Internal Cash Movement and Internal Security Movement Orders

Introduction

Internal cash movement and internal security movement are financial operations where one party (the lender) provides funds or securities to another party (the borrower), with the understanding that the borrower will repay the principal along with interest over a set period. These movements occur between virtual bank accounts that are part of a single omnibus account and are used for internal tracking and management.

Both virtual bank accounts shall relate to 1 Omnibus.

Since internal cash and security movements are not processed through market sources, they cannot be loaded using traditional identifiers. These movements are not reported to external banks, nor are they received as transactions from the bank.

Key Requirements

Participants Involved:

Back Office: Responsible for creating and executing internal cash movement and internal security movement orders.

Client/Portfolio Manager/Sales Manager: View internal cash movement and internal security movement orders, and track performance.

Clients: Clients do not initiate internal cash or internal security movement orders.

Internal cash/Internal security movement orders: These are non-trading orders and are handled internally within the platform.

How to Create an Internal Cash Movement Order

Follow these steps to create an Internal Cash Movement order:

Step 1: Navigate to the Non-Trade Orders Section

Create new order and select Internal Cash Movement

Step 2: Fill in the Required Information

Portfolio: Select the portfolio related to the cash movement.

Order Initiator: Indicate the person or system initiating the movement.

From Bank Account: Choose the bank account that will lend the cash.

To Bank Account: Select the bank account that will borrow the cash.

To Portfolio: Indicate the portfolio that will receive the cash.

Currency: Specify the currency (e.g., USD, EUR).

Quantity: Enter the quantity to be lent or borrowed.

From Bank Account Balance: The platform displays the available quantity of the security in the From Bank Account.

Step 3: Add Additional Information.

Step 4: System Validation

The system will validate the following:

Only bank accounts linked to the same Omnibus Bank Account can be selected.

The system checks the available cash balance in the lender's account to ensure it’s sufficient to cover the loan.

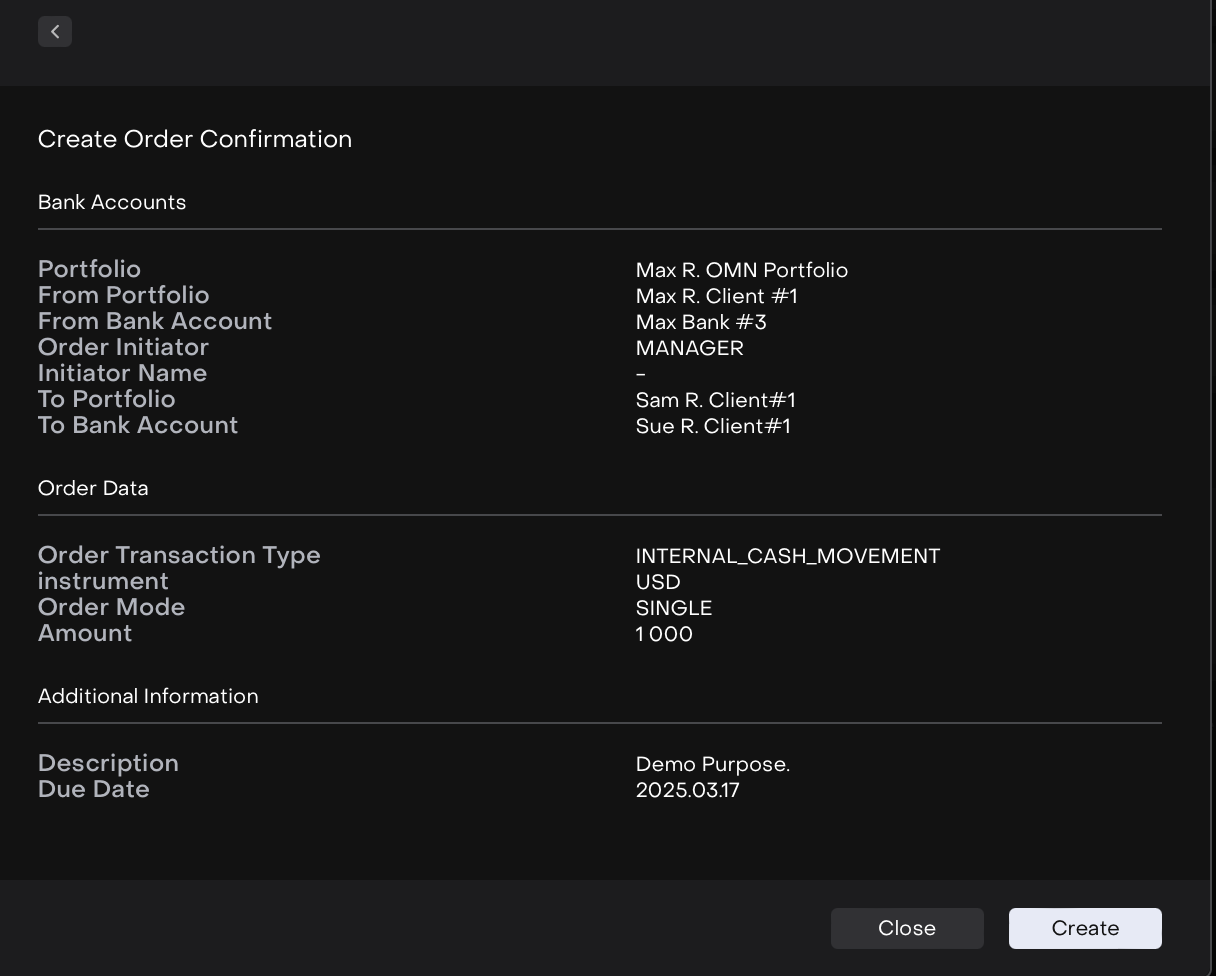

Step 5: Confirm and Create Order

Once all details are filled out and validated, click Create Order to finalize the internal cash movement order.

The Internal Cash Movement order has been created.

Expected Outcome After Execution

For the Lender: The available balance of cash will be decreased.

For the Borrower: The available balance of cash will be increased.

For the Omnibus Account: The position of the omnibus account will remain unchanged.

How to Create an Internal Security Movement Order

Follow these steps to create an Internal Security Movement order:

Step 1: Navigate to the Non-Trade Orders Section

Select Internal Security Movement order

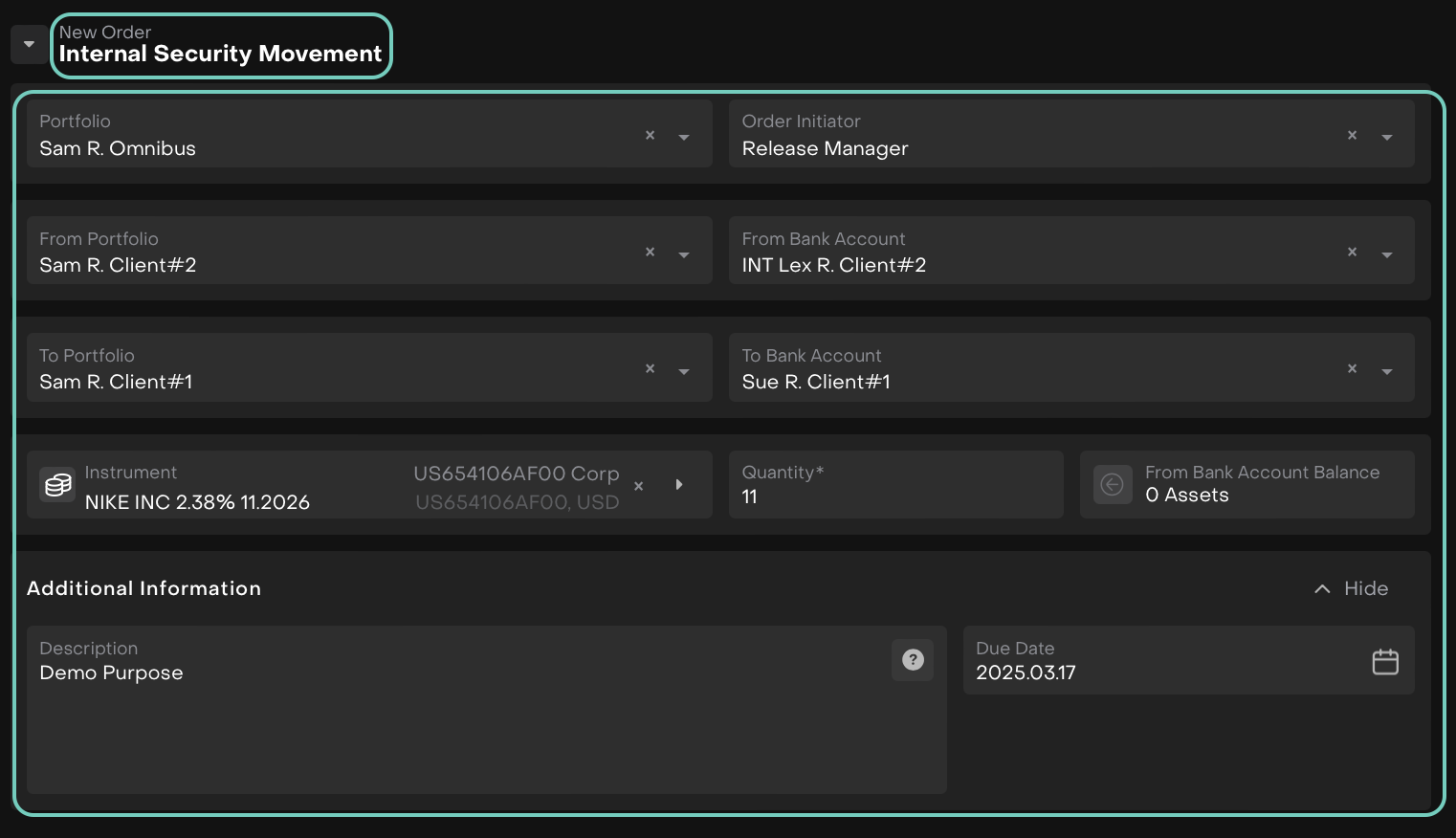

Step 2: Fill in the Required Information

Portfolio: Select the portfolio related to the security movement.

Order Initiator: Indicate the person or system initiating the movement.

From Portfolio: Select the portfolio that will be lending the security.

From Bank Account: Choose the bank account that will lend the security.

To Bank Account: Select the bank account that will borrow the security.

Instrument: Choose Security as the instrument type.

Quantity: Enter the quantity of the security being transferred.

From Bank Account Balance: The platform displays the available quantity of the security in the From Bank Account.

Step 3: Add Additional Details.

Step 4: System Validation

The system will validate the following:

Only bank accounts linked to the same Omnibus Bank Account can be selected.

The system checks the available quantity of the security in the lender's account to ensure sufficient quantity is available for the movement.

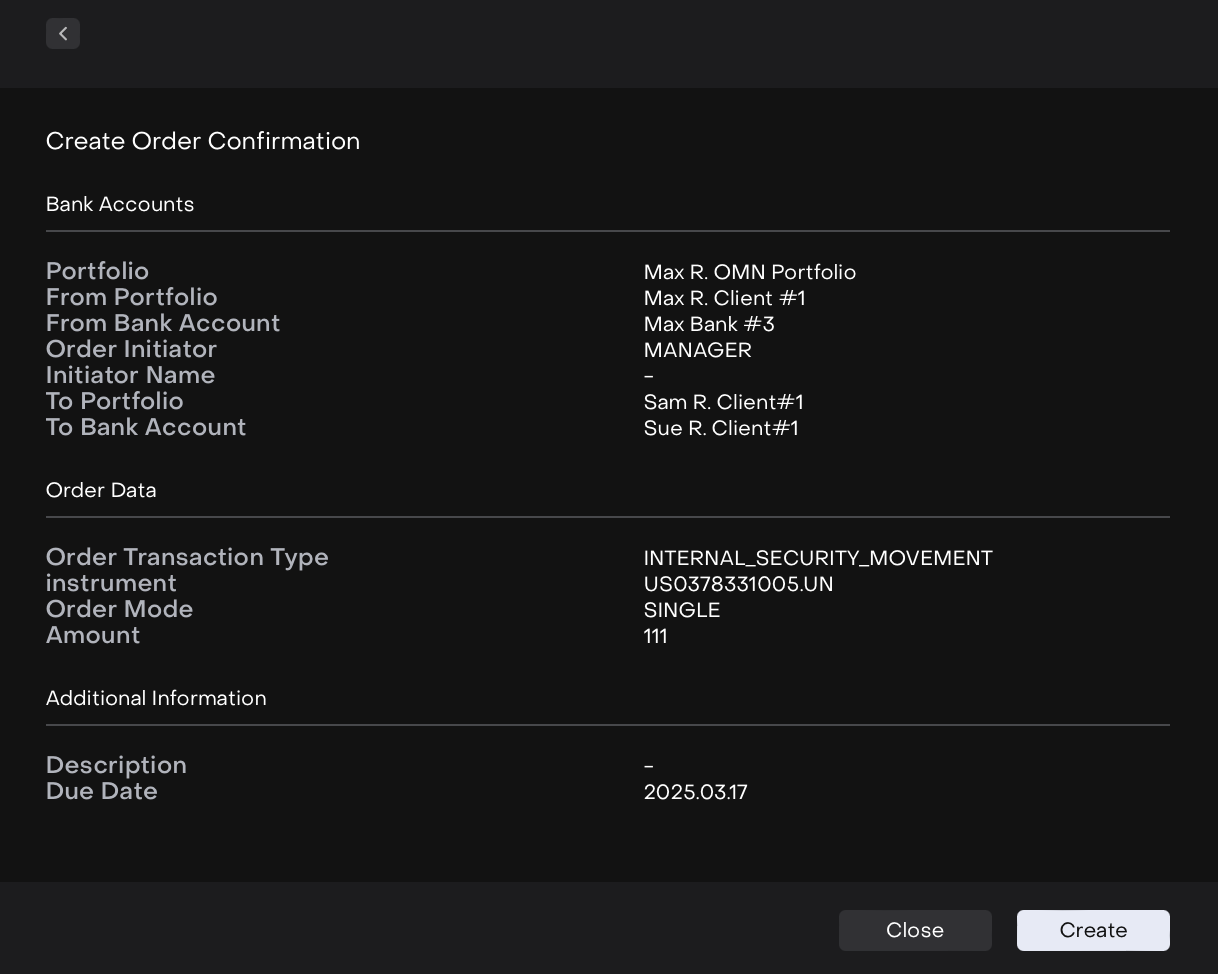

Step 5: Confirm and Create the Order

Once all details are filled out and validated, click Create Order to finalize the internal security movement order.

The Internal Security Movement order has been created.

Expected Outcome After Execution

For the Lender: The available quantity of security will be decreased.

For the Borrower: The available quantity of security will be increased.

For the Omnibus Account: The position of the omnibus account will remain unchanged.