Matching mechanism

Introduction

Reluna Platform has a matching mechanism that helps users to reconcile and confirm transaction received from the bank with data that was expected after execution of order.

Key Terminologies

Matching | Order Transaction |

|---|---|

Procedure of comparing transaction data created after execution of the order with the transaction received from the Bank. | Transaction created by the system after execution of and order. Order transaction has status “Active” and status reason “Order” |

Automatic matching | Manual matching |

Automatic procedure performed by the system when transaction created after execution of order is matched with bank transaction | Procedure performed by a Back Office when a bank transaction couldn't find a match automatically and falls into the status of Pending, Not matched. |

1. Automatic Matching

Automatic matching is performed by the Platform when bank transaction is received.

Back Office is not involved automatic matching.

When automatic matching is performed, the platform will recalculated positions of Portfolio

2. Manual Matching

Where to find matching screen?

Matching is available to users with permissions to match transactions.

Click here to view more about profile configuration

If you don’t have enough access, contact the administrator.

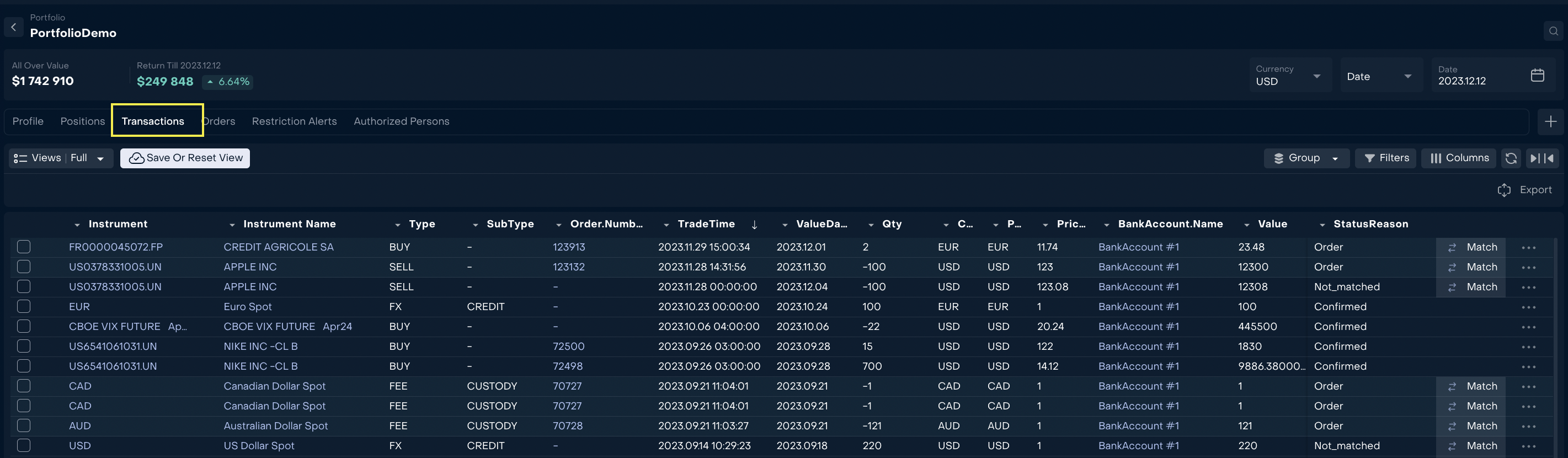

Open transactions (inside portfolio or in All Transactions)

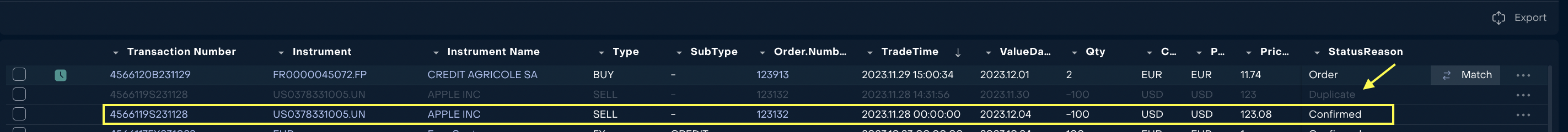

The Transaction table displays the button “Match” on unchecked transactions.

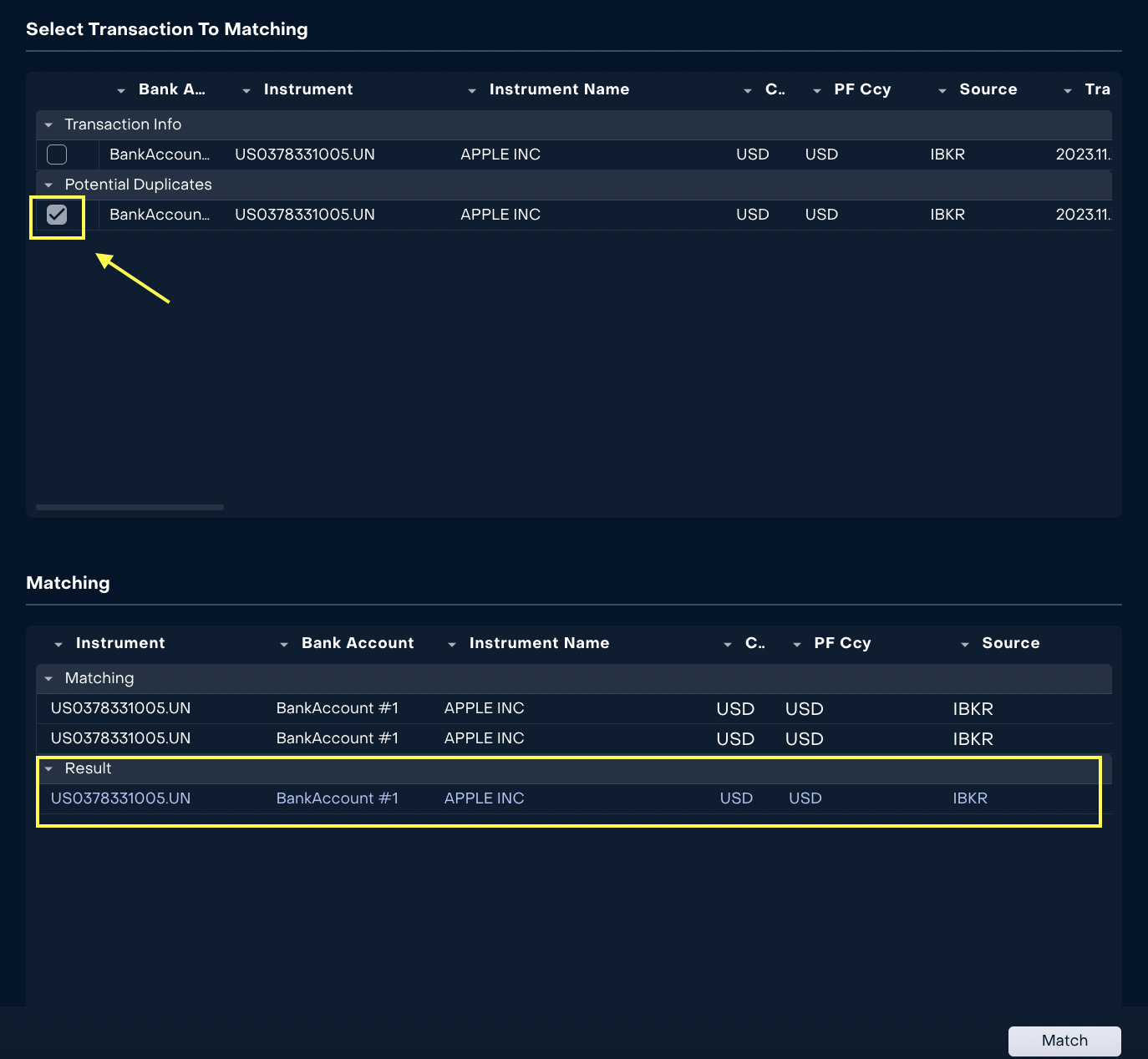

Clicking on it will open a window with the original transaction and possible matching transactions (transactions with the same bank account, instrument, type etc).

Select a pair for matching transaction.

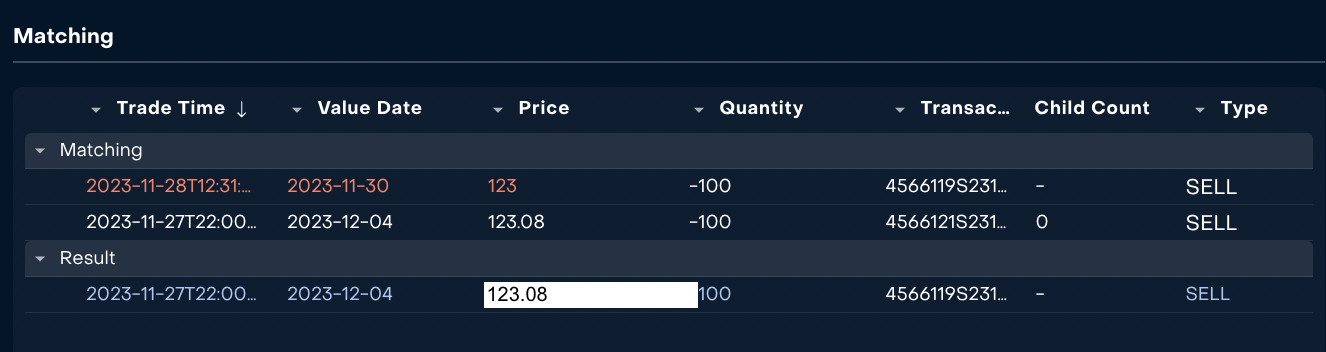

The system will highlight red values of transaction that can be corrected in the final transaction.

If there are discrepancies, you can correct the bottom line by clicking on the highlighted value. Error values are highlighted in red.

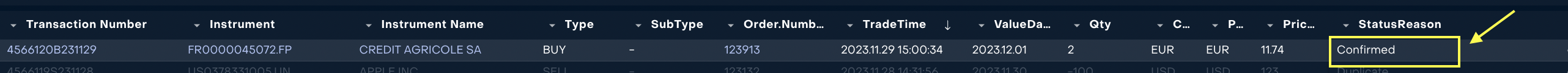

After clicking the button “Match”, order transactions is deactivated and the bank transaction receives status “Active” / status reason “Confirmed” and is linked to the order.

For more convenience, transactions can be checked on the basis of a special view ”Not Matched”. See how to set up a performance here https://help.lunawealth.com/kb/how-can-i-manage-views-and-set-groups-filters-and-#HowcanImanageviewsandsetgroups,filtersandcolumnsinthesystem?-WhattypeofviewsexistandhowcanIcreatemyownview?

3. How to match transaction without order?

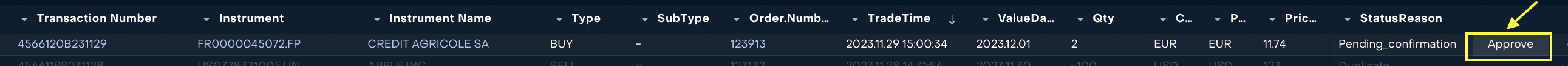

If there is no integration between the platform and the Bank, transactions created after execution of the order will receive status “Pending” and status reason “Pending Confirmation”.

When a such transaction is selected and “Approve“ button is pushed, the platform sets transaction status “Active” and Status Reason “Confirmed”.

4. How to match bank transaction that refers to Omnibus bank account ?

When bank transaction that refers to Omnibus bank account is received, it shall be matched with order transaction that also refers to Omnibus bank account. All related Client order transactions on virtual bank account will be matched and closed automatically with status “Active” and status reason “Confirmed”