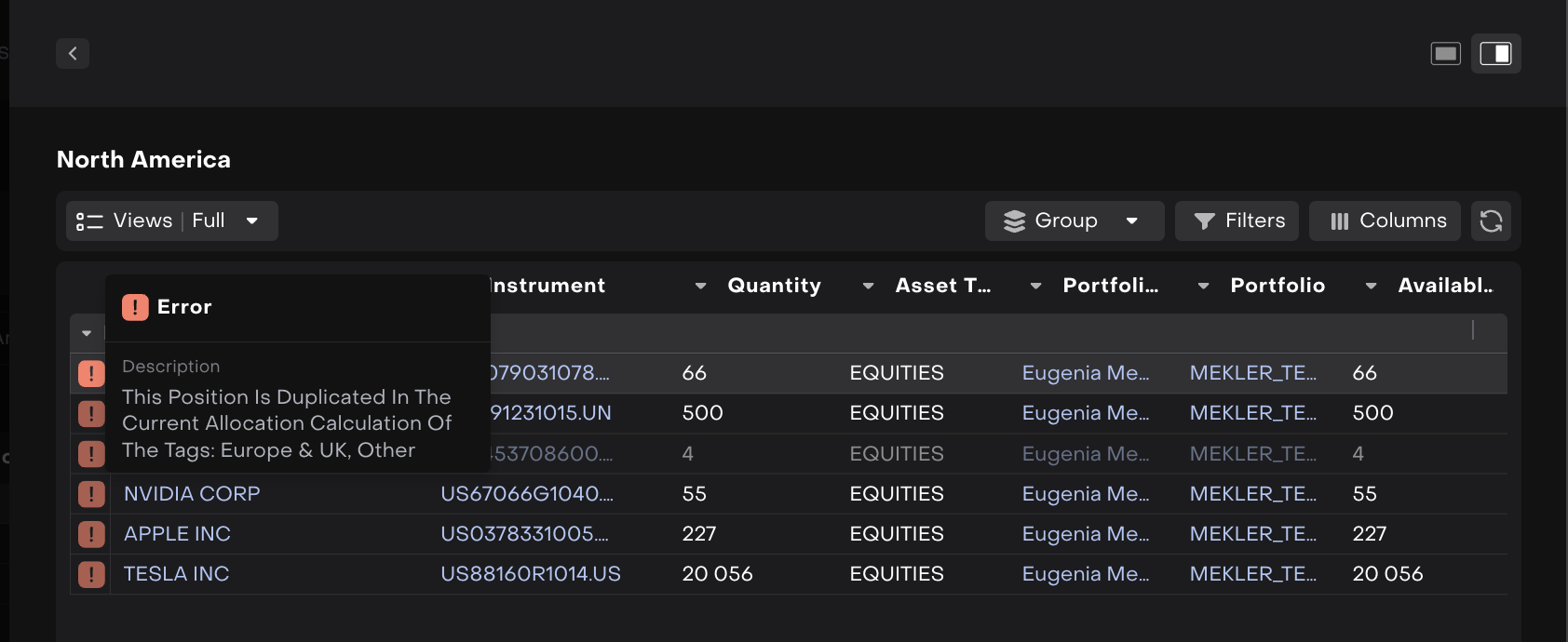

Global Allocation: Enhanced Duplicate Verification and Errors

For Role(s): Financial Analyst

We’ve improved the Global Allocation feature. The system now detects and highlights positions that fall under multiple tags, subtags, or extensions, helping to avoid duplication and maintain accurate allocation.

Open details of allocation error

Feature Benefits:

Improved Accuracy

Enhanced Efficiency

Better Oversight

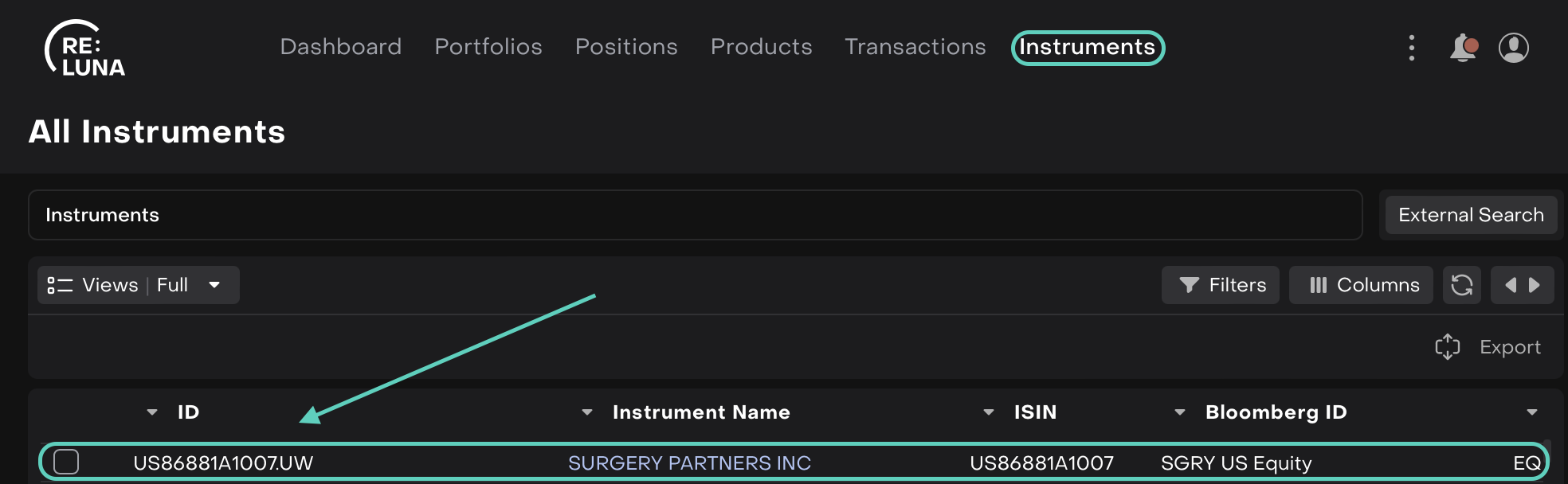

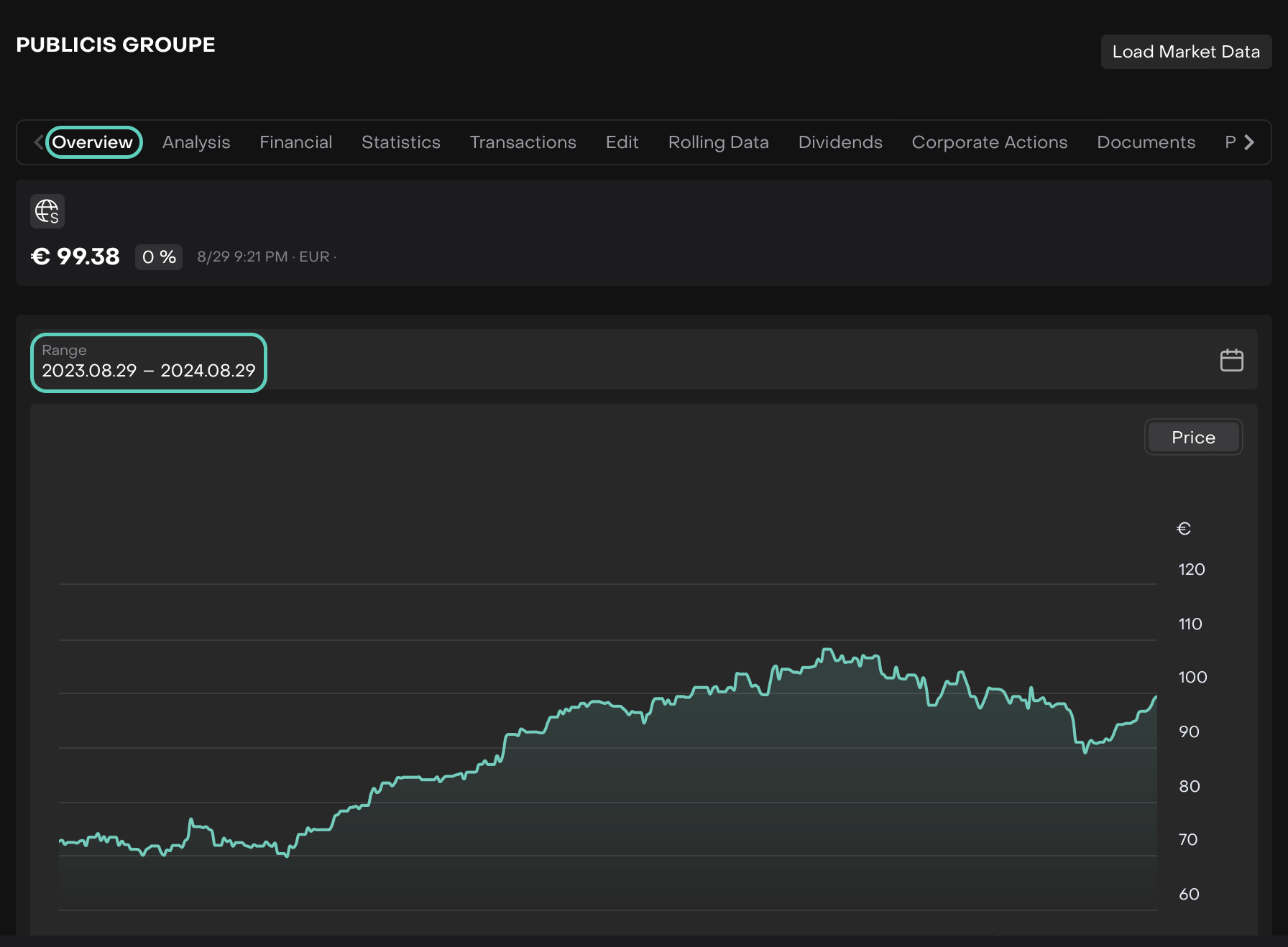

Default Price Chart Period Set to 1 Year

For Role(s): Financial Analyst

The default period for the price chart on Instruments is now set to 1 year.

Go to Instruments > Double-click the entry on the list displayed.

The following screen opens > In Overview tab > The Range is set to 1 Year by default for the price chart.

Feature Benefits:

Comprehensive View

Improved Context

Streamlined Experience

Updated Price Change Calculation for Equity Positions

For Role(s): Financial Analyst

The equity position dialog now recalculates the price change percentage based on real-time price data received. The update also fixed calculation of PNL with real time prices.

Feature Benefits:

Enhanced Accuracy

Real-Time Updates

Improved Data Consistency

Enhanced Instrument Logo Retrieval with MIC Code Mapping

For Role(s): Financial Analyst

Now, MIC code mapping is based on the exchange’s country to ensure accurate instrument identification. Priority is given to an exact match of Symbol and MIC Code. If no exact match is found, the system uses Symbol and MIC Code from exchanges within the same country.

Feature Benefits:

Accurate Identification

Enhanced Matching

Consistent Data

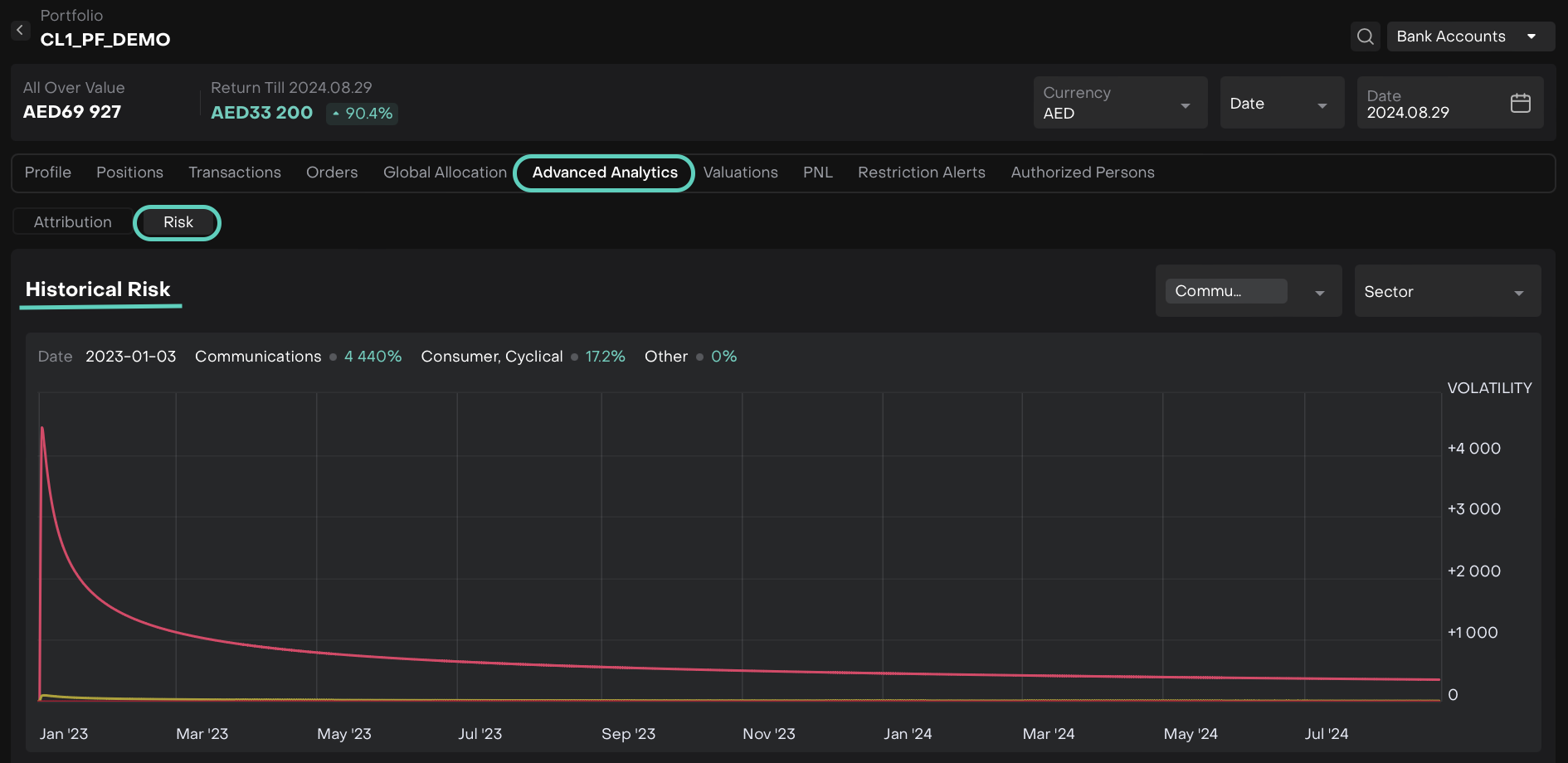

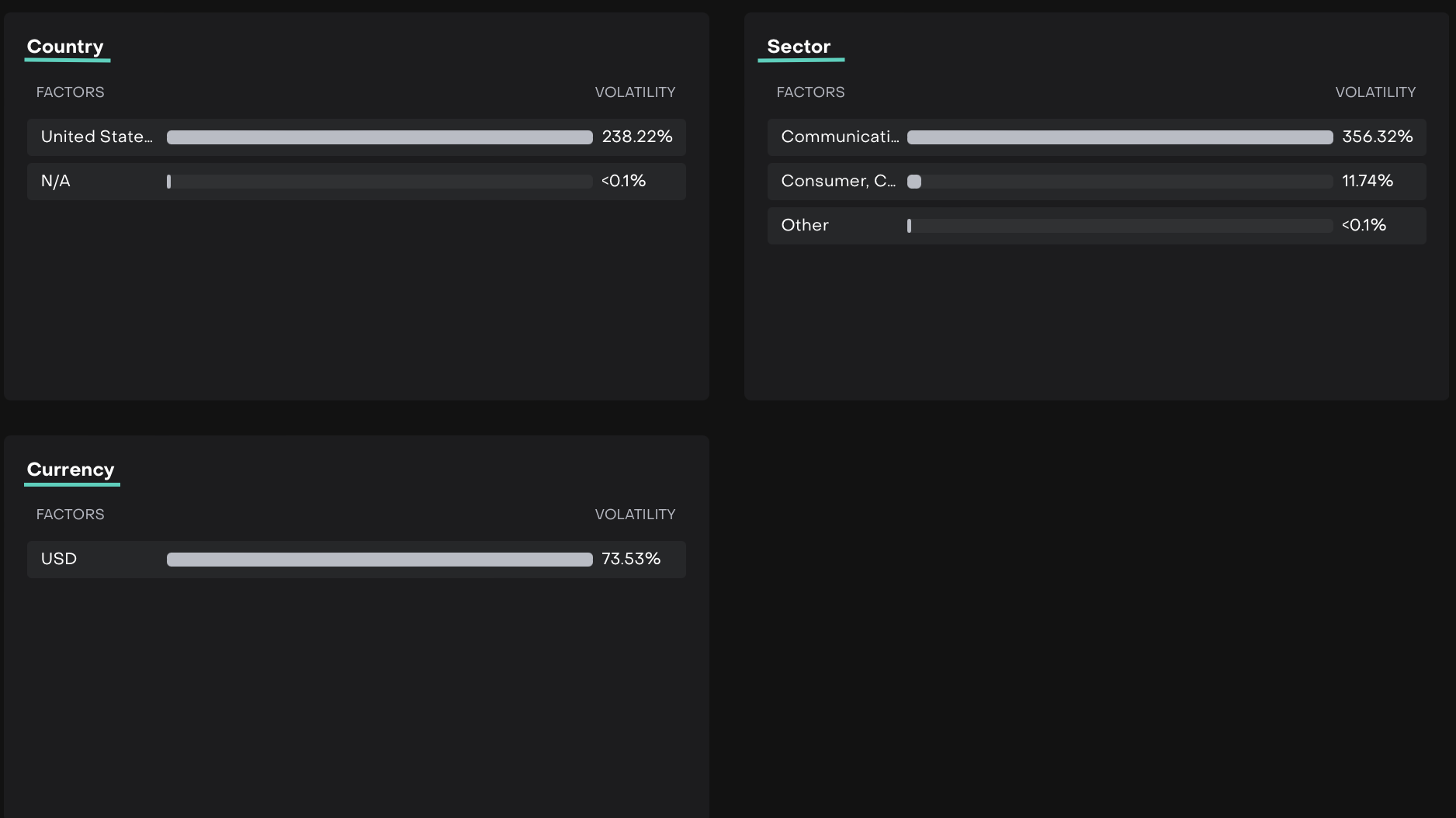

Graph Revamp for Risk Tab Widgets

For Role(s): Portfolio Manager

We’ve three widgets now with a revamped Risk tab graphs for Currency, Country and Sector.

Feature Benefits:

Enhanced Clarity

Improved User Experience

Focused Data Display

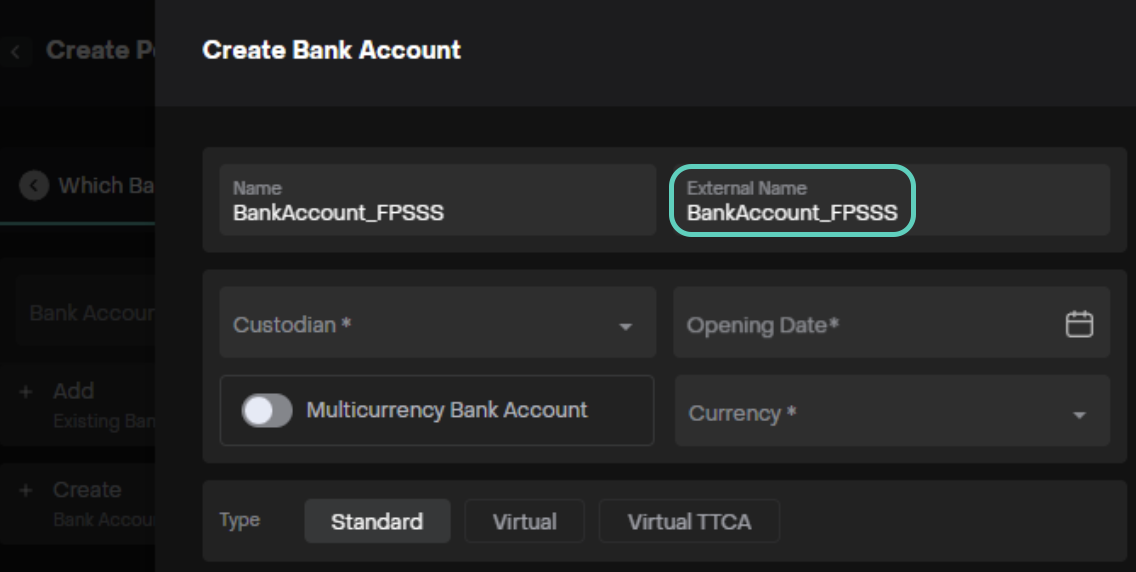

Auto-pre fill and Editable "External Name" for New Bank Accounts

For Role(s): Client Administrator, Back Office

When creating a new Bank Account, the "External Name" field will now be automatically filled with the value from the "Name" field. Users will still have the flexibility to edit the "External Name" after it is prefilled. This is available in both the Portfolio Workflow and the Bank Account creation process.

Feature Benefits:

Streamlined Data Entry

Customization Flexibility

Improved Data Accuracy

Seamless Integration

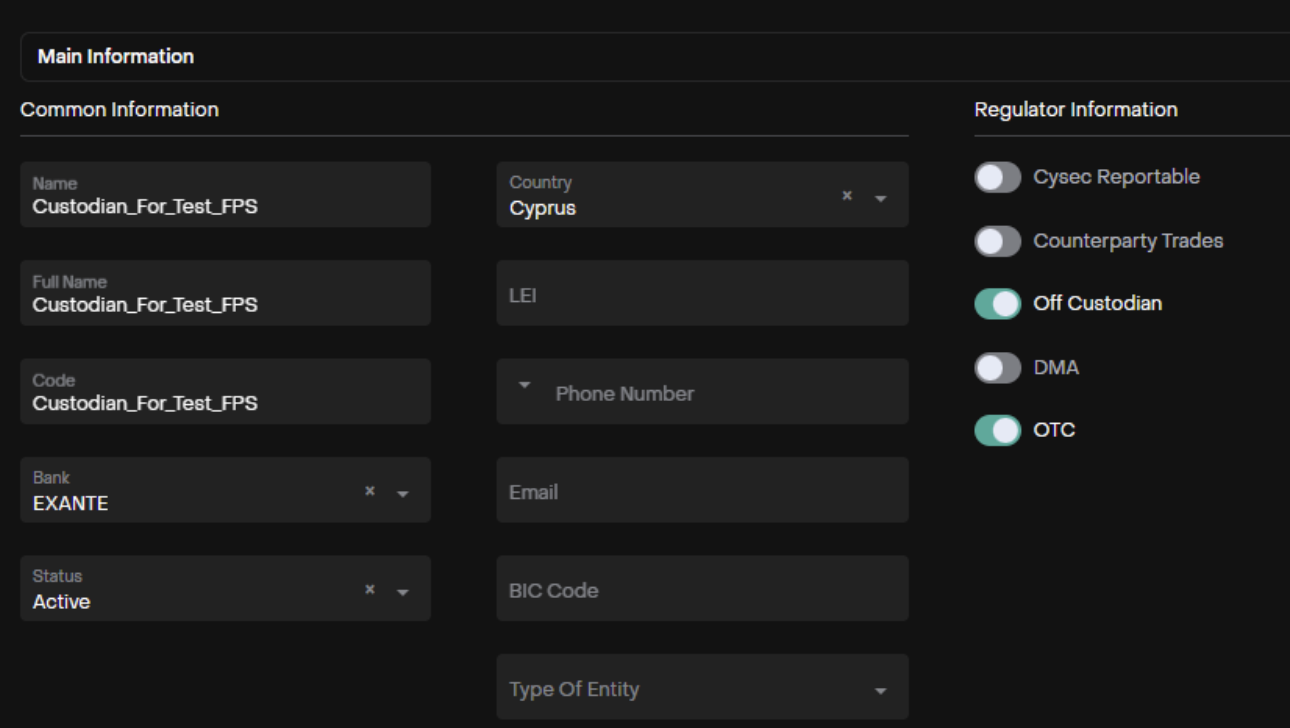

Validation for Duplicate Custodian Codes

For Role(s): Client Administrator, Back Office

We've improved the Custodian creation process. Now, if a Custodian with the same Code already exists, the system will prevent the creation of a duplicate.

Feature Benefits:

Prevents Duplicate Entries

Maintains Data Integrity

Streamlines Creation Process

Note: Currently, users with both Custodian Create and Counterparty Create permissions can create new Custodians.

Coupon and Dividend Data Load and Transaction Generation

For Role(s): All Users

We have enhanced the system's handling of coupon and dividend data to ensure accurate and timely income transaction generation. This update includes improved data loading processes and detailed transaction generation criteria.

Feature Benefits:

Accurate Data Handling

Efficient Processing

Timely Updates

This release note provides an overview of the latest updates and features introduced in Re:Luna - Version 4.7. For more details, please refer to the sections above or contact our support team for assistance. We hope you enjoy the new features and changes in this release.