Trading Orders Management

Introduction

Luna Wealth Platform has a feature that allows to manage Trading Orders: BUY/ SELL on most common assets such as Equities, ETFs, Fixed Incomes (Bonds), Futures, Options, Structure Products.

Main initiators of trading orders are Portfolio managers, Sales Managers, Clients

Direct Market Access is supported (depends on the Custody API)

Key Terminologies

Trading Order | Advanced Order Form |

|---|---|

Orders for BUY/SELL of an asset | Order form with contains additional options and details that are demand additional knowledge to fill in order |

DMA (Direct Market Access) | OTC (Over-the-Counter) |

A way of placing trades directly onto the order books of exchanges | Process of trading securities via a broker-dealer network as opposed to on a centralized exchange |

Mass order | Order on New issue |

Orders are created from one form for 2 (two) or more Bank Accounts | Order for participation in initial offering |

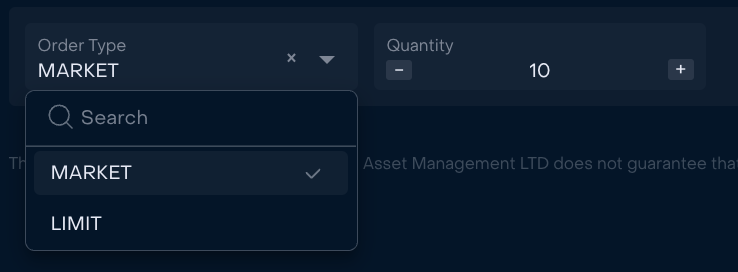

Market Order Type | Limit Order Type |

Order that meant to execute as quickly as possible at the current market price | Order with set maximum or minimum price at which you are willing to buy or sell an asset |

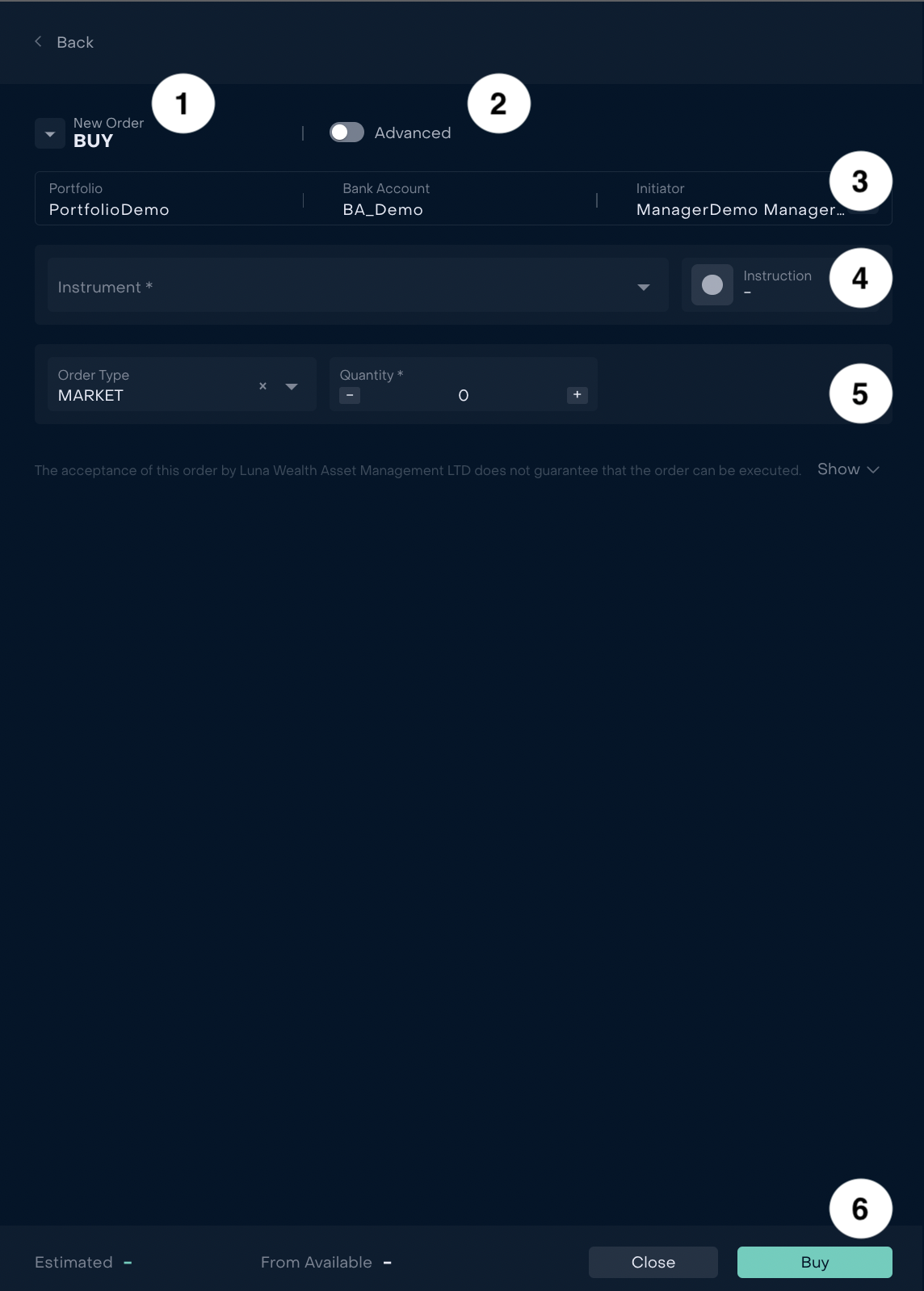

What are the main elements of order?

| # | Description |

|---|---|---|

| Selector of Order type | |

| Switcher to Advanced form | |

| Main information tab with Portfolio, Bank Account and Initiator | |

| Instrument and Exchange | |

| Trade details: Market or Limit Order type and Quantity | |

| Footer with calculations of Estimated and Available and Action Buttons |

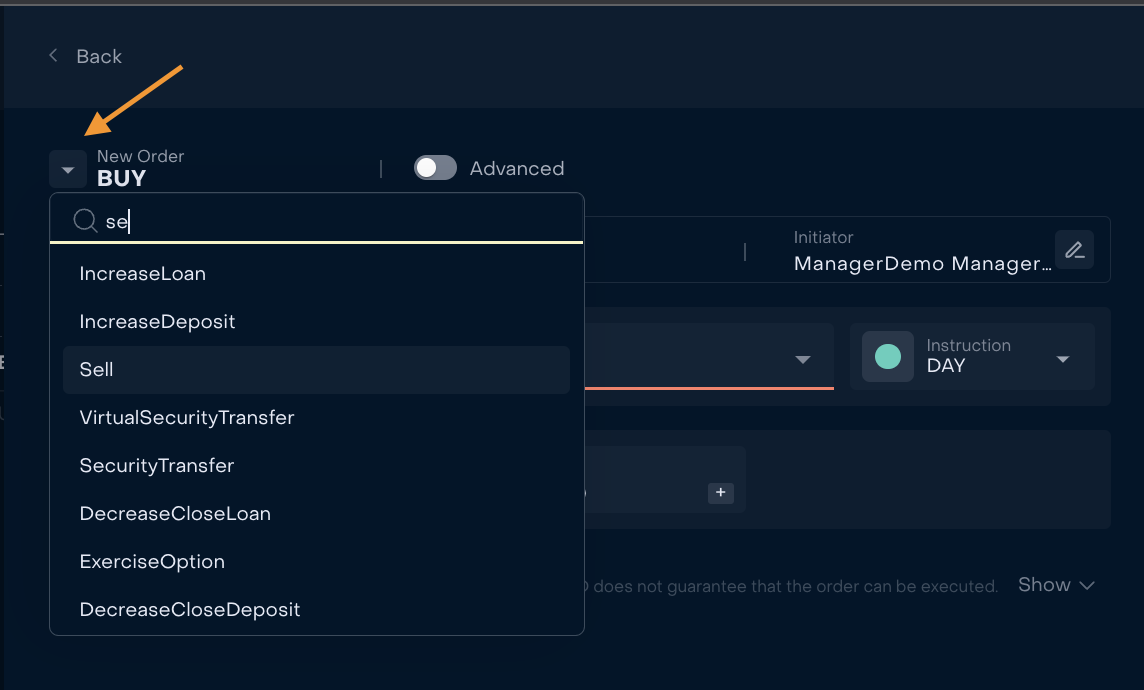

Selector of Order type

When order form is already opened user can change type of order.

If some information was already filled in and then order type is changed, all information we be removed and updated with default values.

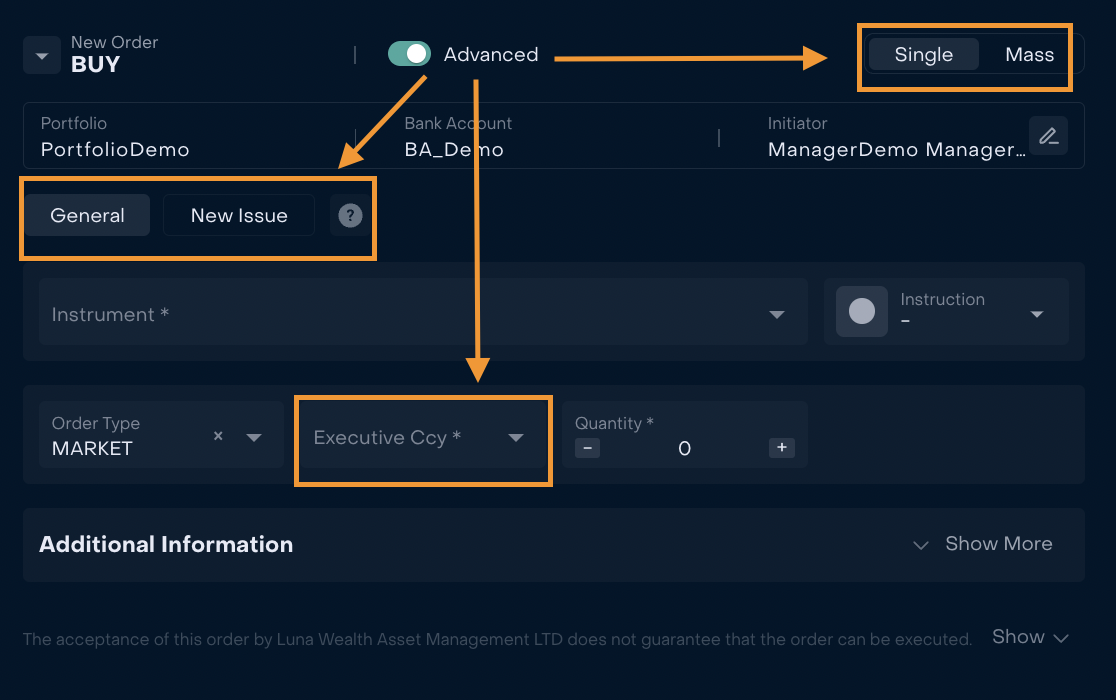

Switcher to Advanced form. What are KEY-differences of Advanced form of order?

Advanced form of Order is available only to users with special permission in LWP (to correct your permissions in the system please contact Support).

Advanced form of order gives additional opportunities to Initiator. First of all, Initiator can create order for one Bank Account or use “Mass” option to create 2(two) or more orders for different Bank Accounts from the same screen. Also advanced form opens opportunity to BUY/SELL Existing instrument (General) or Participate in initial offering (New Issue). In addition, Initiator can select Executive Ccy of trade.

See Detailed Advanced order guide GUIDE: How to use advanced form of Trading Order?

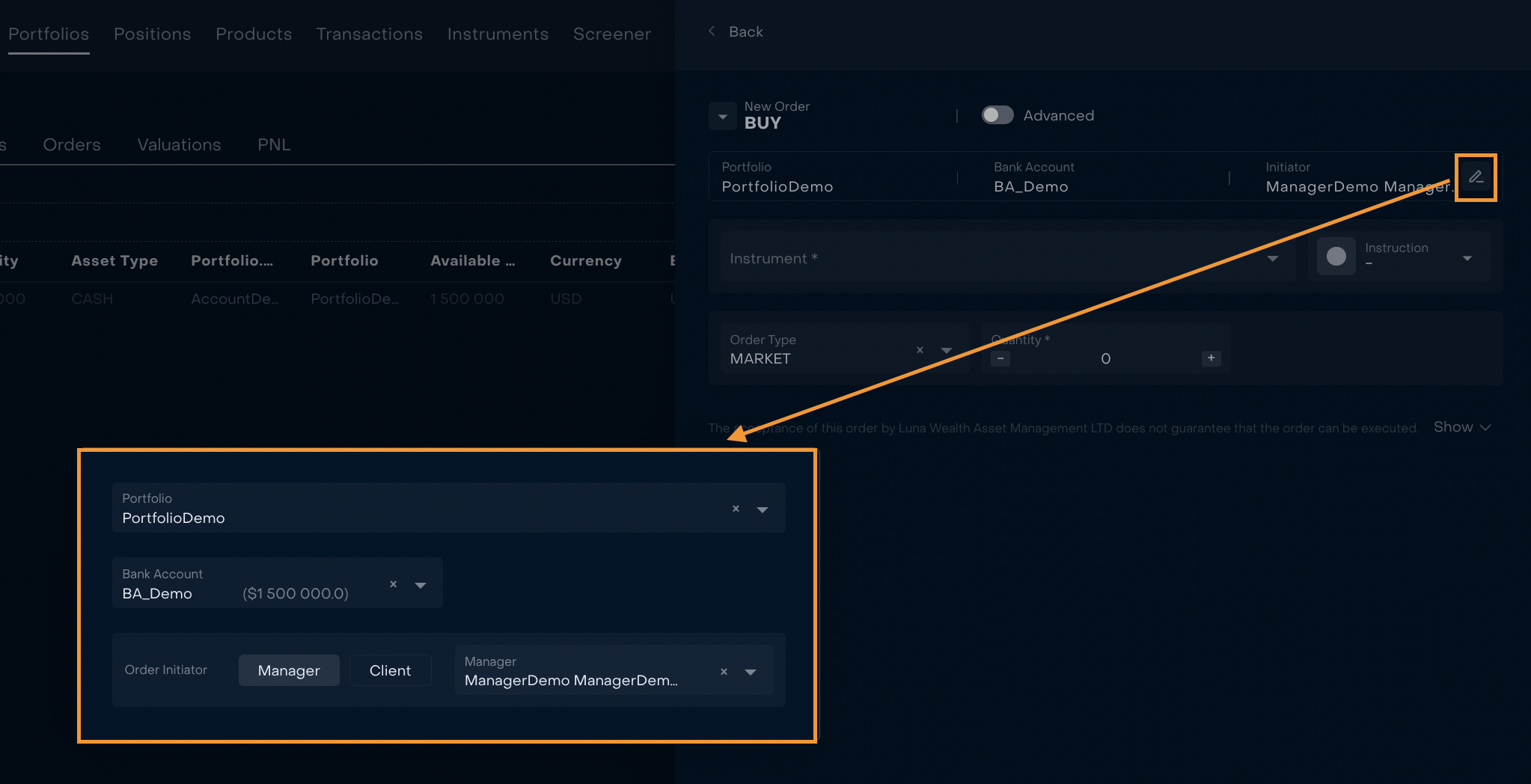

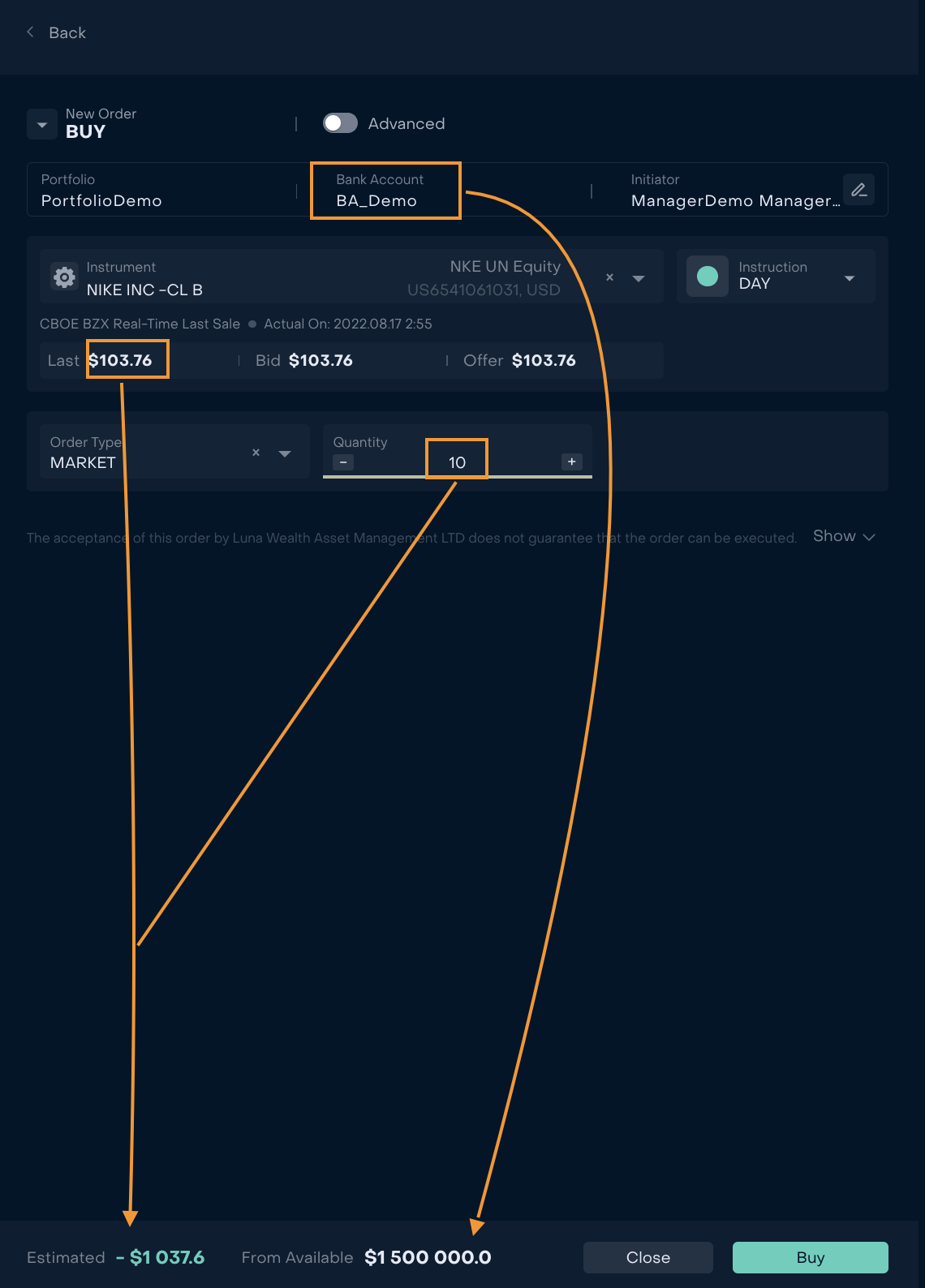

Main information tab with Portfolio, Bank Account and Initiator

Main information on order form is filled in by default: Portfolio, Bank Account , Initiator.

Bank Account is filled in with main Bank Account of Portfolio or Bank Account from position (depending on creation method. See general instruction _____________). Bank Account is displayed with its balance in Portfolio Ccy.

The system supports different types of Management, for example Internal Management, Brokerage etc. Select Order Initiator depending on your Management Type.

By default Manager is considered order Initiator. To change Initiator use switcher and, if necessary, open the list of Clients or Managers related to Portfolio and select the required one.

If you do not see the required Manager or Client in the list, check some useful guides

How to add Managers to Portfolio

https://help.lunawealth.com/kb/Portfolio-Opening-Process.3064430607.html#PortfolioOpeningProcess-AccesstoPortfoliosHow to give Client access to Portfolio

https://help.lunawealth.com/kb/Mandate-Opening-Process.3079831575.html#MandateOpeningProcess-HowtocreateMandate

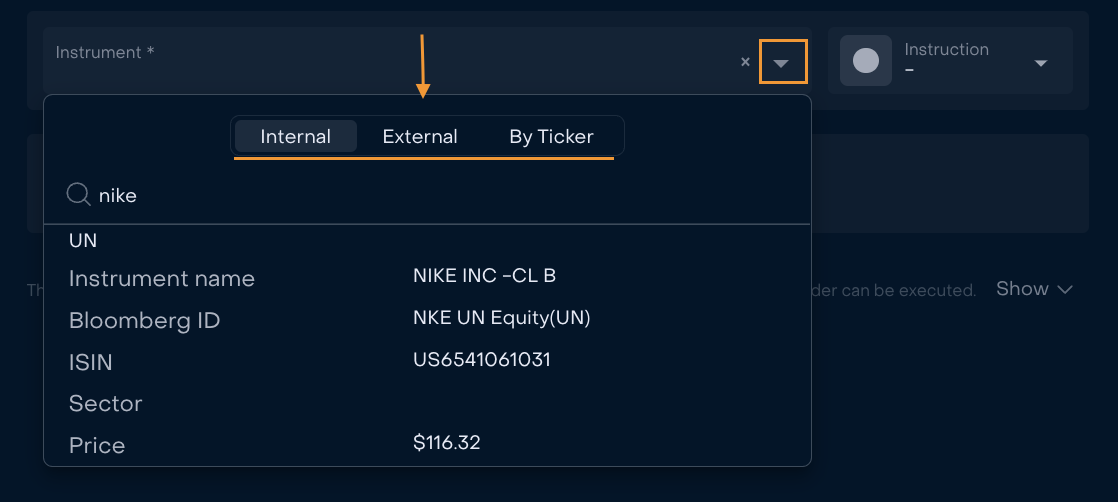

Instrument and Exchange. How to find the Instrument and how it influences the Exchange?

When order is created not from position Instrument will remain empty until user makes his/her choice. Tabs “Internal/External/By Ticker” are designed to perform searches in ways:

Internal search (search is carried out among the installed instruments in the System);

External search (search is carried out among internal and external instruments through Bloomberg);

By Ticker (advanced search is carried out among external tools using Bloomberg ID and asset type of Instrument).

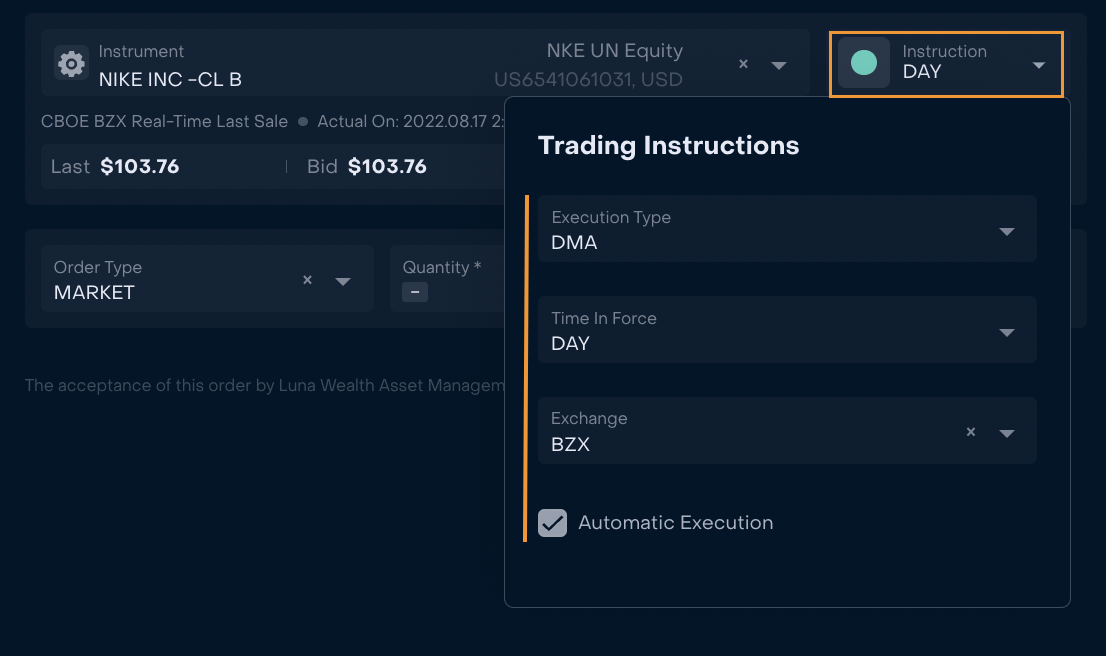

When the Instrument is selected LWP displays last available information on Instrument’s Market Price, Bid and Offer.

At the same time depending on the Instrument and Bank account of order LWP displays corresponding settings of Exchange: indicator OTC or DMA and Trading Instructions.

DMA is available if the option is provided by Custody

GREEN - DMA is available

GREY - DMA is not available

Trading Instructions include:

1) Execution Type (DMA or OTC);

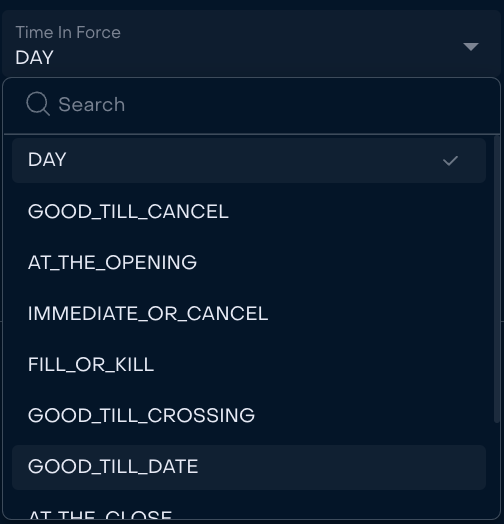

2) Time in Force (select form the list)

3) Exchange

Exchange is set automatically by LWP, but can be changed by user from list of available exchanges of the Instrument. If exchange is obligatory for particular order, the field will become highlighted as required.

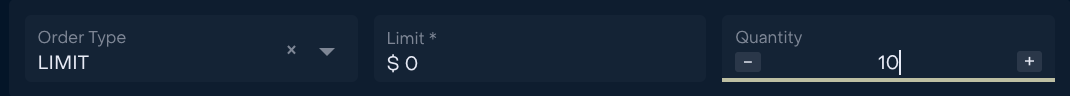

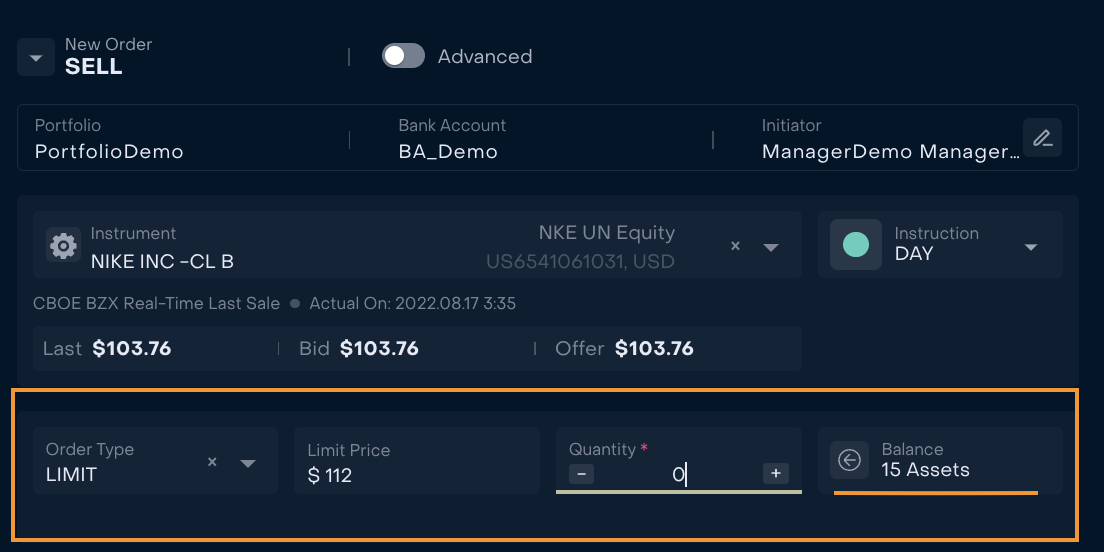

Where to set Trade Details: Market / Limit order and Quantity?

Trade details have separate block on the order form. By default order type is Market

If order type Limit is selected, Limit field is displayed. User sets the Limit manually.

Field Quantity is also filled in manually.

If user opens SELL order form, LWP displays “On Bank Account” block with available assets. Remember that it is impossible to sell more assets than is available on Bank Account Balance. Exception: cases when Short Trading is allowed.

Calculations of Estimated and Available and Action Buttons

LWP automatically calculates Estimated for Trading Orders on the basis of Instrument Asset Type, Price and Quantity. Available equals available on the Bank Account that is used in the order.

Button Buy transfers user to Confirmation form of order.

Button Close closes order form without creation of order.