GUIDE: How to postallocate FX transactions?

Introduction

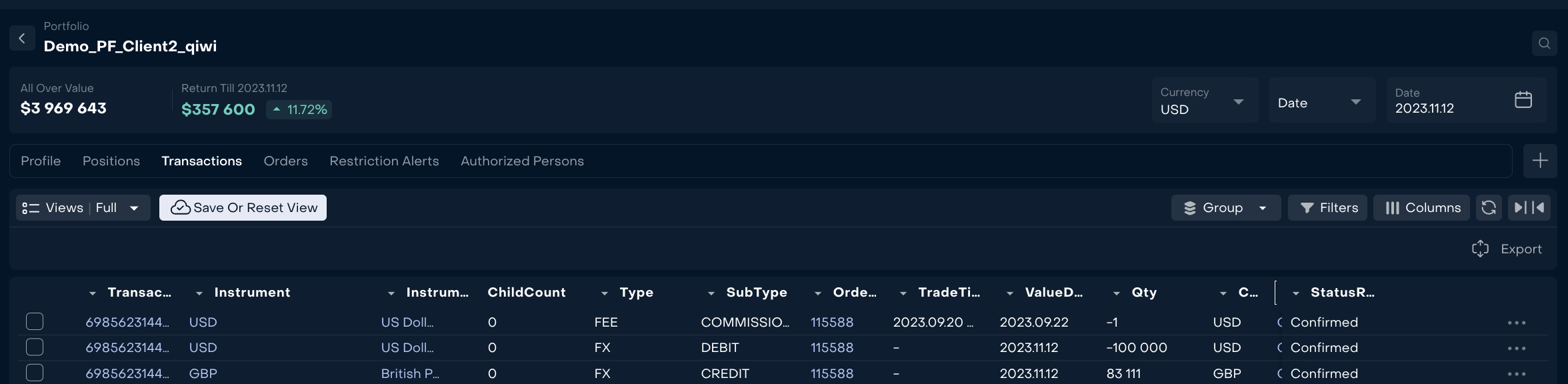

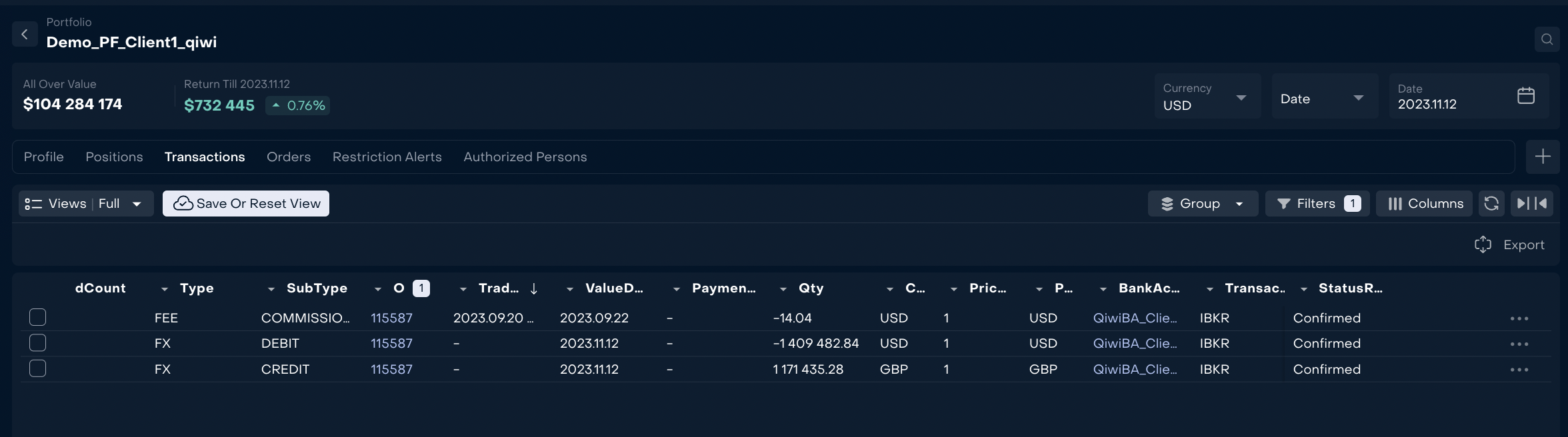

Reluna platform provides a mechanism for postallocation of FX transactions that include FX (DEВIT) и FX (CREDIT) and optionally FEE transaction.

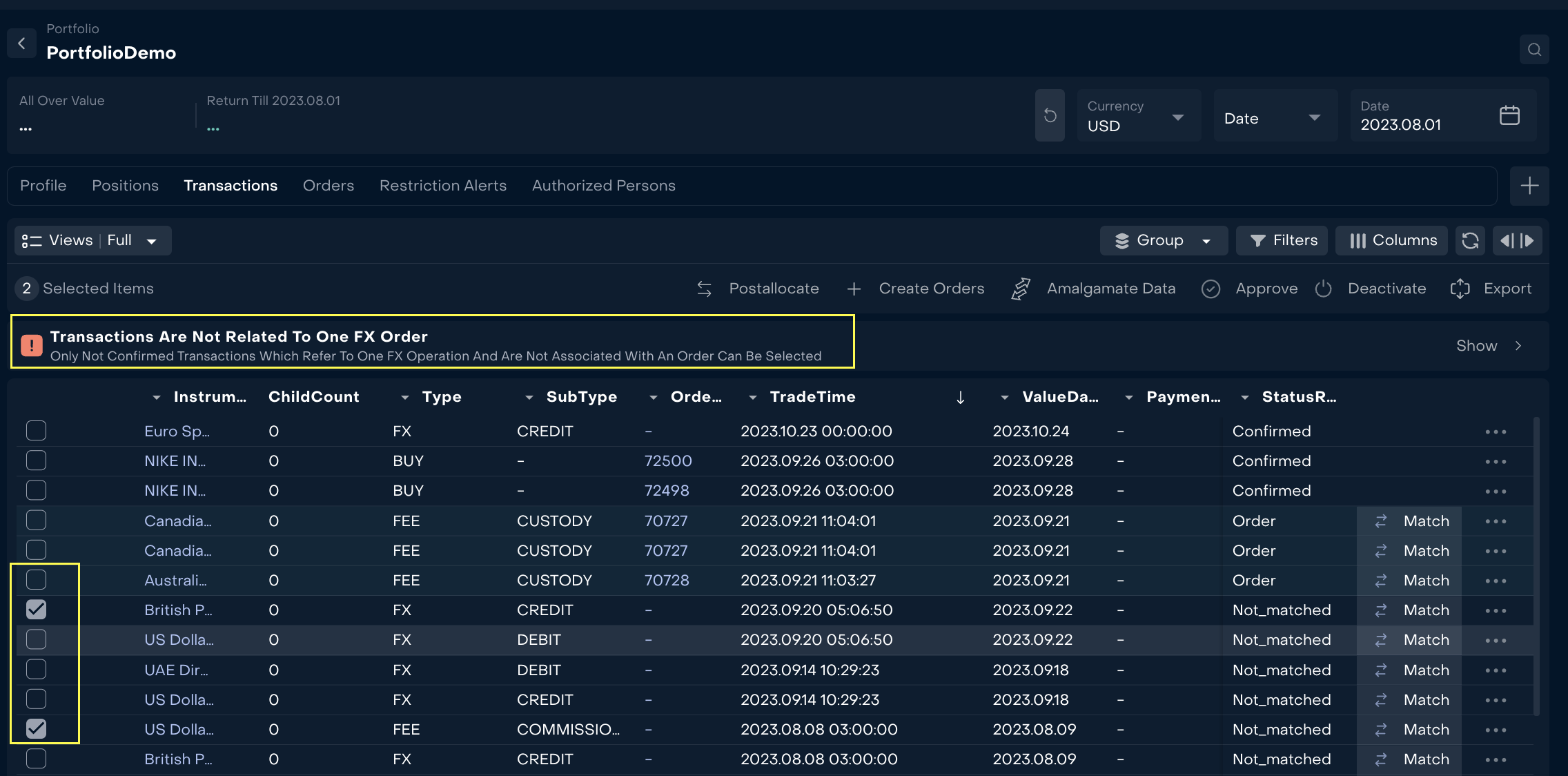

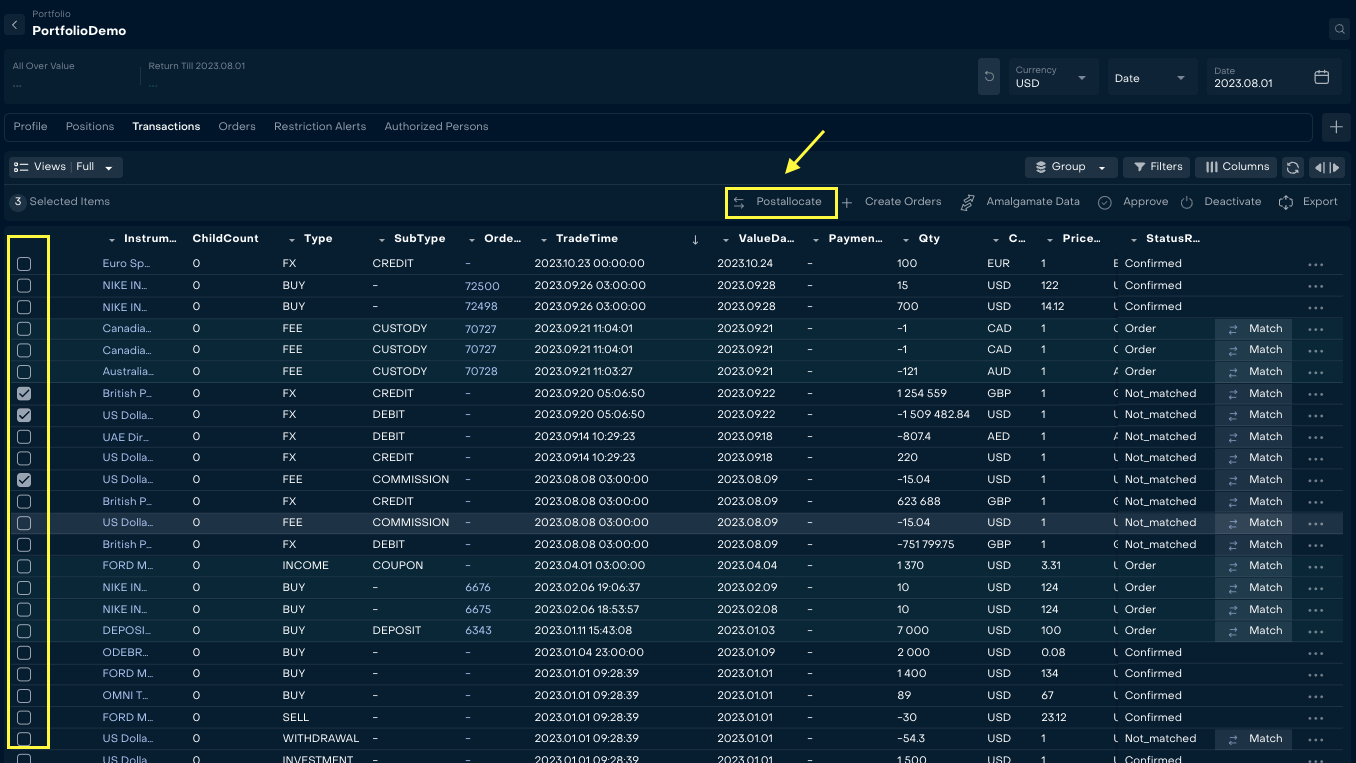

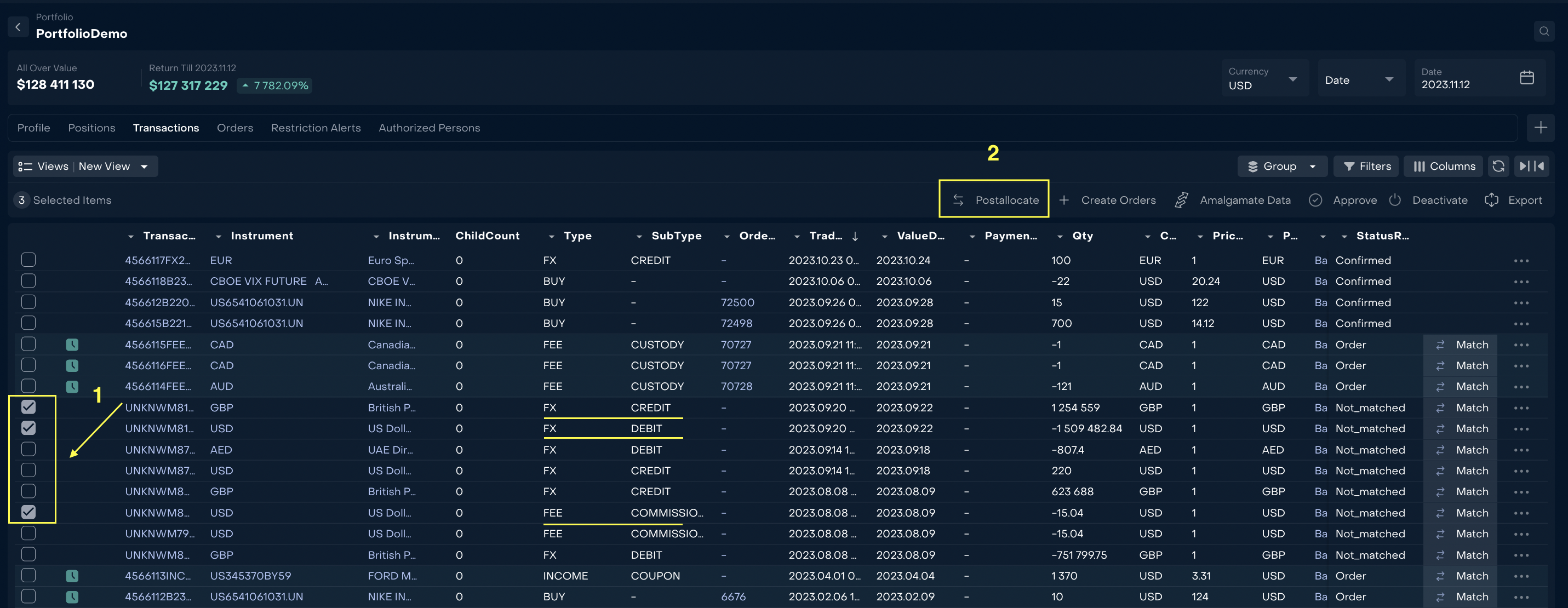

Where to find postallocation mechanism?

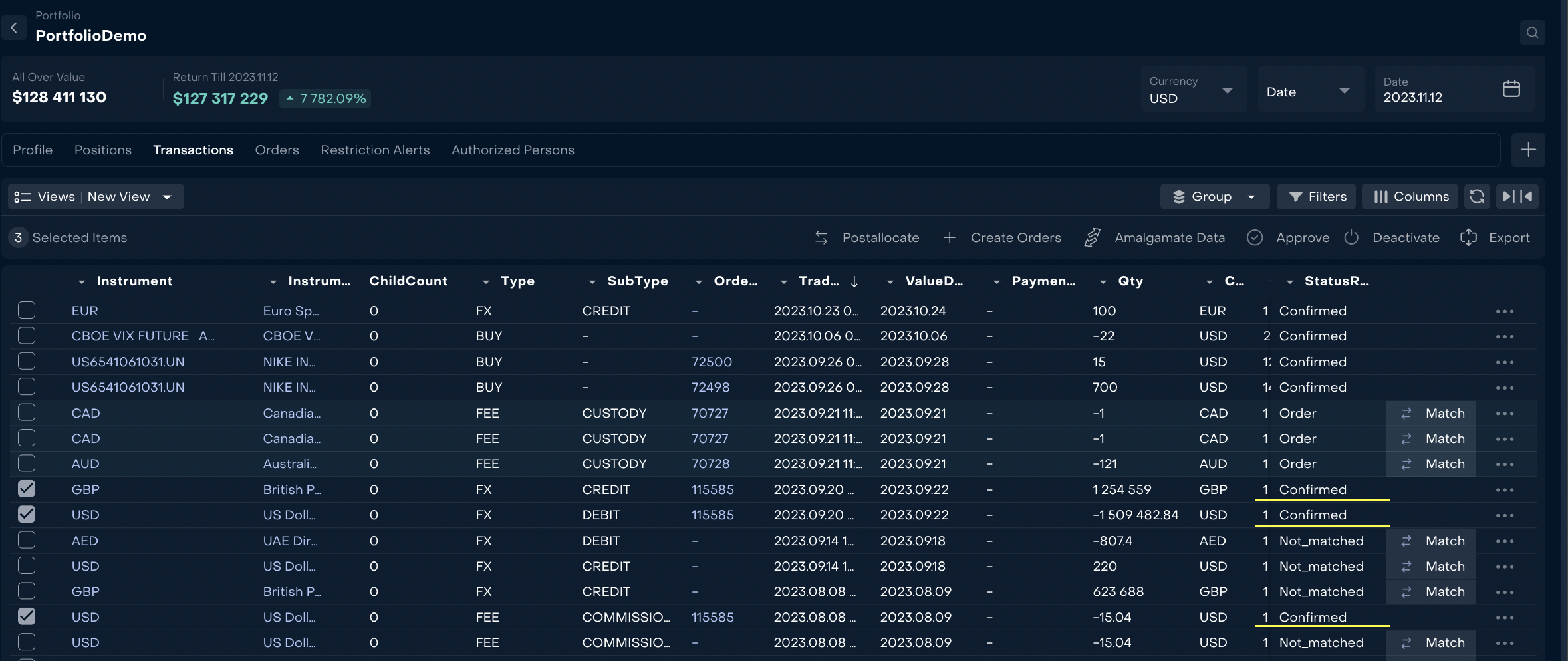

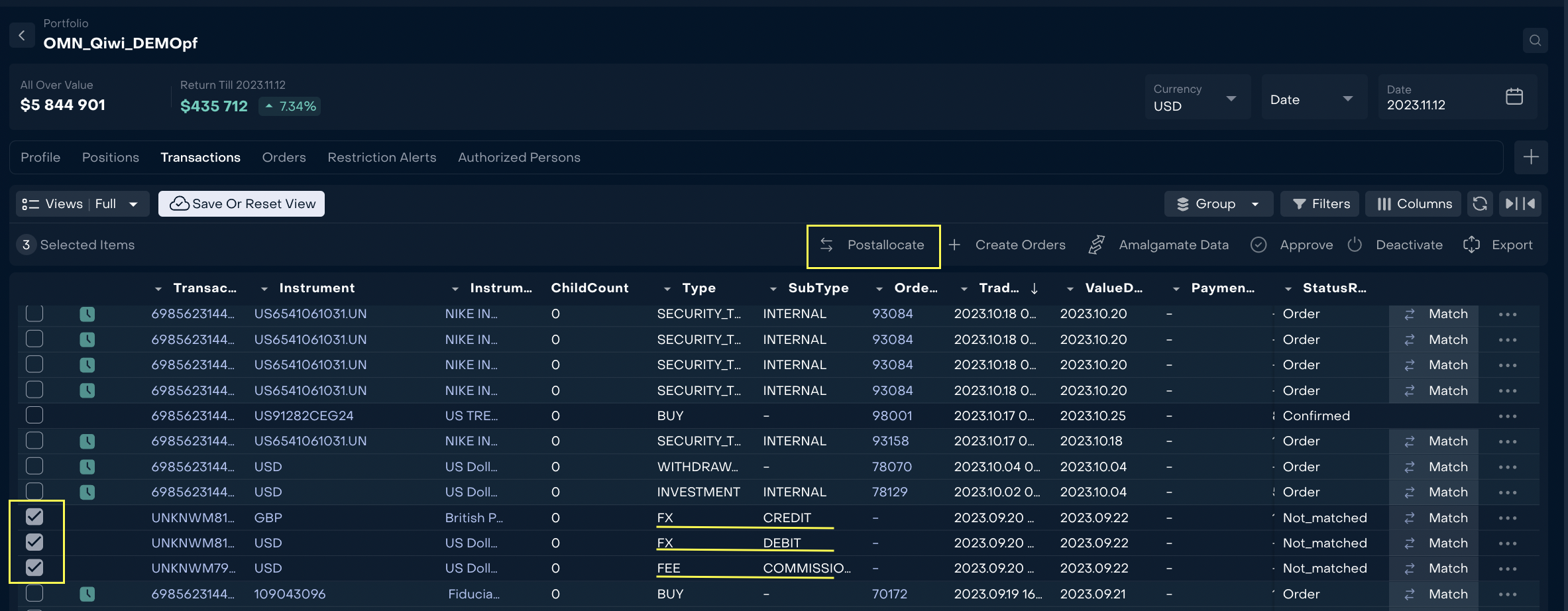

Order creation mechanism is available to authorized users in All Transactions or in Portfolio Transactions-> Select transactions → Button “Postallocate”

Button “Postallocate” is available when at least 1 transaction is selected by “tick” and the User has permission “Transactions_modify”

Button “Create Orders” is available when at least 1 transaction is selected by “tick” and the User has permission “Transactions_modify”

How to use the mechanism?

Back office selects transactions according to the following criteria:

Transaction type “FX” (DEBIT) and “FX” (CREDIT) + optionally FEE that refers to forex operation

Transaction status= ”PENDING” and “NOT_MATCHED”

Transaction is not linked with order (Order Number is empty on transaction)

The system automatically creates drafts of SELL FX order where main fields are filled in.

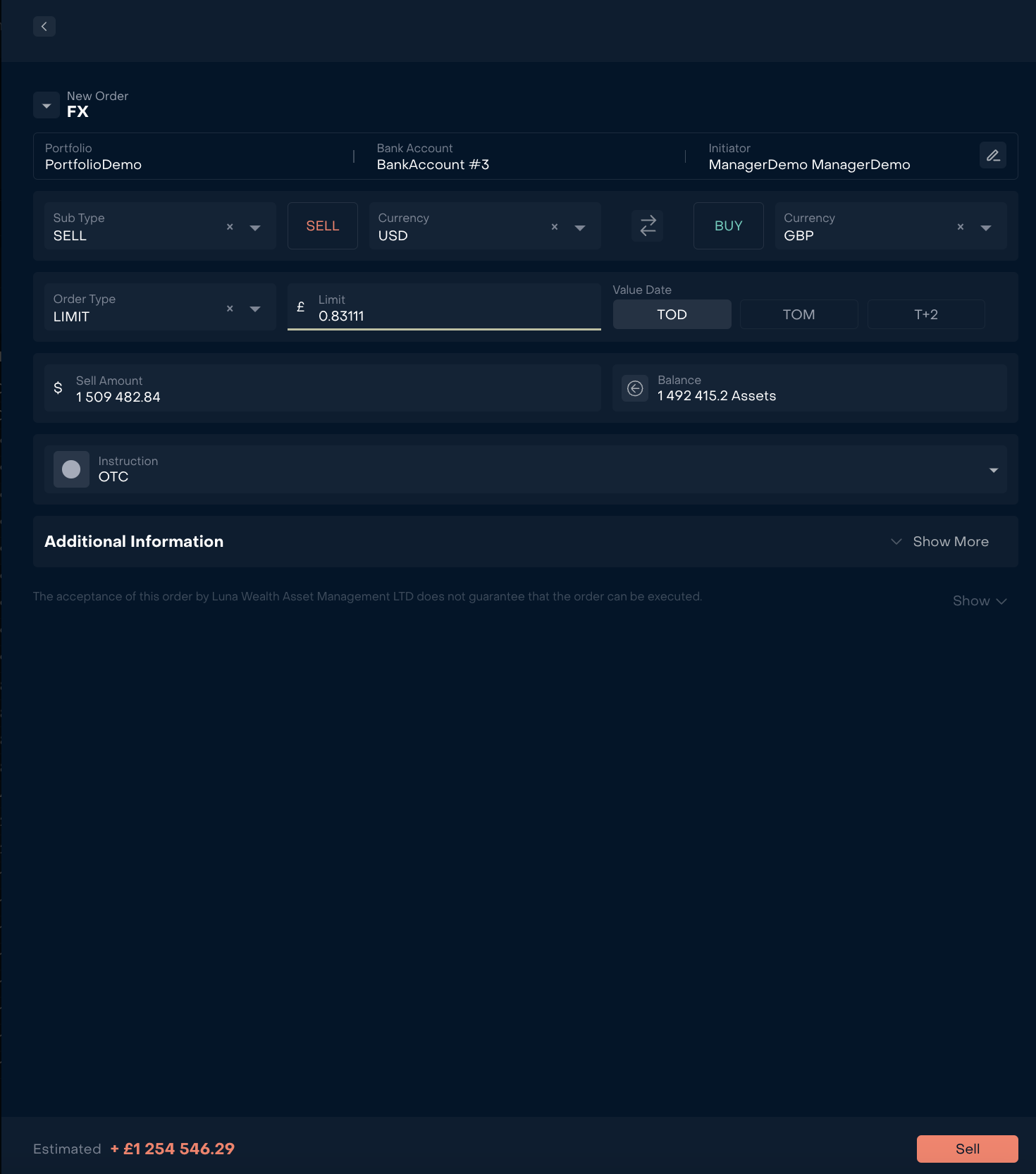

2.1 Order for Standard Bank account

Bank account= Bank account from selected transactions

SubType= SELL FX (by default)

Sell Ccy- from FX Debit Transaction

Buy Ccy-from FX Credit transaction

Price- calculated automatically according to Qty

Trading type=OTC

Additional information

The order is automatically executed and all selected FX transactions and Commission received status=Confirmed.

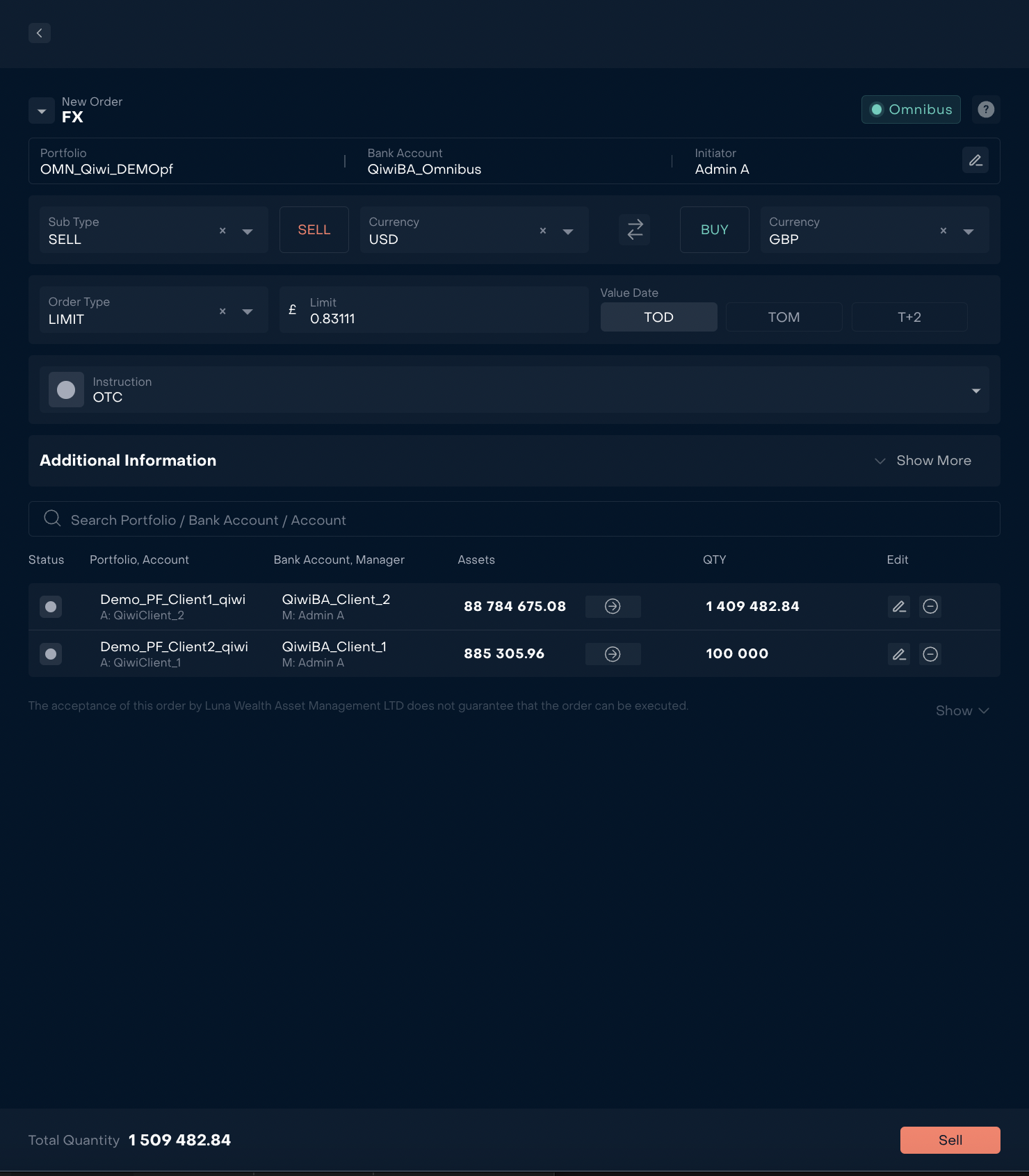

2.2 Order for Omnibus Bank account

Bank account= Bank account from selected transactions

SubType= SELL FX (by default)

Sell Ccy- from FX Debit Transaction

Buy Ccy-from FX Credit transaction

Price- calculated automatically according to Qty

Trading type=OTC

Add Clients to postallocate the FX amount

Additional information

The system will automatically split Commission (from Fee transaction) according to allocated Qty

The order is automatically executed and all selected FX transactions and Commission received status=Confirmed on Omnibus level and on Clients' level.