Transaction Management

1. Introduction

The Reluna platform enables you to manage a wide range of transactions that impact your portfolios— whether you are buying securities, making transfers or processing corporate actions. Transactions can be created automatically from bank integrations or added manually through the platform.

This guide will help you:

Navigate the Transactions tab on the platform or from Portfolios

Understand available transaction types

Create and approve transactions with varied source

Use the Simple/Advanced Forms for detailed transaction entry

1.1. Purpose

To give you full control and visibility into your transactions—from creation to approval—ensuring accurate and up-to-date portfolio data on the platform.

2. Understanding Sources of Transaction Creation

Transactions can originate from various sources based on the platform or subscriptions. Some require manual matching while others are auto-processed using predefined rules, such as:

Transaction Source | How Transactions Are Created | Conditions for Availability |

|---|---|---|

Bank Files | Requires active integration with custodian(s) | Integration with custodians must be enabled |

Manual Entry | Created manually by Users | Manual creation is required when:

|

Platform-Generated Transactions | Automatically created based on platform settings (e.g., coupon, bond redemptions) | Requires a subscription that includes automated transaction generation |

Transactions From Orders | Generated when an order is executed | Requires a subscription that includes Order Management module and/or to coupon tracker |

2.1. Accessing the Transactions Tab

From the top menu, click Transactions.

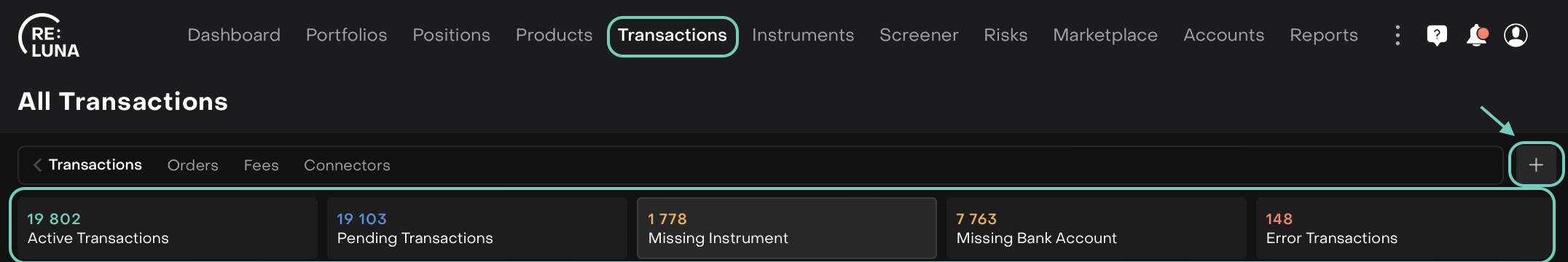

You will be redirected to the All Transactions dashboard with categorized counters:

Active Transactions – shows all successfully created transactions

Pending Transactions – transactions awaiting approval or matching

Missing Instrument – transactions with unlinked instruments

Missing Bank Account – where the bank account is not defined

Error Transactions – incomplete or incorrect entries

These real-time counters help you track operational issues and prioritize transaction clean-up.

Deactivated transactions are excluded from counters.

Click the ➕ icon in the top right to create a new transaction.

3. Creating a New Transaction

After clicking the ➕ icon:

Select a Transaction Type (e.g., Buy, Fee, Income, etc.)

Choose the form type:

Simple Form – for basic inputs

Advanced Form – for full field-level entry (covered below)

👉 To understand which form to use (Simple or Advanced), click here.

4. Managing Transactions in Bulk: Activate, Approve and Deactivate

The Reluna platform now offers enhanced control over transaction statuses via three new bulk actions: Activate, Approve and Deactivate. These actions can be performed directly from the Transactions tab and allow you to manage multiple transactions simultaneously based on their status.

4.1. Approving & Activating Transactions

Activation reinstates previously deactivated transactions (with Error status reason) so that they are again included in portfolio calculations. Approval is the preceding confirmation step that typically applies to transactions in a Pending state.

How to Approve or Activate Transactions:

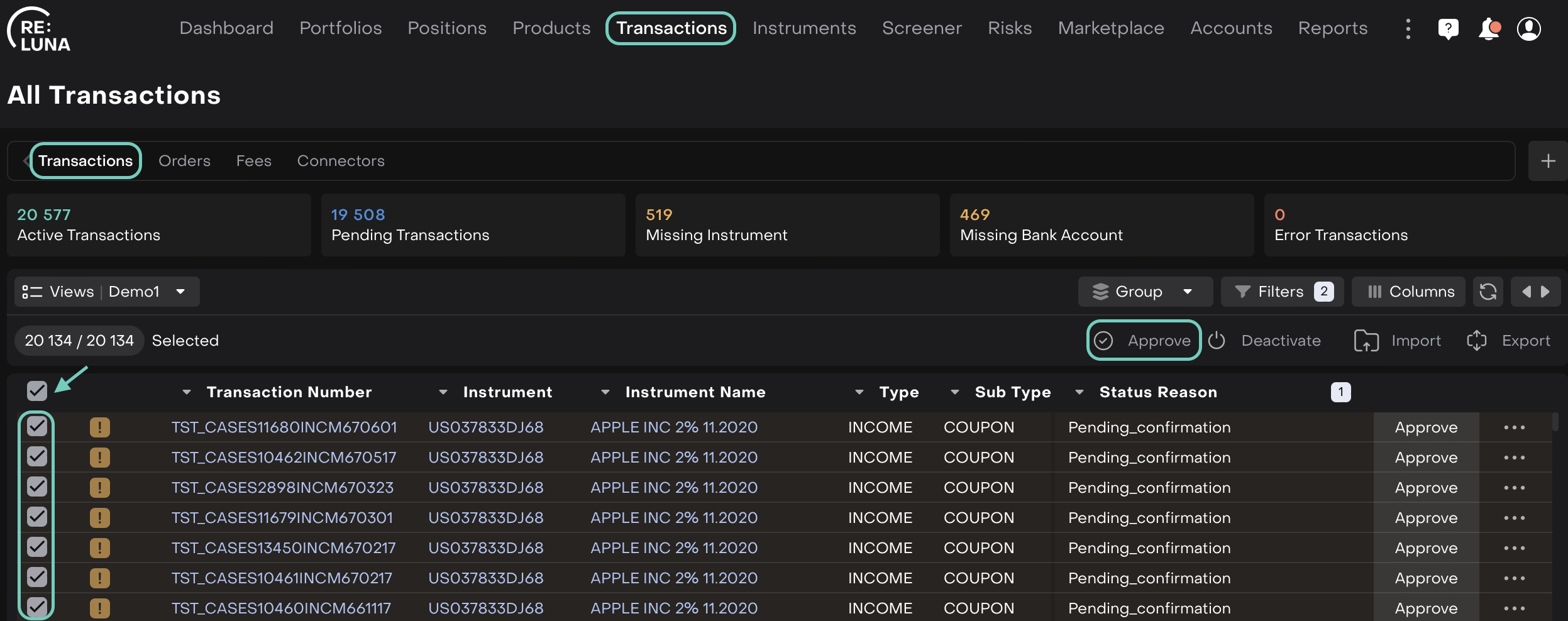

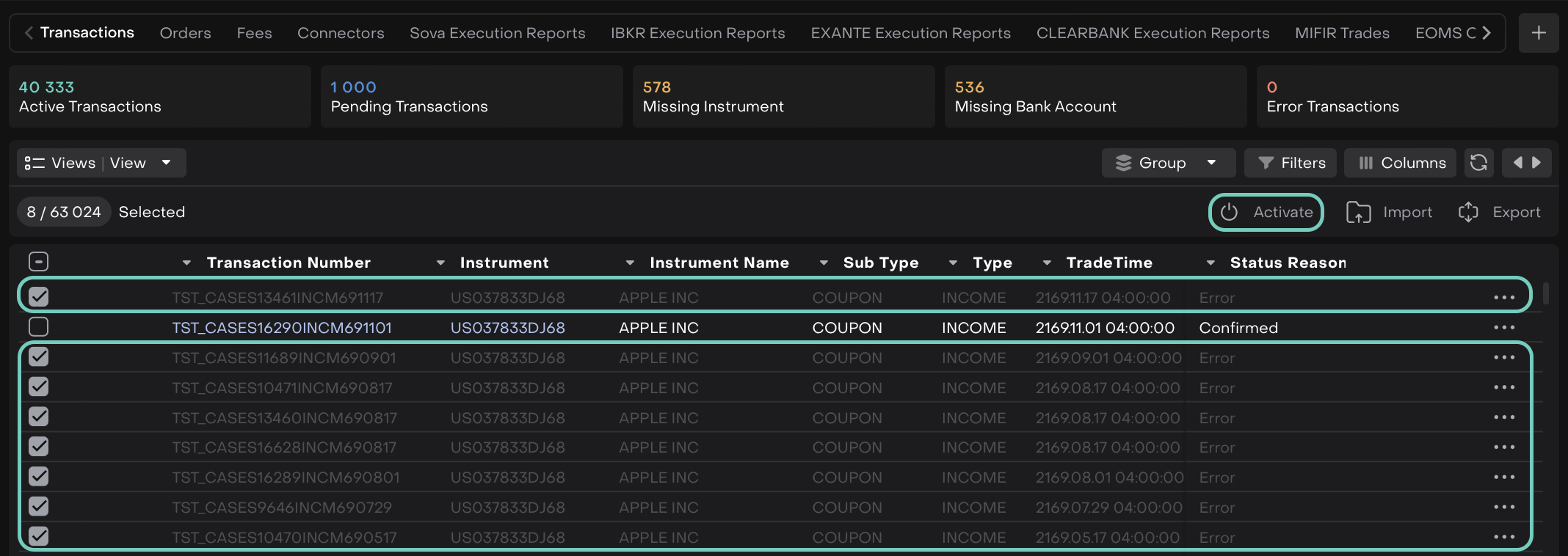

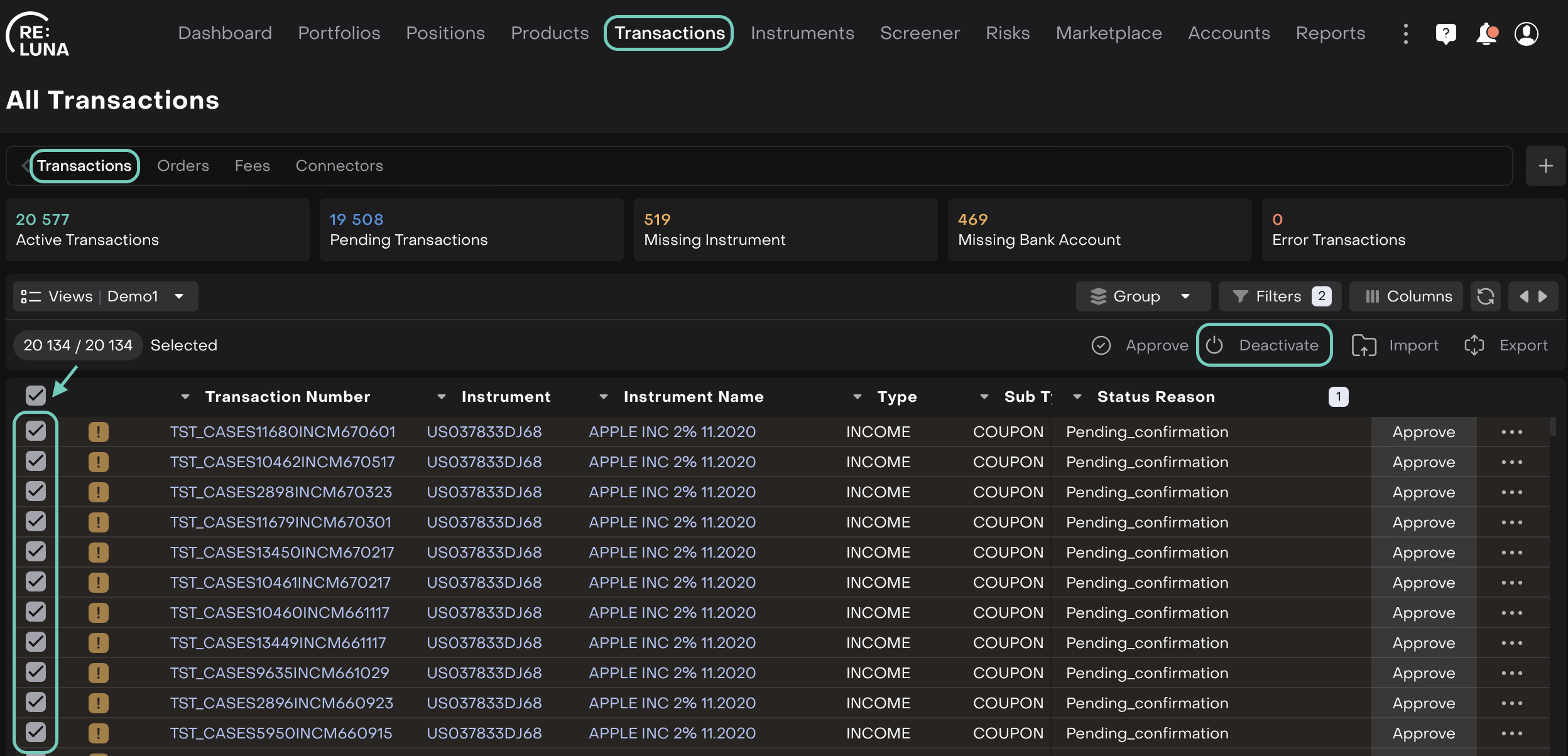

Go to the Transactions Tab on dashboard.

Navigate via the top menu > Transactions tab.

Use checkboxes to select individual transactions or click Select All.

Click “Approve” or “Activate”:

The “Approve” button is shown for transactions in a

Pendingstate.

The “Activate” button is shown for transactions with an

Errorstatus.

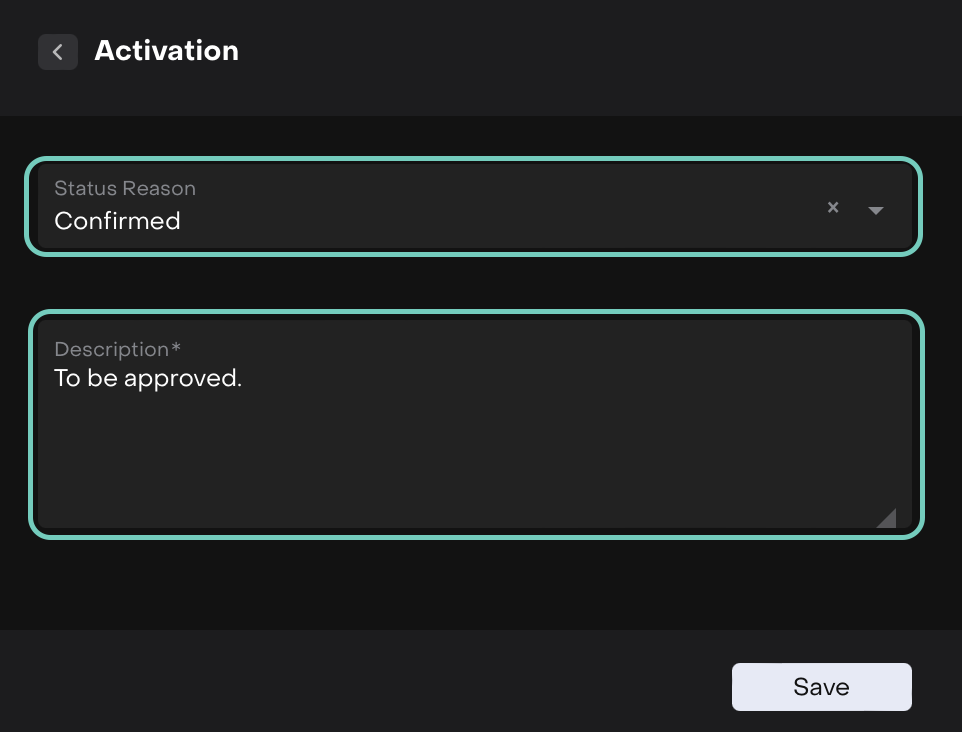

Set Status Reason

Default reason for Approve is

Confirmed.Enter a required comment explaining the approval.

Click “Save” and the selected transactions are updated accordingly. Portfolio positions and relevant counters are recalculated.

When to Use Approve or Activate

Finalizing reviewed transactions from an import or integration.

Reinstating previously erroneous transactions after correcting data.

Moving from

Pendingto active status after review.Re-activating after resolving missing instrument or bank account links.

4.2. Deactivating Transactions

Deactivation is a way to temporarily or permanently exclude transactions from analytics and processing without deleting them. This is especially useful for correcting errors or cleaning up data.

How to Deactivate Transactions:

Click on the Transactions tab from the main navigation.

Choose transactions using checkboxes or select all.

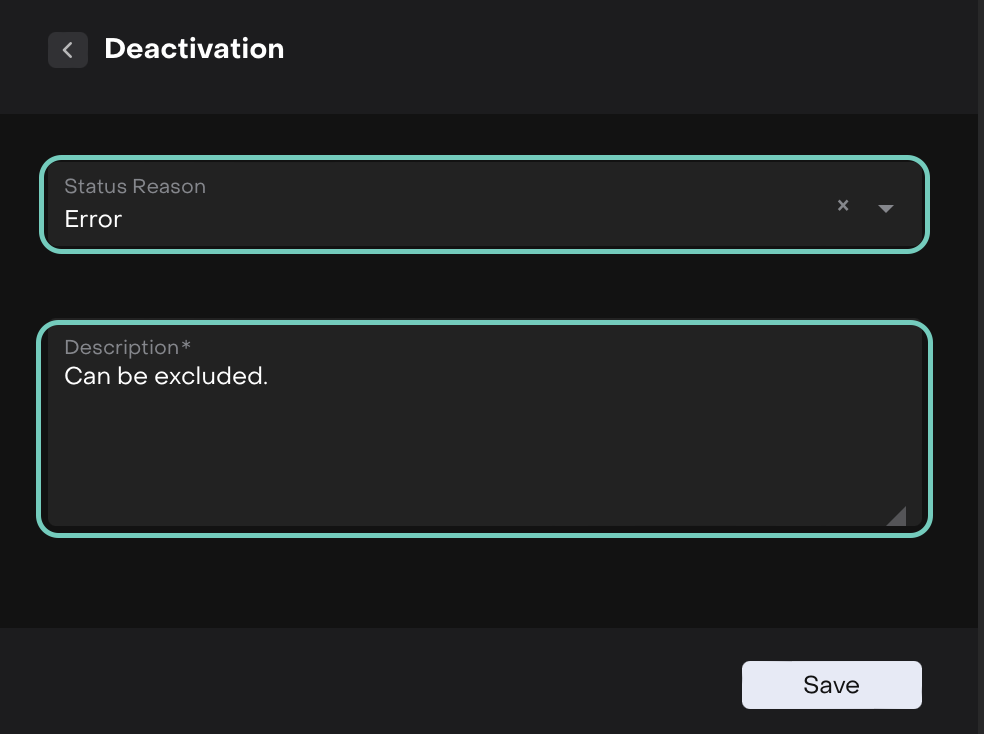

Click “Deactivate”.

The window opens where the default status reason is

Errorbut you may choose from options likeDuplicate,Missing Instrument, etc.Include a short explanation (required) to describe the deactivation reason.

Click “Save” and then the transactions are excluded from calculations and reports.

When to Use Deactivate

To remove incorrect or duplicated transaction entries.

Temporarily exclude transactions awaiting further review.

Cleaning up irrelevant or outdated transactions from older data imports.

4.3. Notifications and Feedback

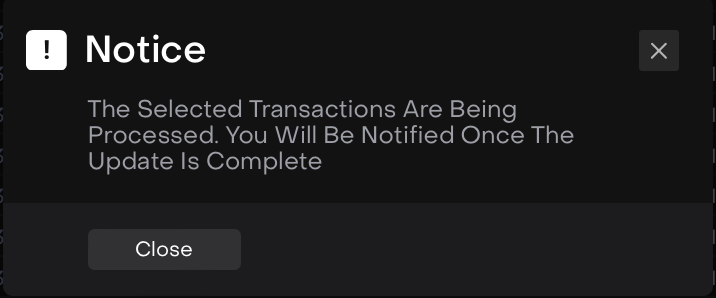

After performing any bulk action (Activate, Approve, Deactivate), the platform displays a notification:

Example of notification after bulk action

5. Available Transaction Types on Reluna

Below are high-level transaction types supported on the Reluna platform:

Type | Subtype(s) | Description |

|---|

Type | Subtype(s) | Description |

|---|---|---|

Buy | - | Purchase Of Assets Or Securities, Increasing Portfolio Holdings. |

Sell | - | Sale Of Assets Or Securities, Reducing Portfolio Holdings. |

Fx | DEBIT | Currency Exchange, Converting Funds Between Different Currencies. |

CREDIT | ||

REPO | BUY | Asset Sale With Repurchase Terms, Providing Short-Term Financing. |

SELL | ||

Adjustment | DEBIT | Corrections To Past Transactions, Adjusting Balances Or Values. |

CREDIT | ||

Fee | CUSTODY MANAGEMENT ADMINISTRATION SUCCESS COMMISSION REVENUE OTHER HANDLE_FEE INTEREST_CALCULATION SERVICE_CHARGE_CALCULATION CONSENT EXECUTION OPERATION SETTLEMENT_FEE WITHDRAWAL_FEE EXCHANGE_FEE STOCK_TRANSFER_FEE CASH_TRANSFER_FEE ADR_FEE AMENDMENT_FEE EXPOSURE_FEE OVERNIGHT_POSITION_FEE REIMBURSEMENT RETROCESSION INCENTIVE LEI DEPOSITORY | Charge Applied For Transactions Or Account Services. |

Investment | - | Inflow Of Funds To An Account, Increasing Available Balance. |

Revenue | MANAGEMENT SUCCESS CUSTODY TRADING PAYMENT RETRO OTHER | Inflow From Asset Sales Or Other Income Sources, Increasing Funds. |

Cash Transfer | IN | Movement Of Cash Between Accounts, Without Asset Changes. |

OUT | ||

INTERNAL | ||

Income | COUPON | Revenue From Dividends, Interest, Or Other Income-Generating Assets. |

DIVIDEND | ||

Margin | CREDIT | Use Of Borrowed Funds For Investments, Affecting Balance. |

DEBIT | ||

Tax | WITHHOLDING_TAX SALES_TAX BOND_TAX DIVIDEND_TAX TAX_CORRECTION OTHER_TAX PERSONAL_INCOME_TAX | Mandatory Deduction Applied By Authorities On Income Or Asset Gains. |

Expense | - | Deduction Due To Costs Or Outflows, Reducing Account Balance. |

Interest | CREDIT | Amount To Be Paid/Deducted For Holding A Cash Position. |

DEBIT | ||

Payment | IN | Outflow Of Funds To Fulfill An Obligation Or Settle A Purchase. |

OUT | ||

INTERNAL | ||

Withdrawal | - | Removal Of Funds From An Account, Decreasing Available Balance. |

Bond Redemption | - | Full Repayment Of Bond Principal At Maturity, Concluding the Bond Term. |

Bond Redemption Partial | - | Partial Repayment Of A Bond, Reducing Outstanding Principal. |

Exercise Option | - | Execution Of A Right To Buy Or Sell Under An Options Contract. |

Expire Option | - | The End Of An Options Contract Without Exercise, Leaving No Impact. |

Internal Transfer | - | Movement Of Securities Between Bank Accounts Of A Single Portfolio. |

Security Transfer | IN | Movement Of Securities Between Accounts Or Portfolios. |

OUT | ||

Corporate Action | SPLIT REVERSE_SPLIT SPIN_OFF ISIN_CHANGE | Events Like Dividends Or Splits That Impact Shareholders And Holdings. |

Info | BLOCKING_OF_CERTIFICATE UNBLOCKING_BLOCKING MERGE CORP_ACTION ISIN_CHANGE SPLIT | Informational Transaction With No Direct Effect On Funds Or Holdings. |

Transfer | IN | Relocation Of Funds Or Assets Between Different Accounts. |

OUT | ||

Block | BLOCKING | Temporary Restriction On Funds Or Assets For Security Or Compliance. |

UNBLOCKING | ||

Product Subscription | - | Investment In A Strategy Product Under Company Management. |

Product Unsubscription | - | Full Or Partial Unsubscription Form Strategy. |

Reversal | IN | Reverting An Earlier Transaction, Restoring Funds Or Holdings. |

OUT | ||

Virtual Security Transfer | IN | Transfer Of Security Under Strategy To/From Main Bank Account. |

OUT | ||

Unknown | - | Unclassified Transaction Pending Review Or Categorization. |

See Also