Overview of User Roles and Permissions

Role model and rights

The system provides a role and profile builder that will help customize the system according to your business needs. However, for ease of use, the system comes preconfigured with the following default roles and their permissions:

VIEW ALL- view all records created in the System

VIEW BY COMPANY - view all records related to the Company of the current user

VIEW RELATED- view only records related to the Portfolio where current user is associated

CREATE - create the new record

MODIFY ALL - modify all records created in the System

MODIFY BY COMPANY - modify all records related to the Company of the current user

MODIFY BY RELATED - modify only records related to the Portfolio where current user is associated

Role | Description | Accounts | Portfolios | Transactions | Orders | Risk Profile, restrictions | Reports |

|---|---|---|---|---|---|---|---|

Global | Technical role for a global administrator to setup the system ignoring company access restrictions | VIEW ALL CREATE MODIFY ALL | VIEW ALL CREATE MODIFY ALL | VIEW ALL CREATE MODIFY ALL | VIEW ALL CREATE MODIFY ALL | VIEW CREATE MODIFY | VIEW ALL CREATE |

Admin | Technical role for administrating the system within the scope of access to the company. | VIEW BY COMPANYCREATEMODIFY BY COMPANY | VIEW BY COMPANY CREATE MODIFY BY COMPANY | VIEW BY COMPANYCREATEMODIFY BY COMPANY | VIEW BY COMPANY CREATEMODIFY BY COMPANY | VIEW CREATEMODIFY | VIEW BY COMPANY CREATE |

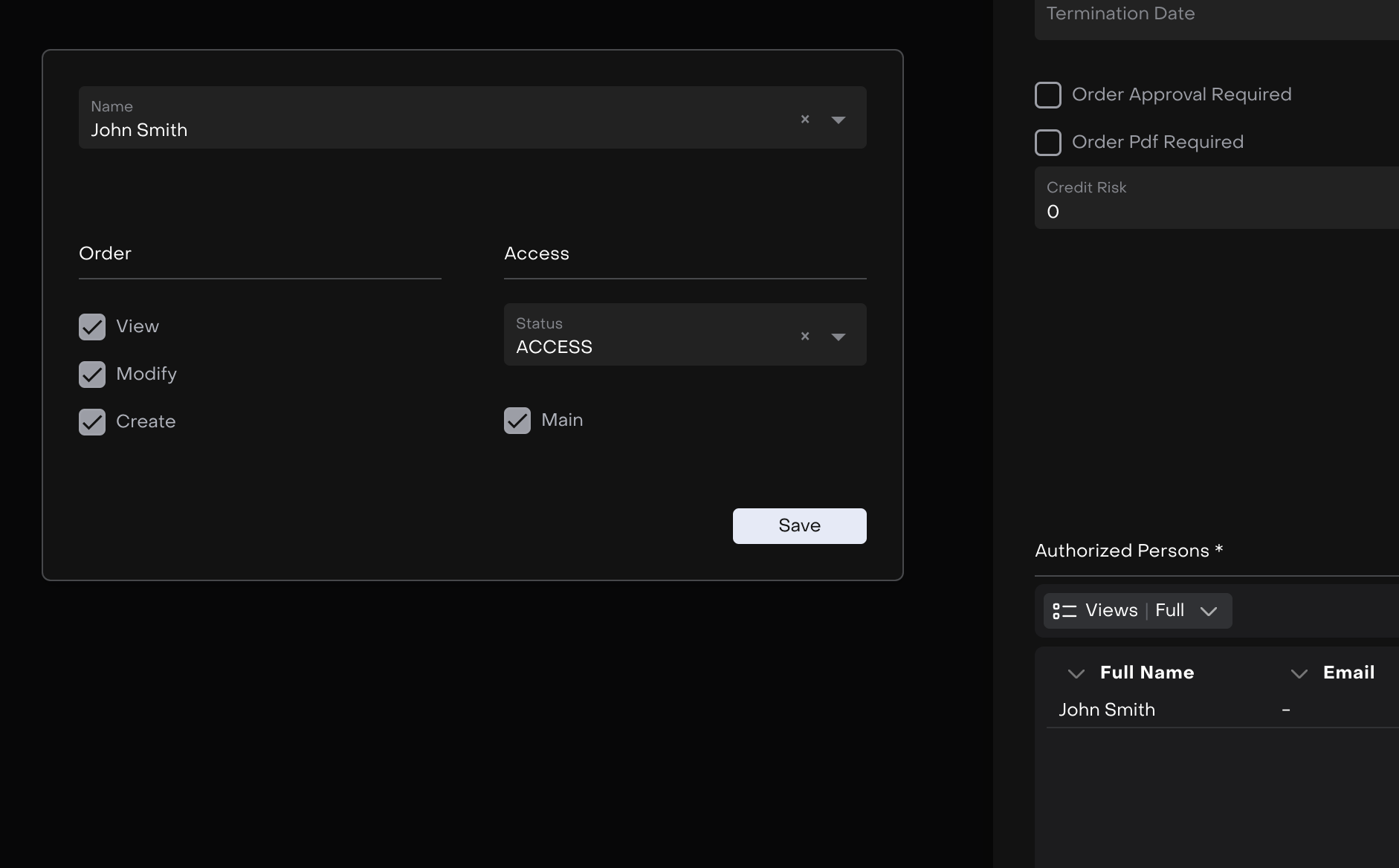

Client | An Individual who has been granted the authority to view or manage the client's portfolio within agreed-upon parameters. | VIEW RELATED | VIEW RELATED | VIEW RELATED | VIEW RELATED CREATE RELATED MODIFY RELATED | - | VIEW RELATED |

Head of Sales | Involved in acquiring new clients, managing existing client relationships, providing information about the company's products and services, and facilitating transactions. | VIEW RELATED | VIEW RELATED | VIEW RELATED | VIEW RELATEDCREATE MODIFY RELATED | - | VIEW RELATED |

Agent | |||||||

Sales Manager | |||||||

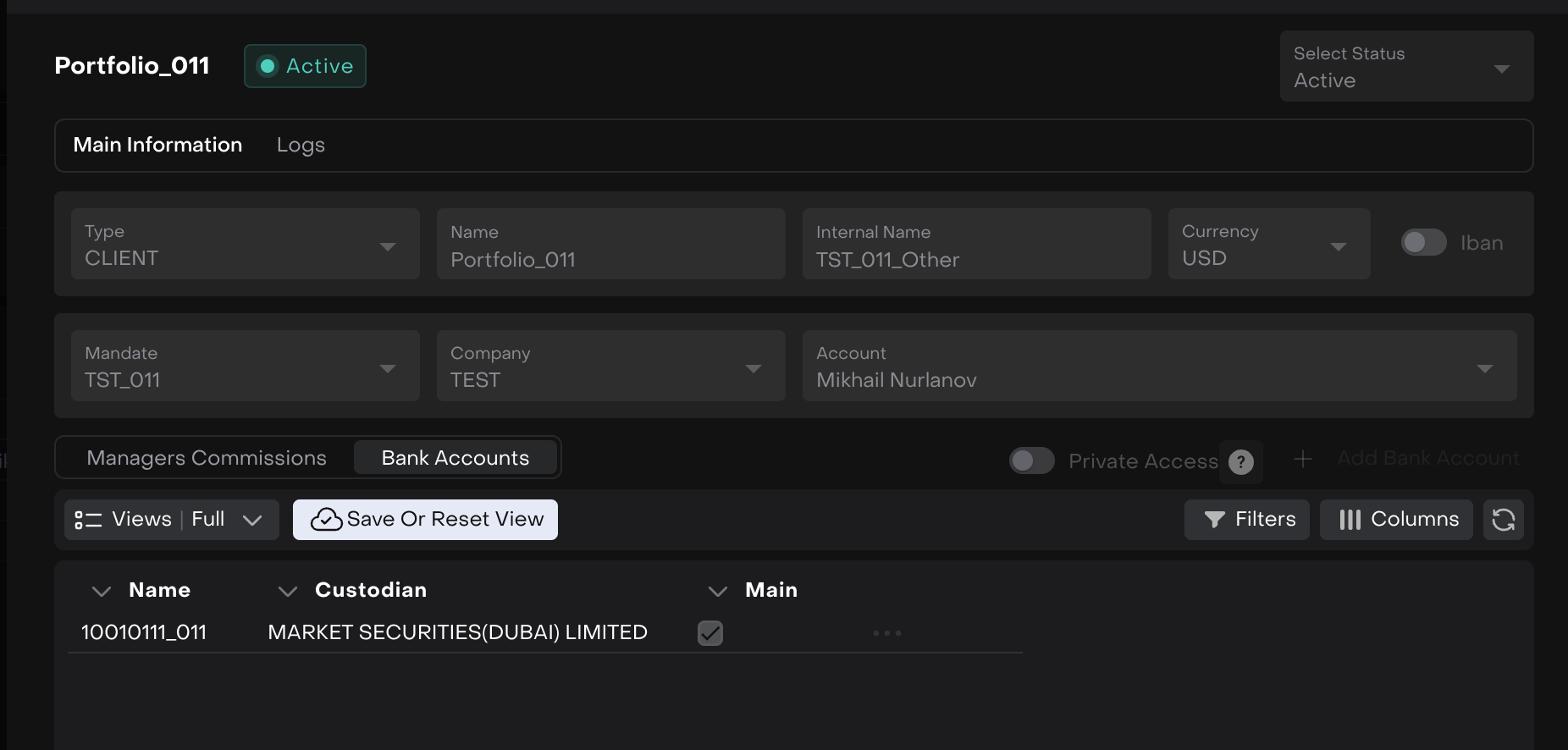

Client Administrator | Responsible for client servicing, communication, meeting their needs, and addressing any concerns or inquiries they may have. | VIEW BY COMPANYCREATEMODIFY BY COMPANY | VIEW BY COMPANY CREATE MODIFY BY COMPANY | VIEW BY COMPANY | VIEW BY COMPANY | VIEW | VIEW BY COMPANY CREATE |

Head of Investment Department | Responsible for managing investment portfolios, developing investment strategies, and making asset allocation decisions for clients. | VIEW BY COMPANY | VIEW BY COMPANY | VIEW BY COMPANY | VIEW BY COMPANY CREATEMODIFY BY COMPANY | VIEW | VIEW BY COMPANY CREATE |

Portfolio Manager | |||||||

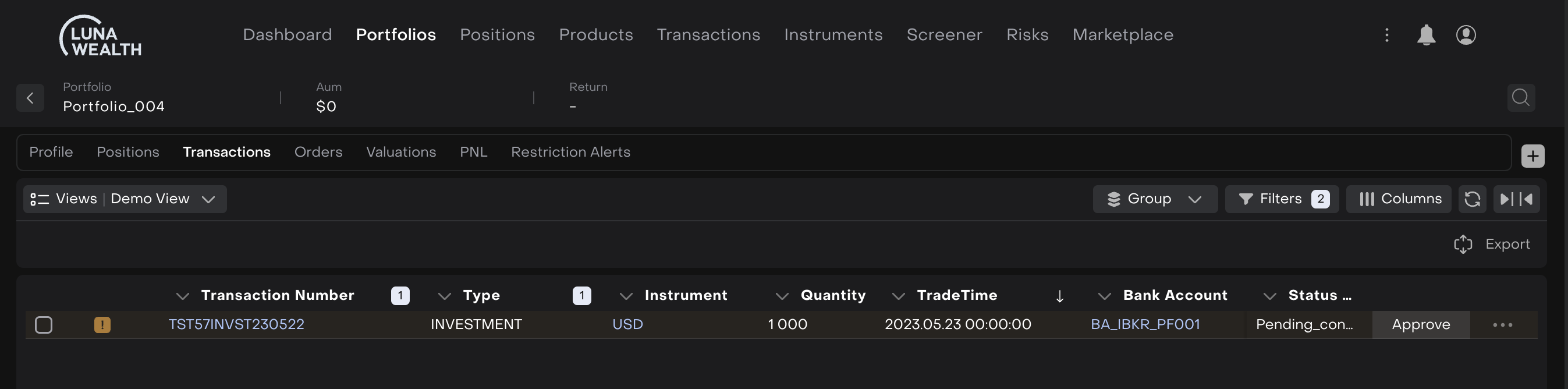

Trader | Responsible for executing trading operations in financial markets, monitoring liquidity, prices, and carrying out instructions for buying and selling financial instruments. | VIEW BY COMPANY | VIEW BY COMPANY | VIEW BY COMPANYCREATEMODIFY BY COMPANY | VIEW BY COMPANY CREATEMODIFY BY COMPANY | VIEW | VIEW BY COMPANY CREATE |

Analyst | Engaged in financial market analysis, tracking trends, researching companies and industries to provide investment recommendations and assist in portfolio decision-making. | ||||||

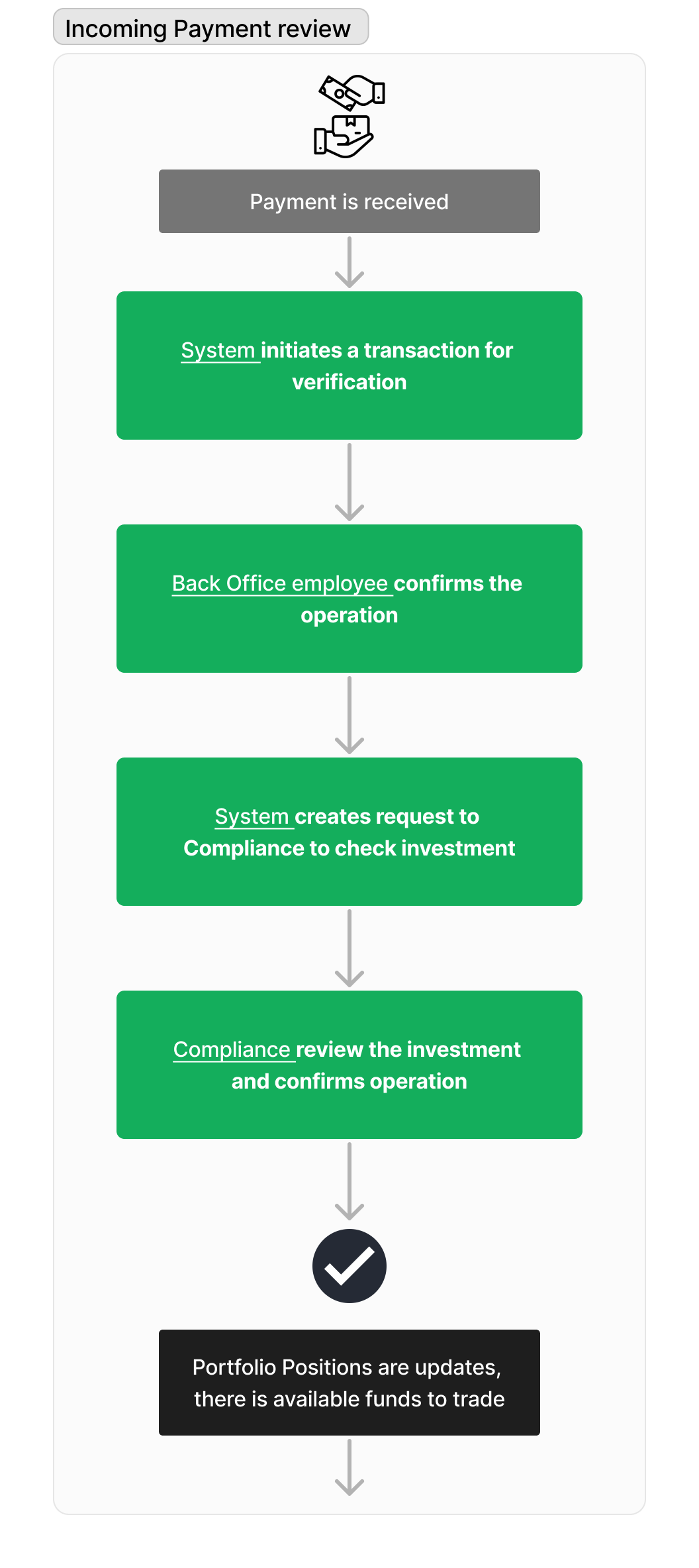

Head of Back / Middle Office | Responsible for handling post-trade activities and ensuring the smooth processing and settlement of transactions. The primary focus on tasks related to record-keeping, accounting, compliance, and administrative functions. | VIEW BY COMPANYCREATEMODIFY BY COMPANY | VIEW BY COMPANY CREATE MODIFY BY COMPANY | VIEW BY COMPANY CREATE MODIFY BY COMPANY | VIEW BY COMPANY CREATE MODIFY BY COMPANY | VIEW | VIEW BY COMPANY CREATE |

Back Office Manager | |||||||

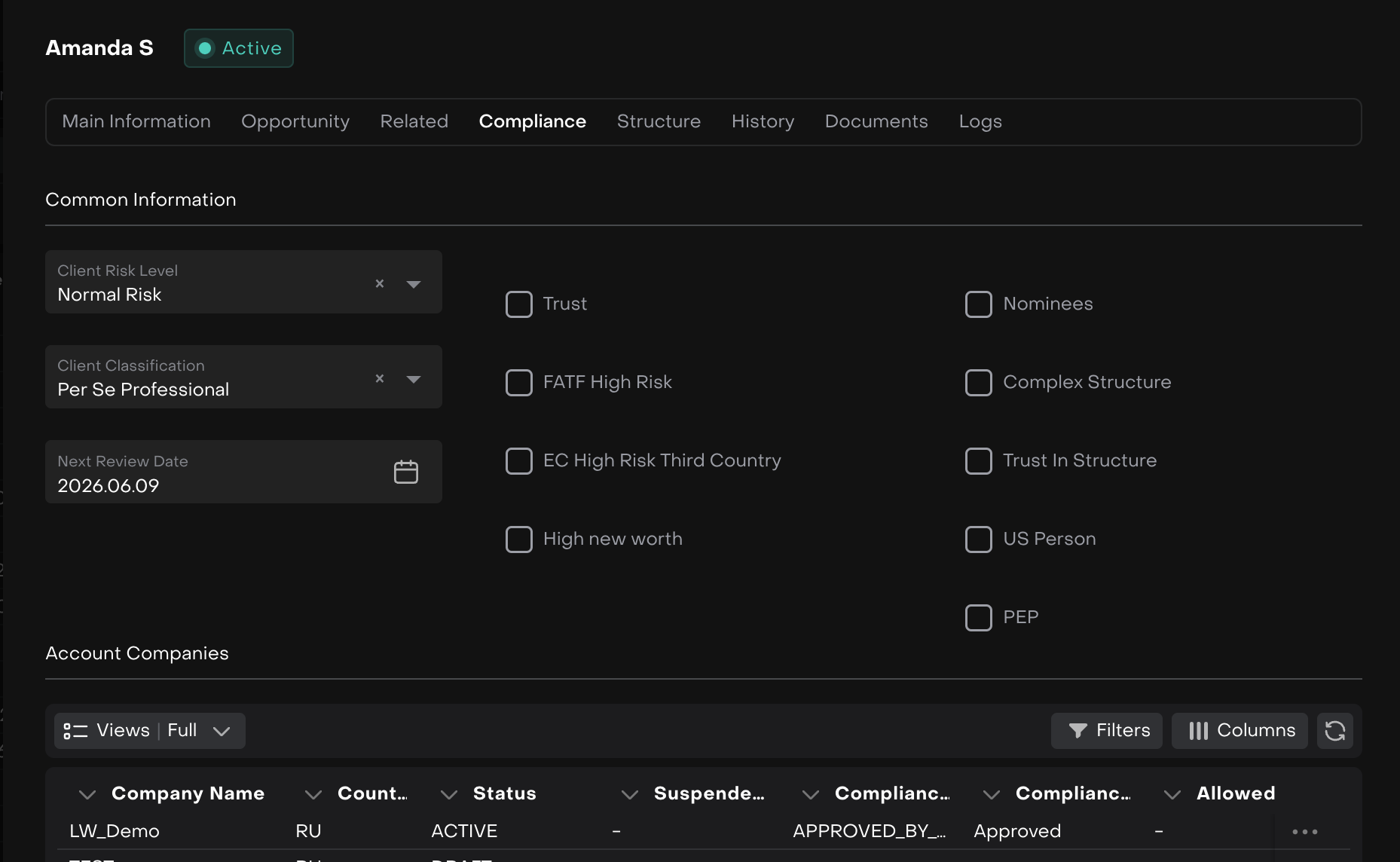

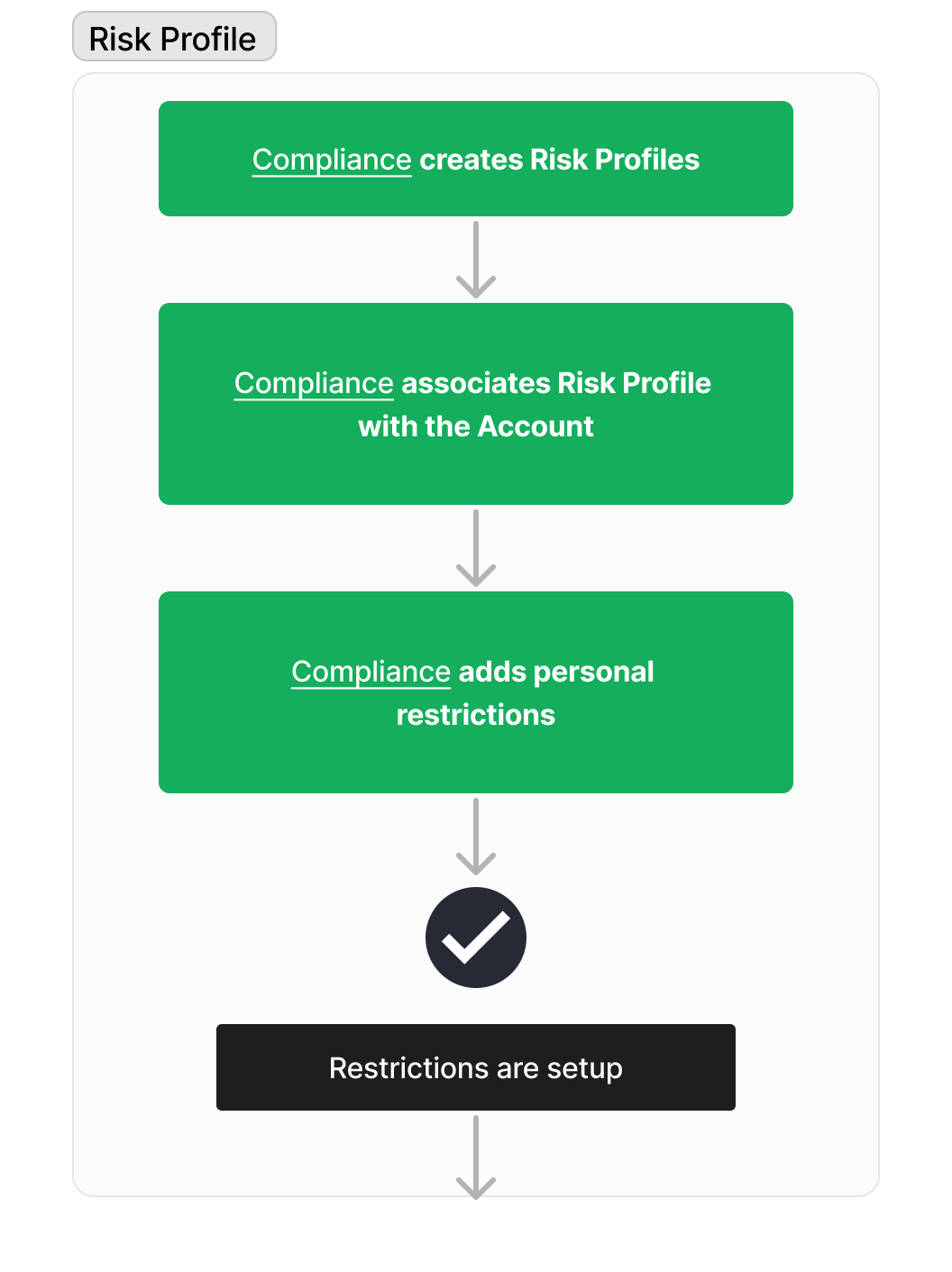

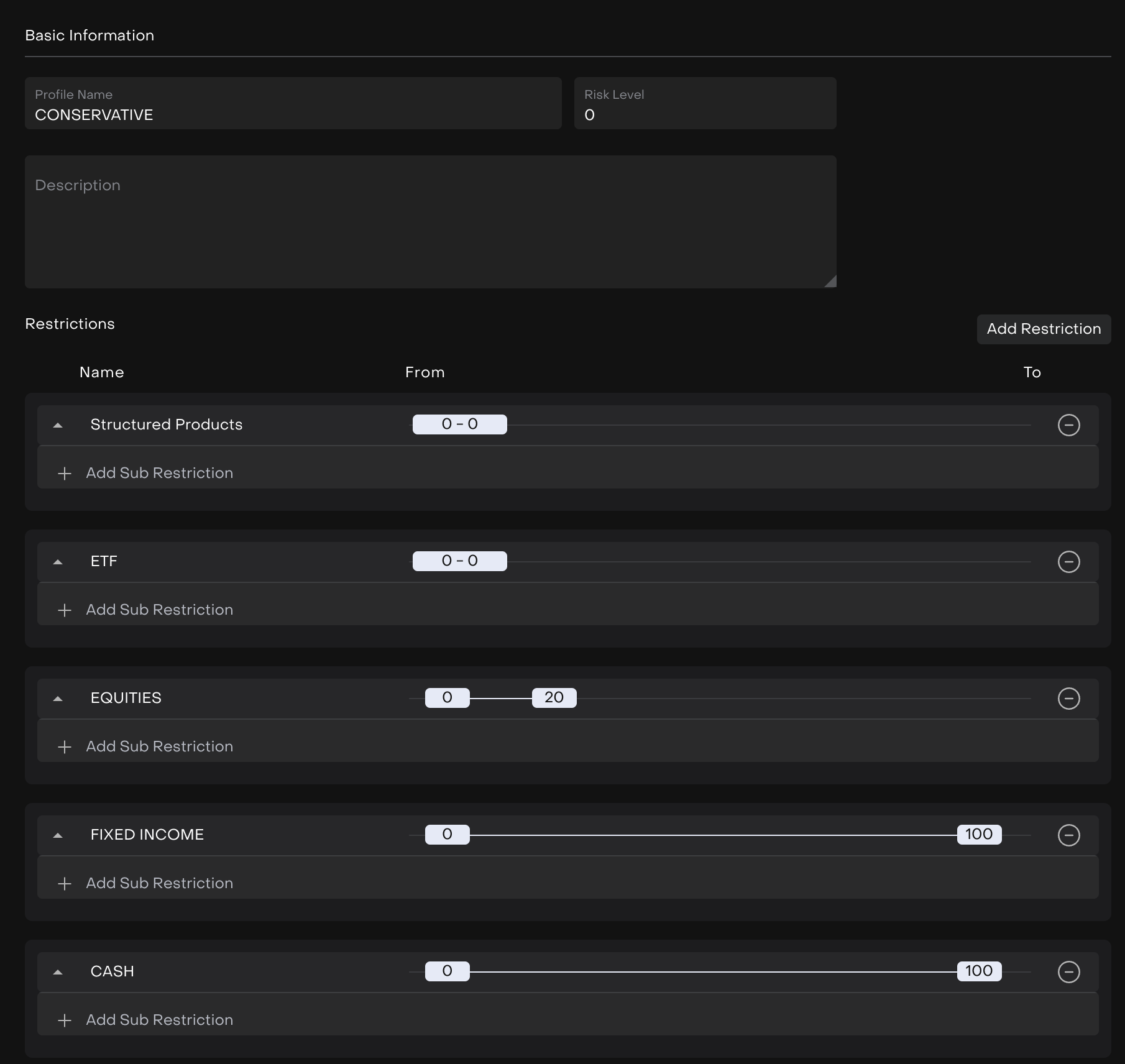

Compliance | Responsible for ensuring the company's compliance with legal and regulatory requirements, monitoring adherence to internal rules and procedures. | VIEW BY COMPANYMODIFY BY COMPANY | VIEW BY COMPANY | VIEW BY COMPANY CREATE MODIFY BY COMPANY | VIEW BY COMPANY CREATE | VIEW CREATEMODIFY | VIEW BY COMPANY CREATE |

Risk Manager | Involved in assessing and managing risks associated with investment operations and portfolios, analyzing potential risks, and developing risk management strategies and policies. | VIEW BY COMPANYMODIFY BY COMPANY | VIEW BY COMPANY | VIEW BY COMPANY CREATE MODIFY BY COMPANY | VIEW BY COMPANY | VIEW CREATEMODIFY | VIEW BY COMPANY CREATE |

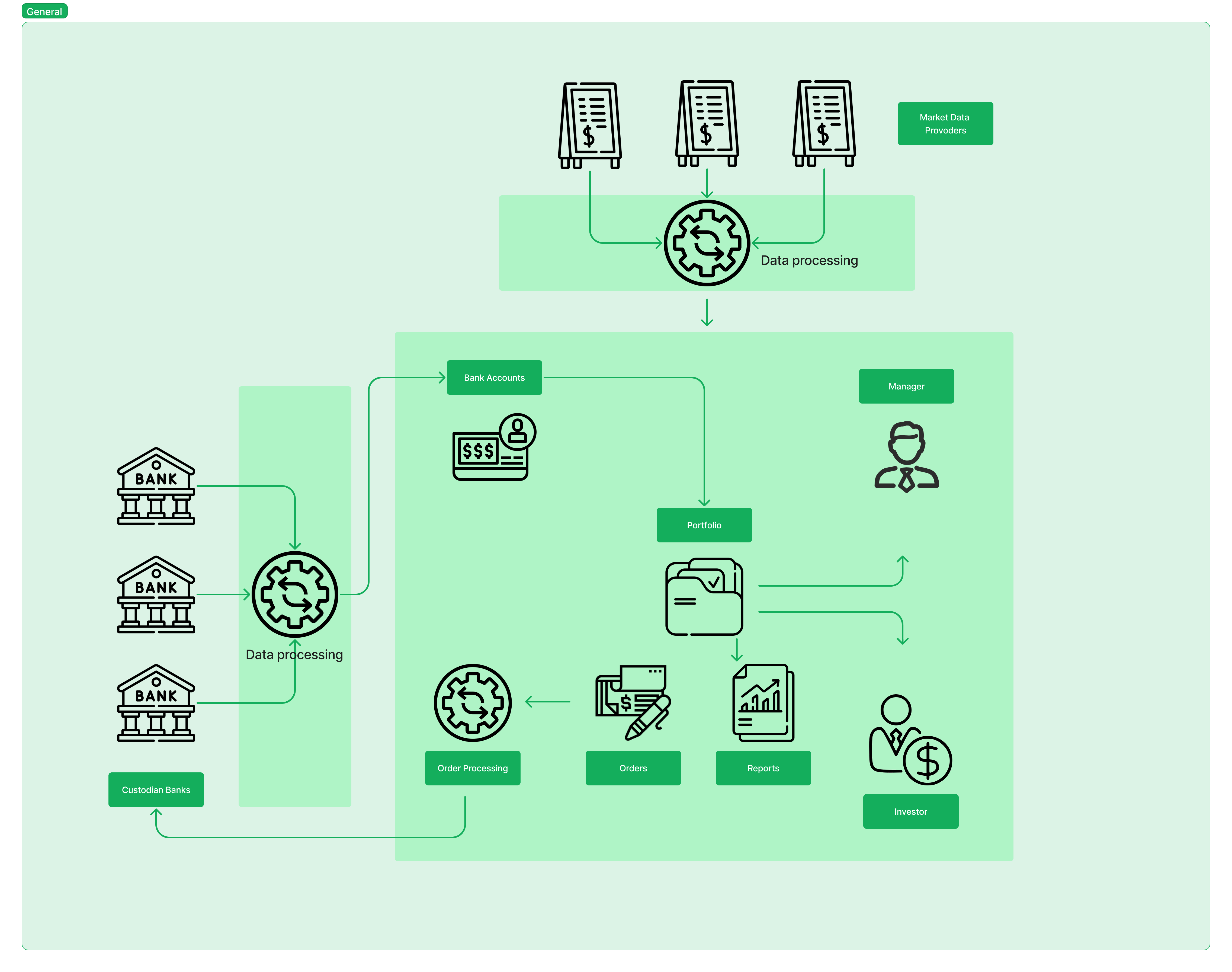

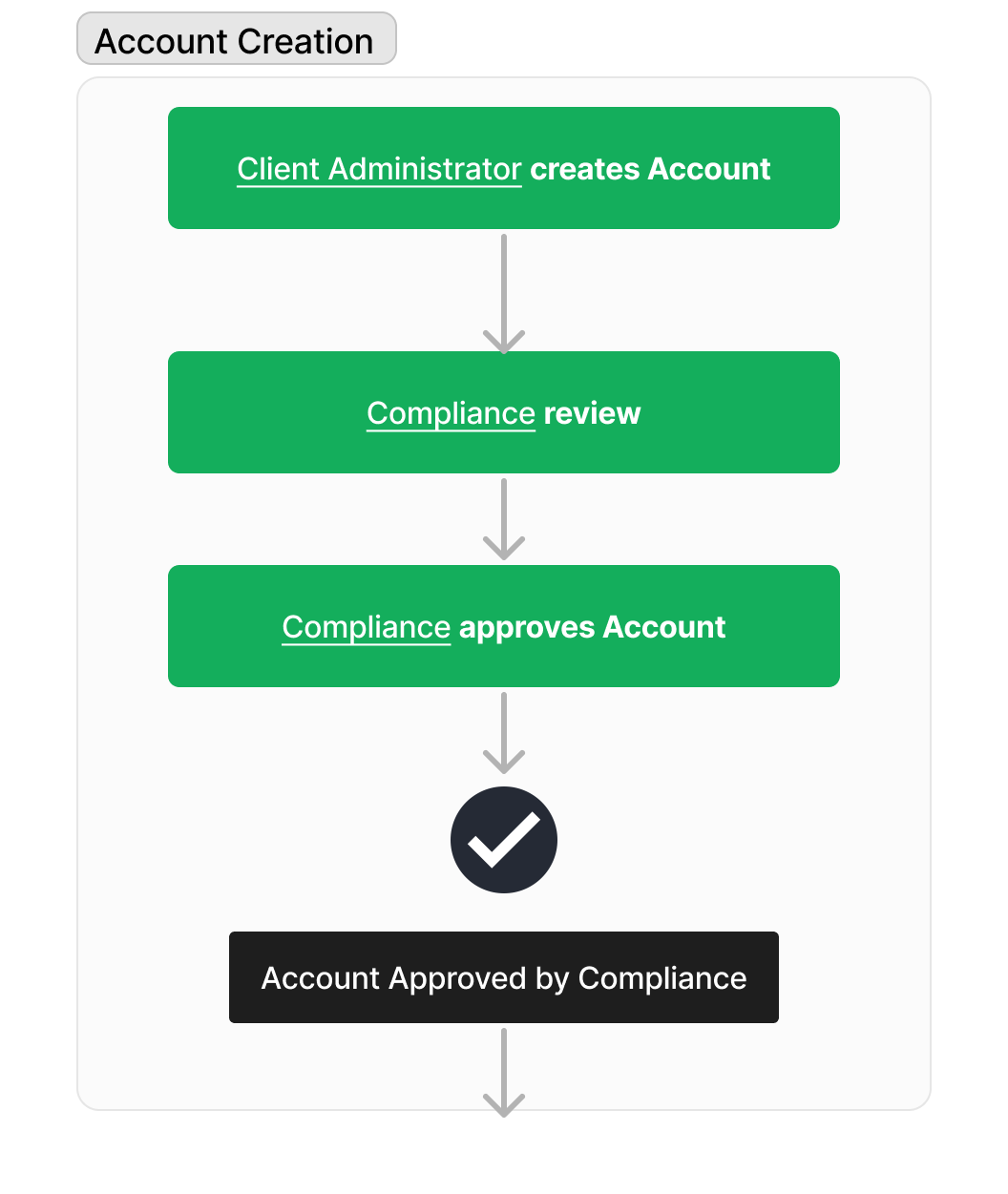

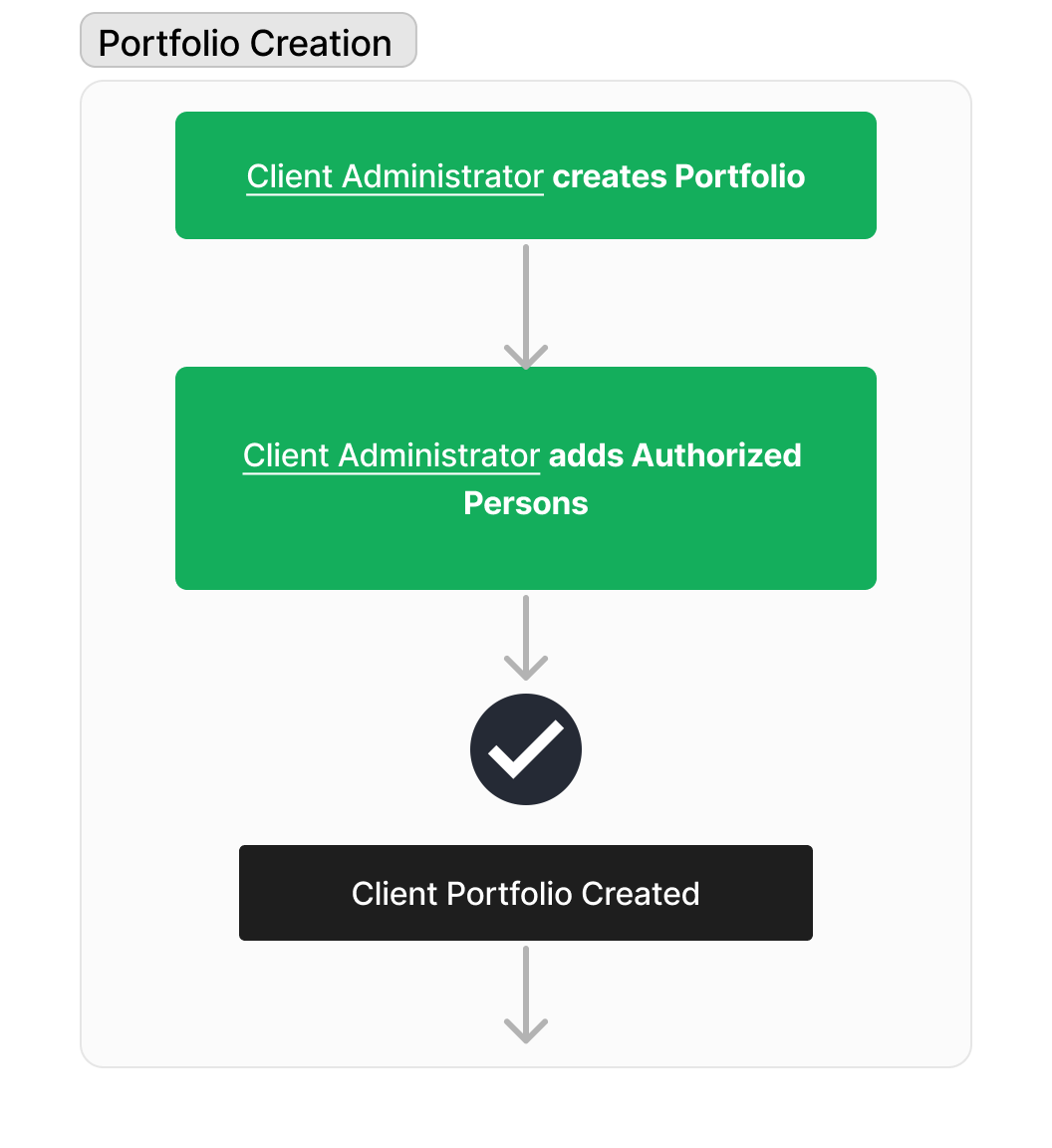

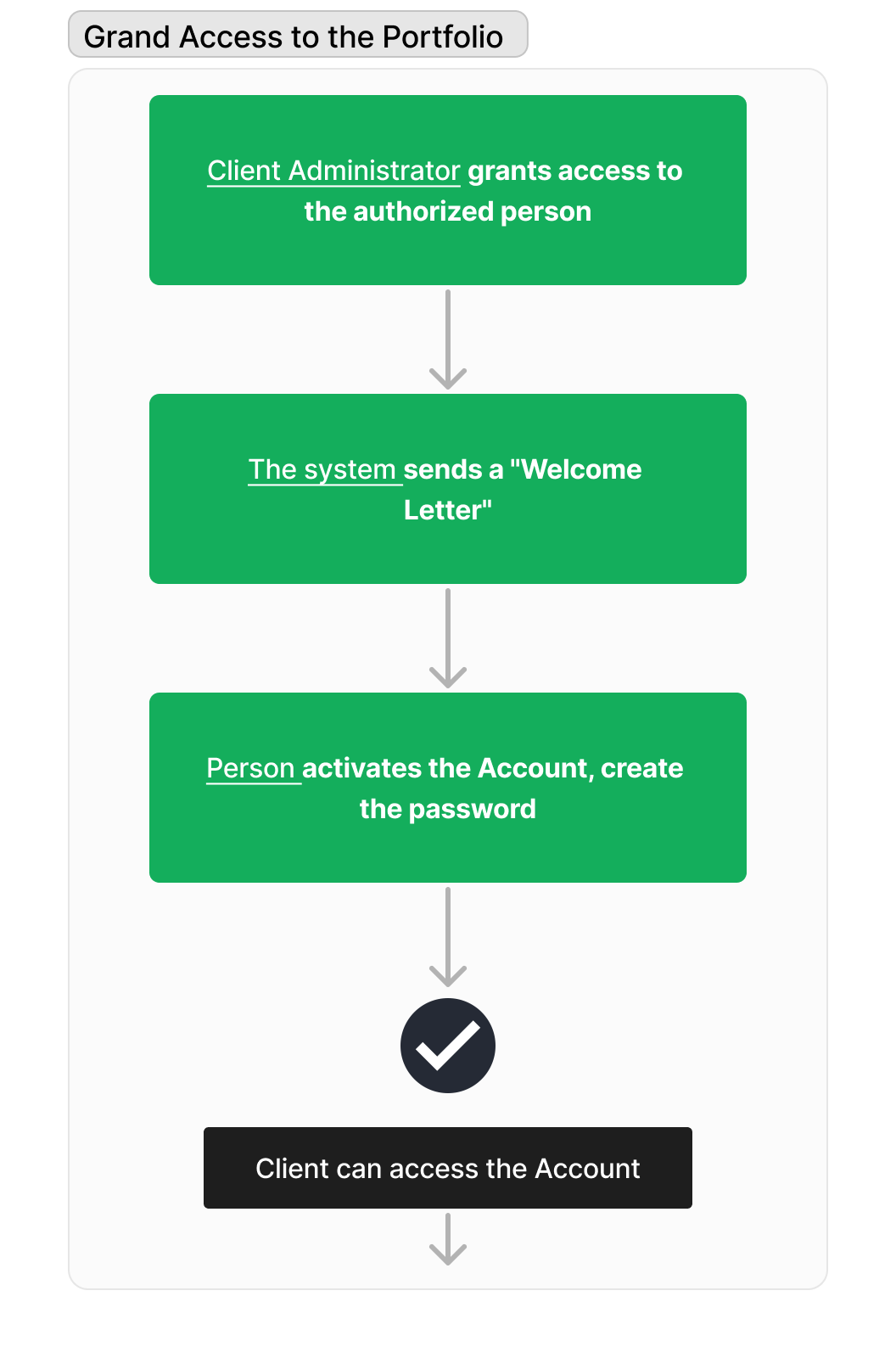

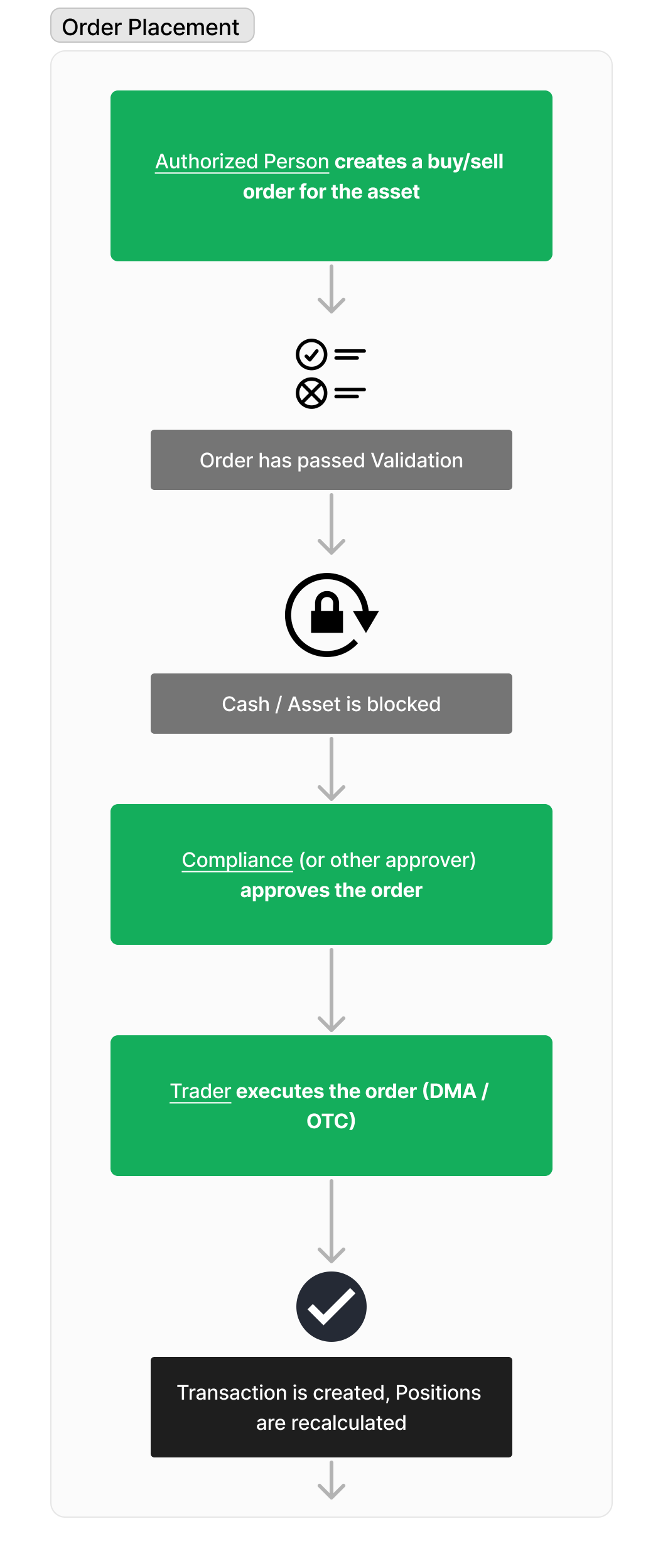

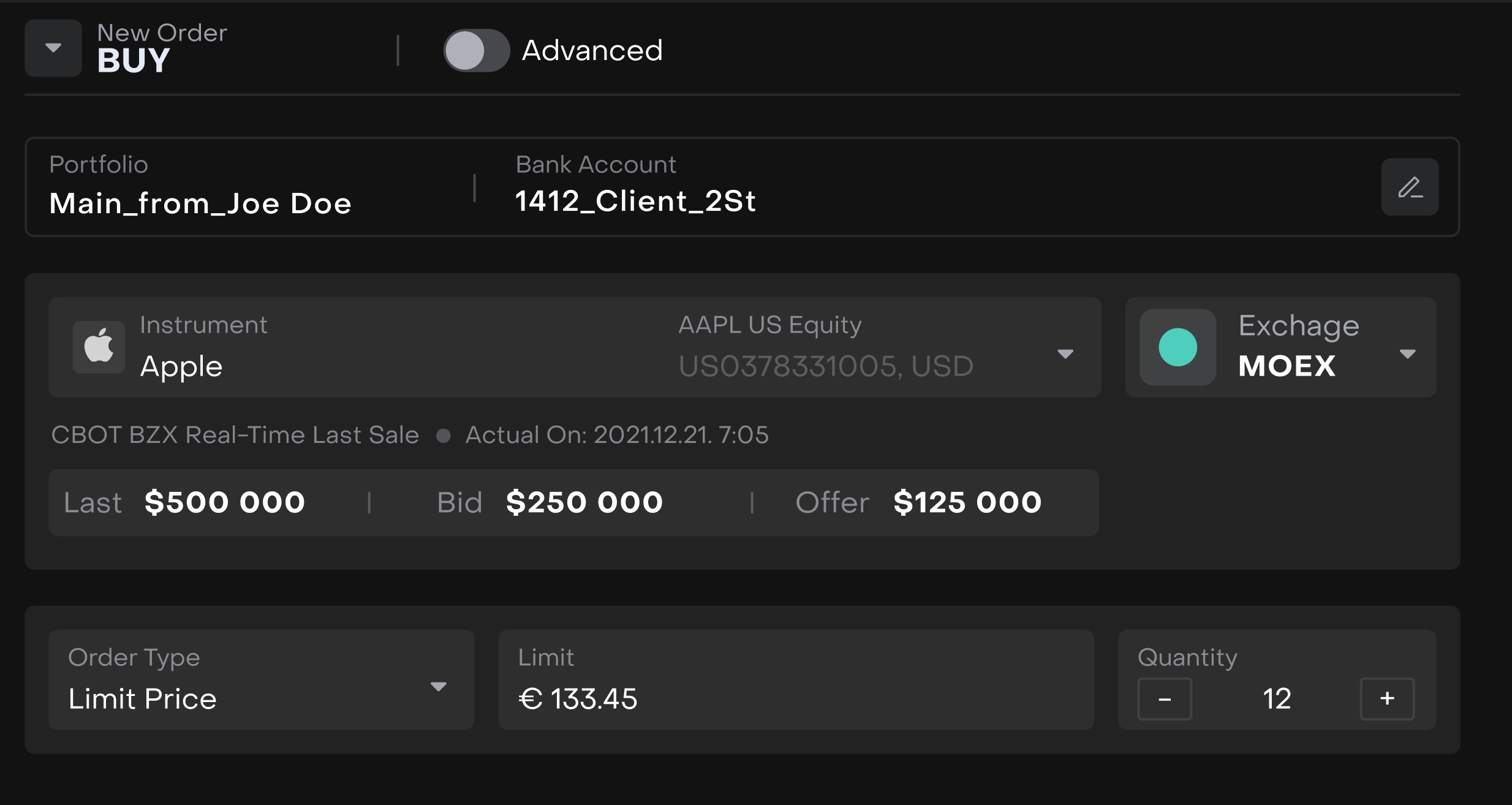

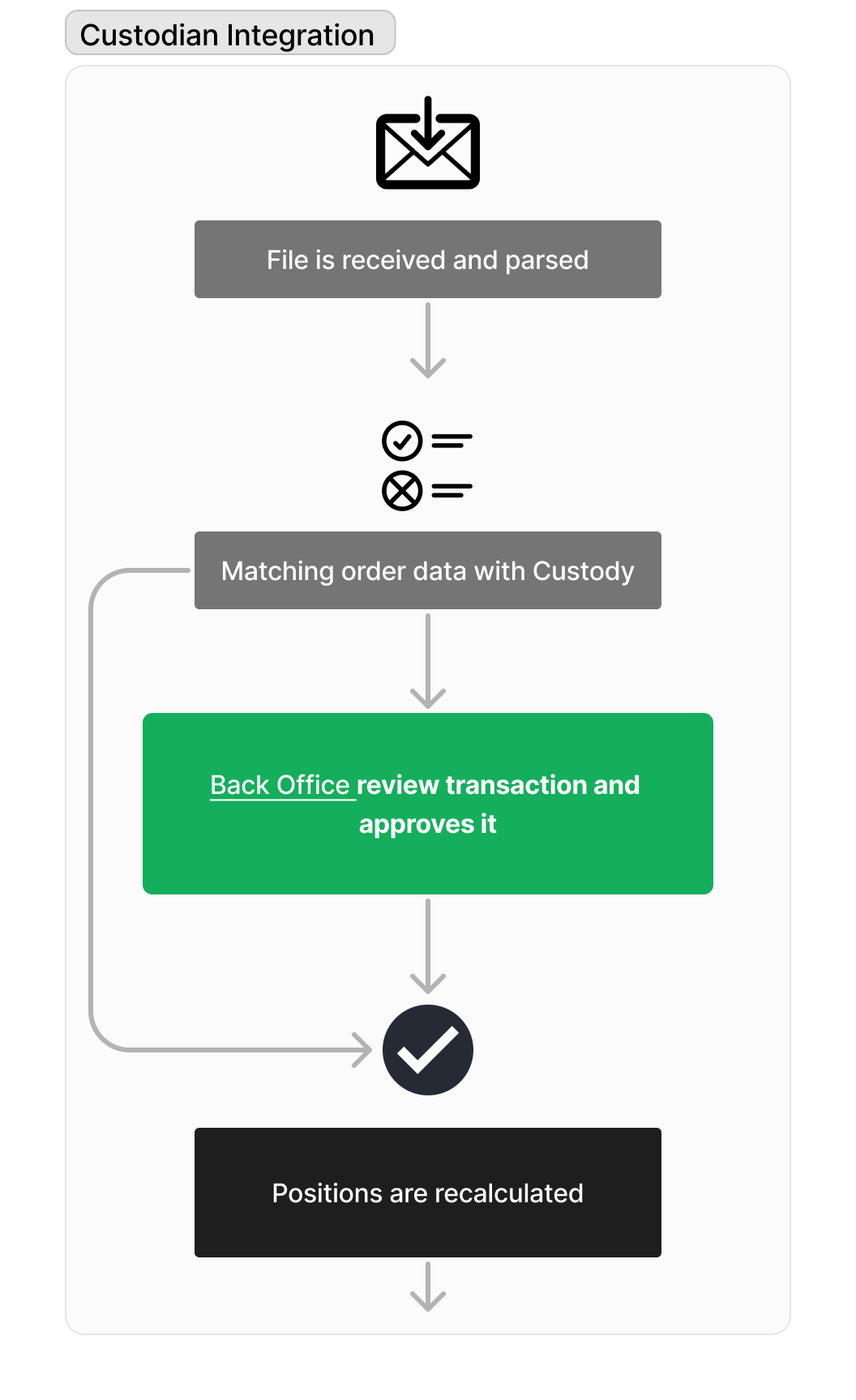

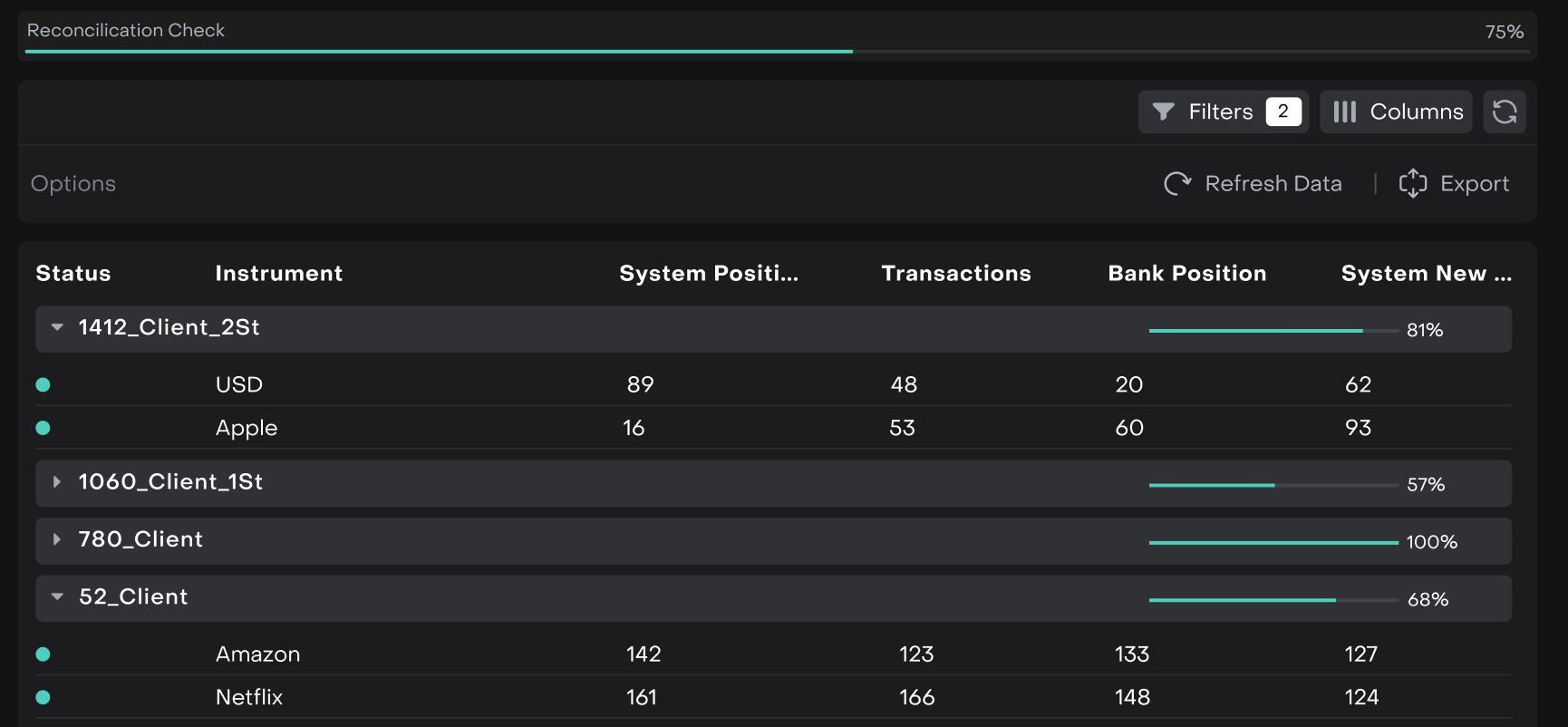

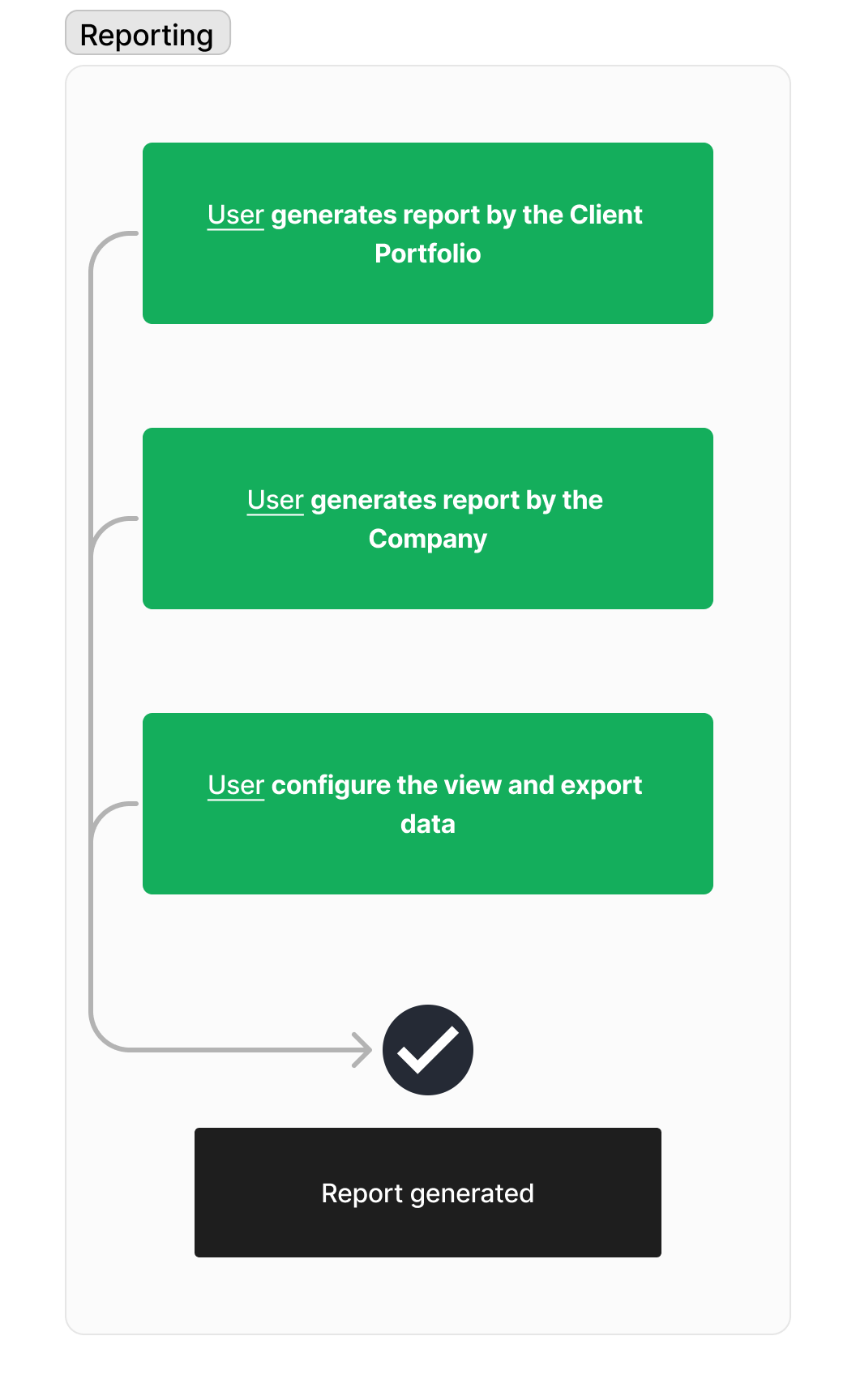

Use Cases