Deposit and Loan orders

Introduction

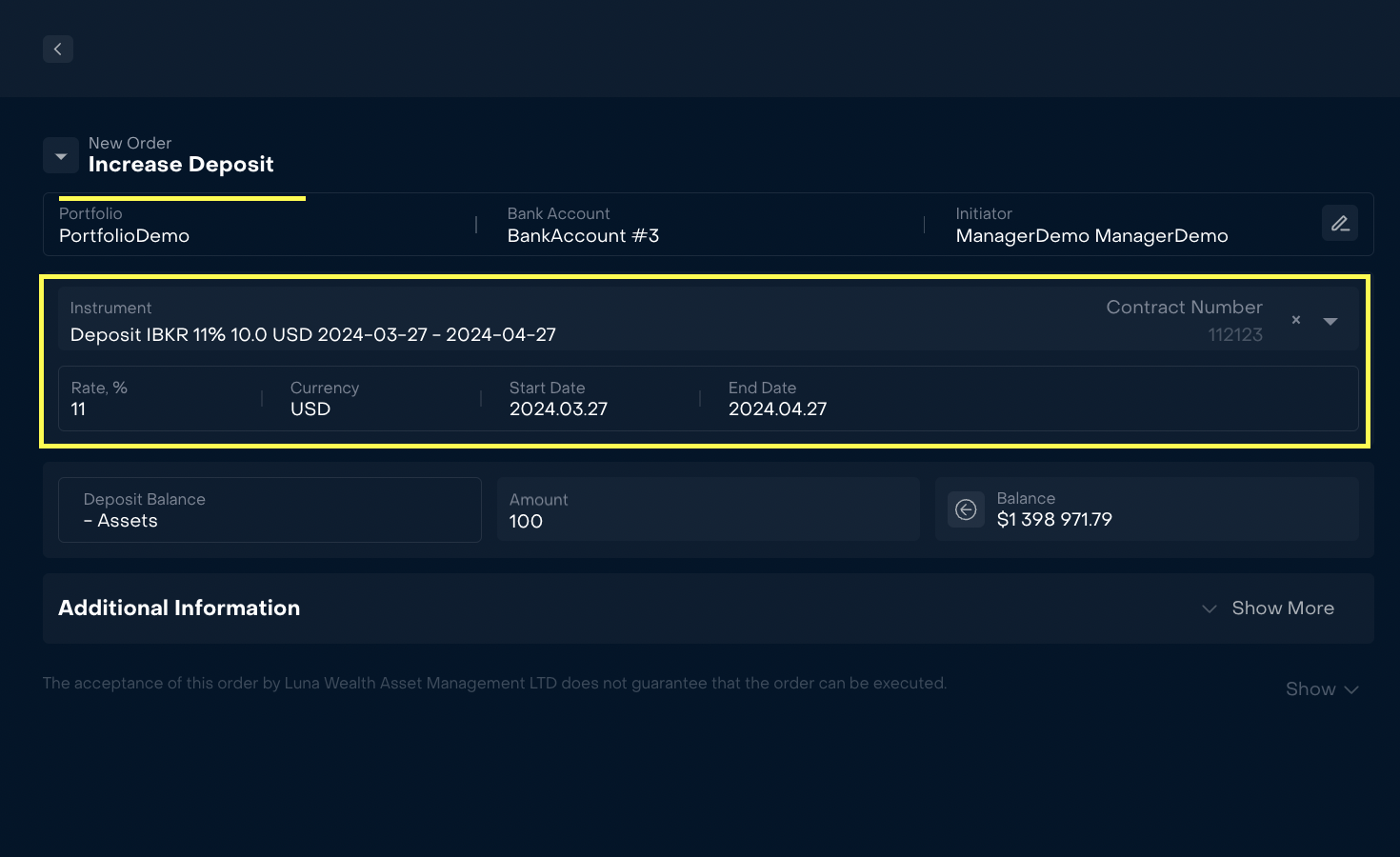

Reluna Platform has a feature that allows to manage Non-Trading Orders: “Open Deposit" / "Open Loan”, “Increase Deposit”/ “Increase Loan” and “Decrease/ close Deposit” and “Decrease/ close Loan”.

Key terminology

Term | Description |

|---|---|

Deposit | Placing money into a bank or financial institution for safekeeping and potential return. |

Loan | Financial arrangement where a lender provides funds to a borrower, and the borrower agrees to repay the principal amount along with interest over a specified period |

What are the main elements of order?

| # | Description |

|---|---|---|

| Type of Order and Main information tab with Portfolio, Bank Account and Initiator | |

| Information Currency, Amount | |

| Expected Rate | |

| Expected duration with options | |

| Additional information | |

| Footer with calculations of Estimated/ Available and Action button |

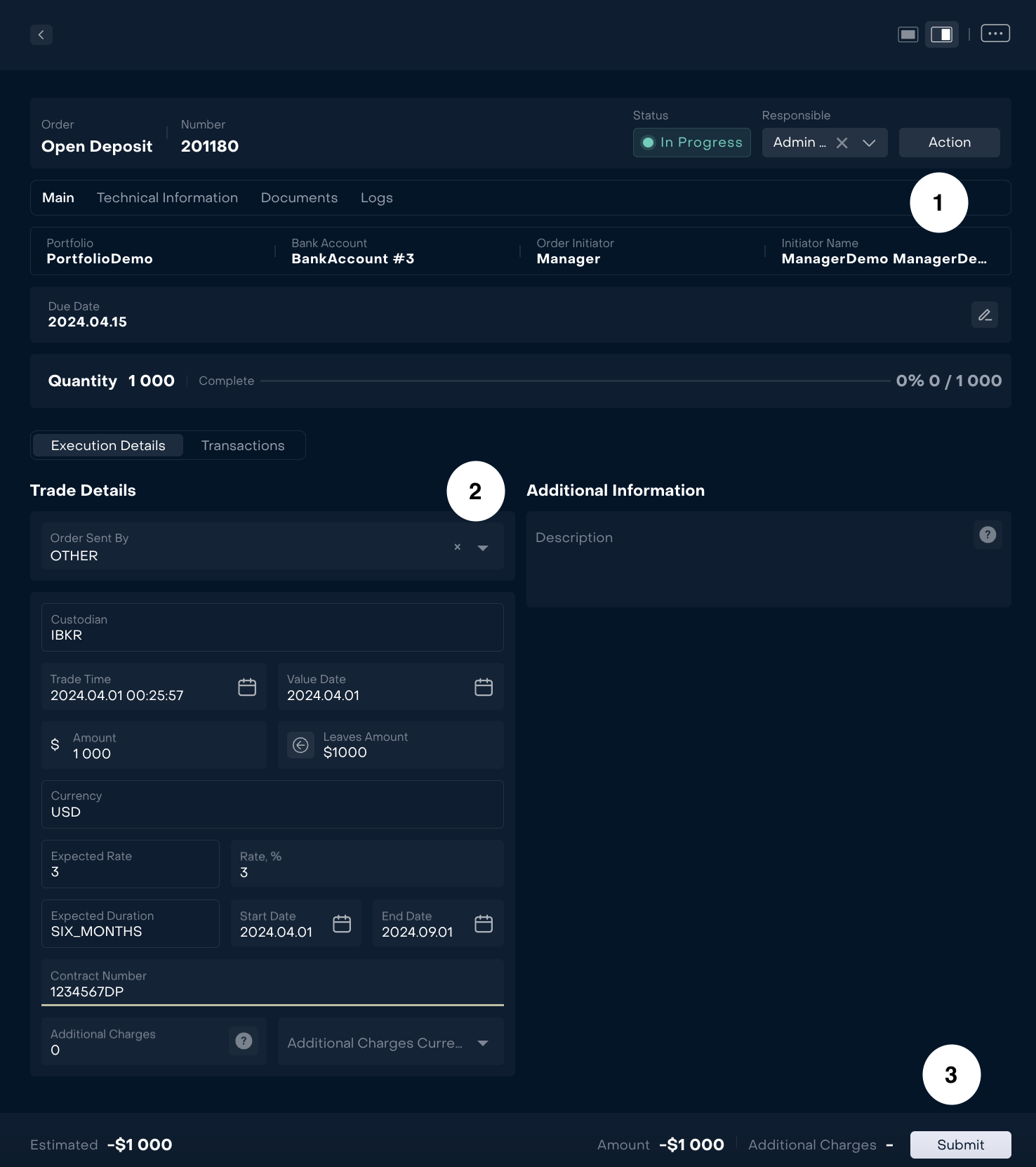

Deposit or Loan is created after execution of an order.

User shall add detailed information about deposit or loan received from the Bank.

| # | Description |

|---|---|---|

| Type of Order and Main information tab with Portfolio, Bank Account and Initiator | |

| Trading details Contract number will be a unique identifier of the deposit or loan | |

| Footer with calculations of Estimated/ Available/Additional charges and Action button |

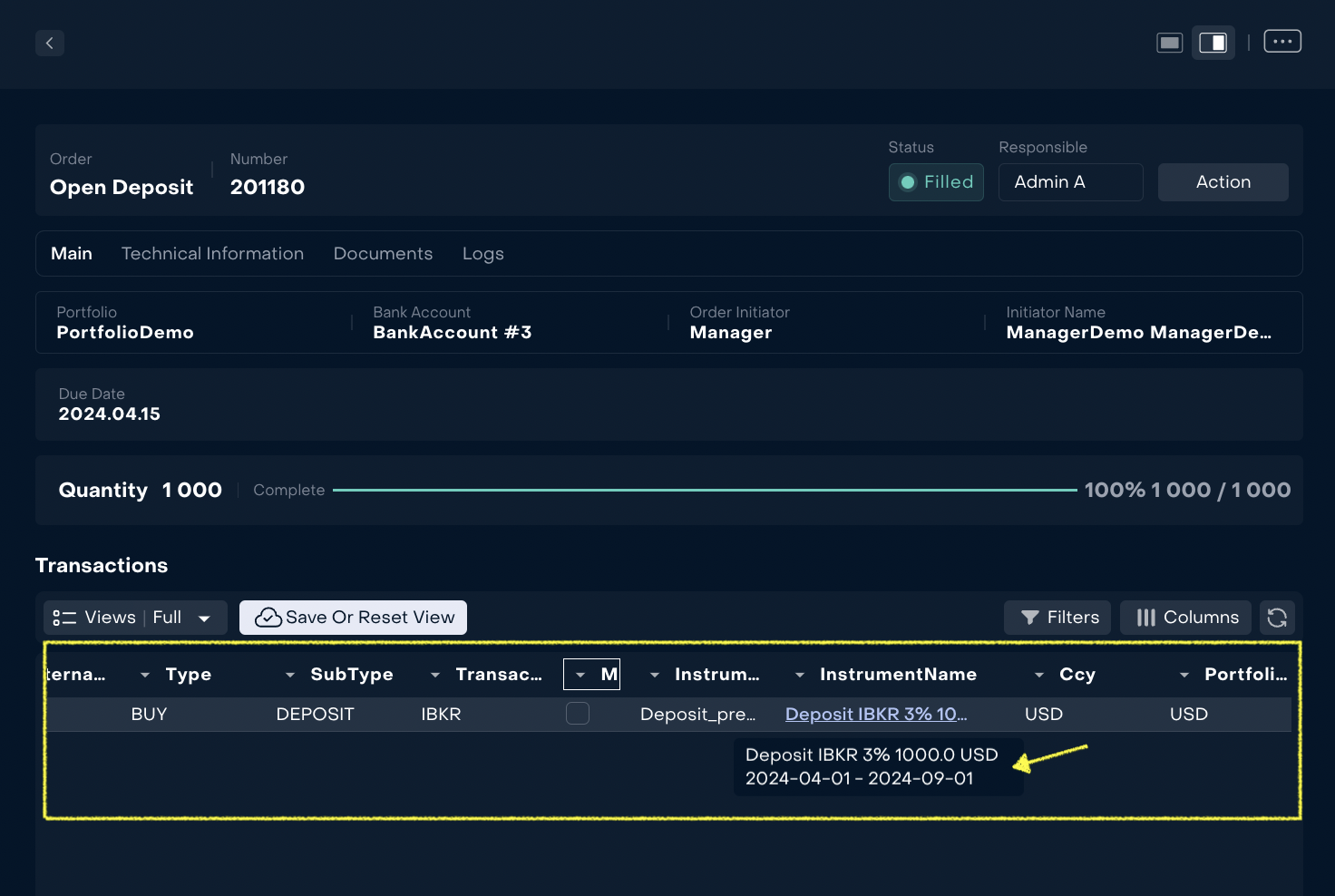

Results of order execution

When order is executed the system automatically created transaction in status “Active” and status reason “Order” with a created instrument. The name of the instrument will be formed on the basis of order information.