User guide: Cross Trade Order

Introduction:

A Cross Trade operation refers to the buying or selling of a security between different portfolios within the same company.

Cross Trades include the following two main scenarios:

Buy/Sell between Client Portfolios: The transfer of assets between different client portfolios within the same company.

Buy/Sell between Client Portfolio and Proprietary (PROP) Portfolio: This involves the transfer of assets between a client’s portfolio and the company’s proprietary portfolio (PROP Bank account).

How to fill in Cross Trade order form:

Available forms of Order: Single and Mass

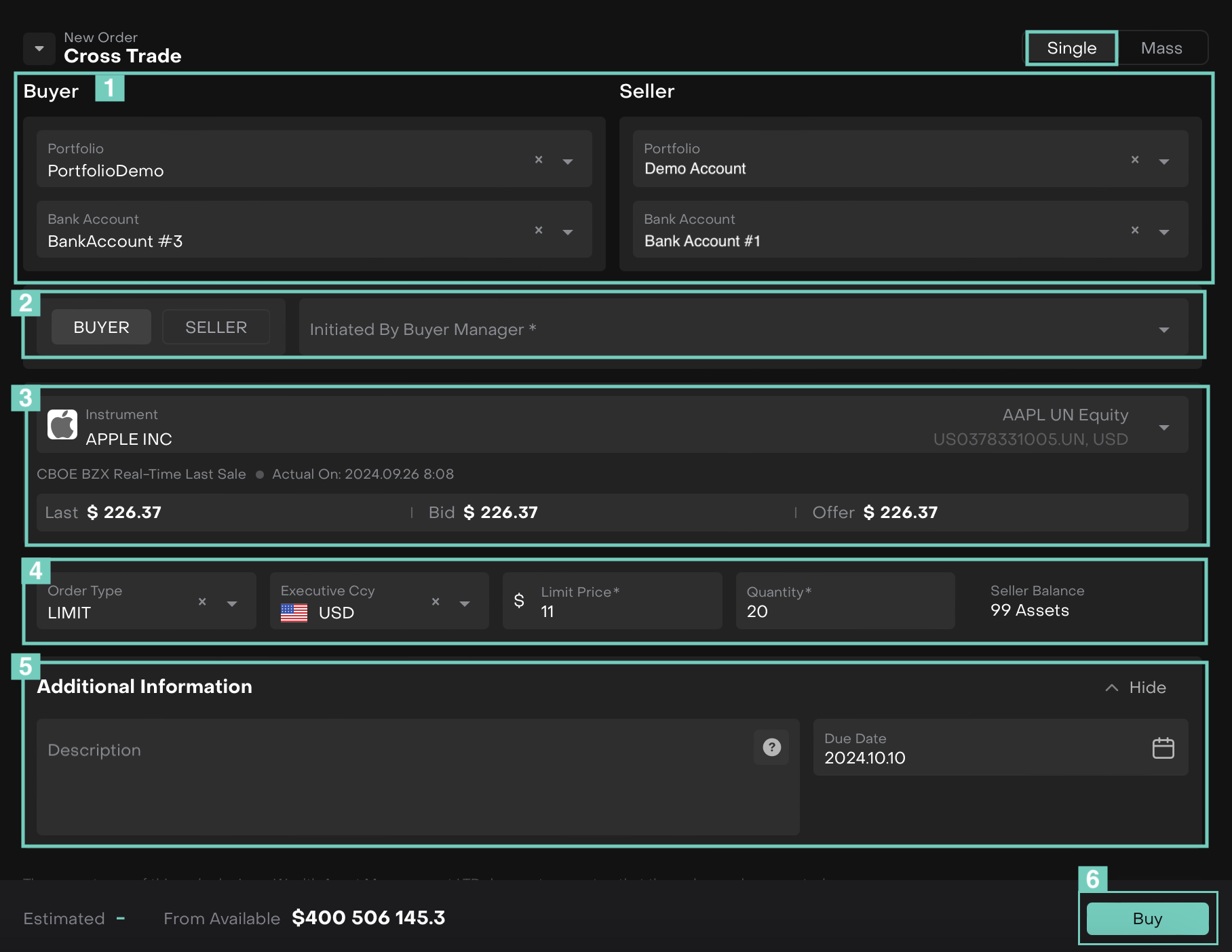

Single Order (Buy & Sell):

On Cross Order page, click on the Edit button to add Portfolio and Bank Account details for Buyer and Seller fields.

Cross Trades Are Supported Between Standard, Virtual, Virtual TTCA And Prop Bank Accounts.

Choose Buyer from the switch and choose the Initiated By buyer Manager dropdown menu.

Select the Instrument.

Fill in the required fields such as the Order Type (Limit/Market), Executive CCY, Limit Price and Quantity. The Seller Balance autogenerates on selection of Portfolio and Bank Account.

Enter the Additional Information with Description and Due Date.

Click on Buy button to generate the order.

Or,

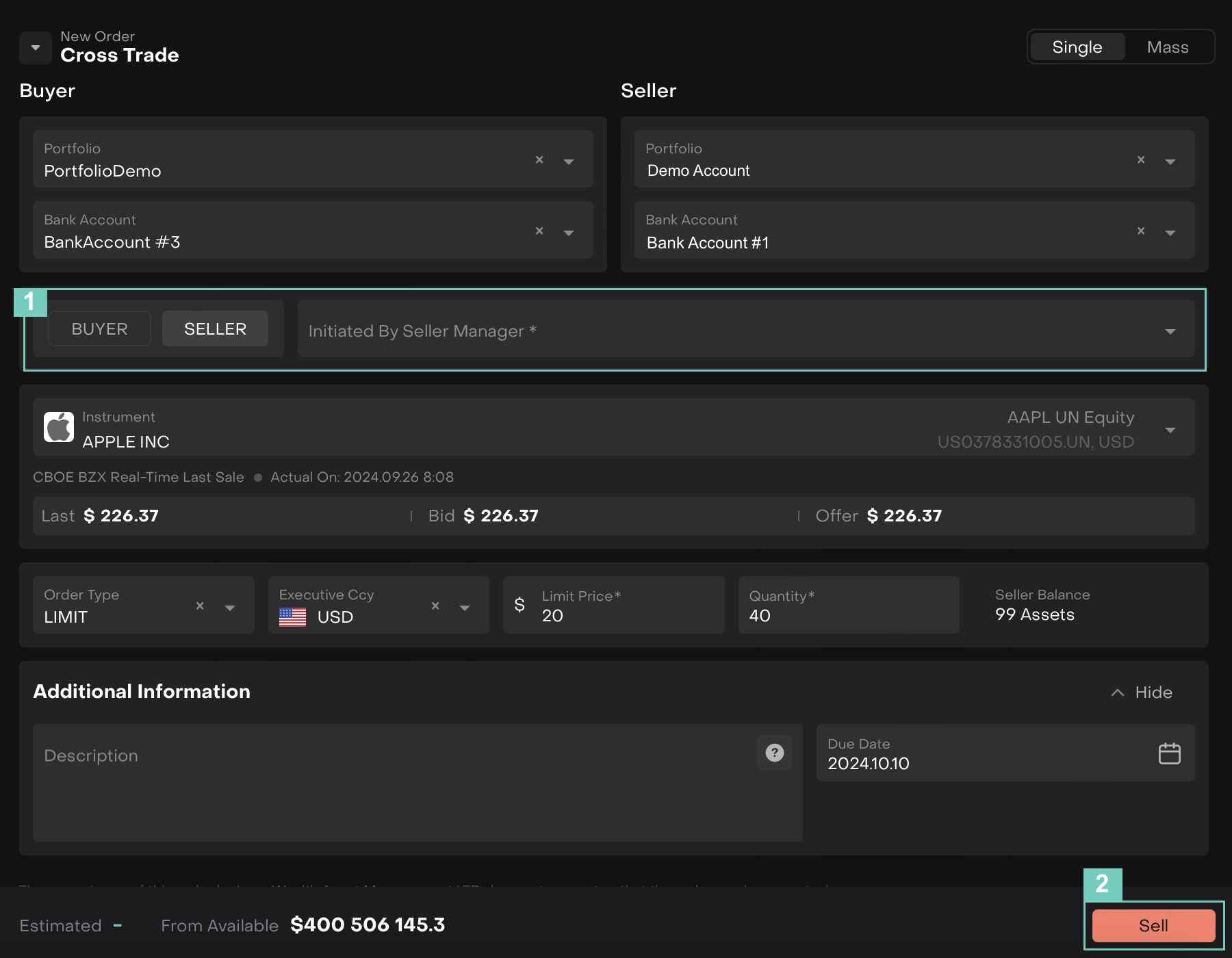

For Single order (Sell):

Simply, switch it to Seller and choose the Initiated By Seller Manager dropdown menu.

Fill in the required fields as shown above.Click on Sell button to generate the order.

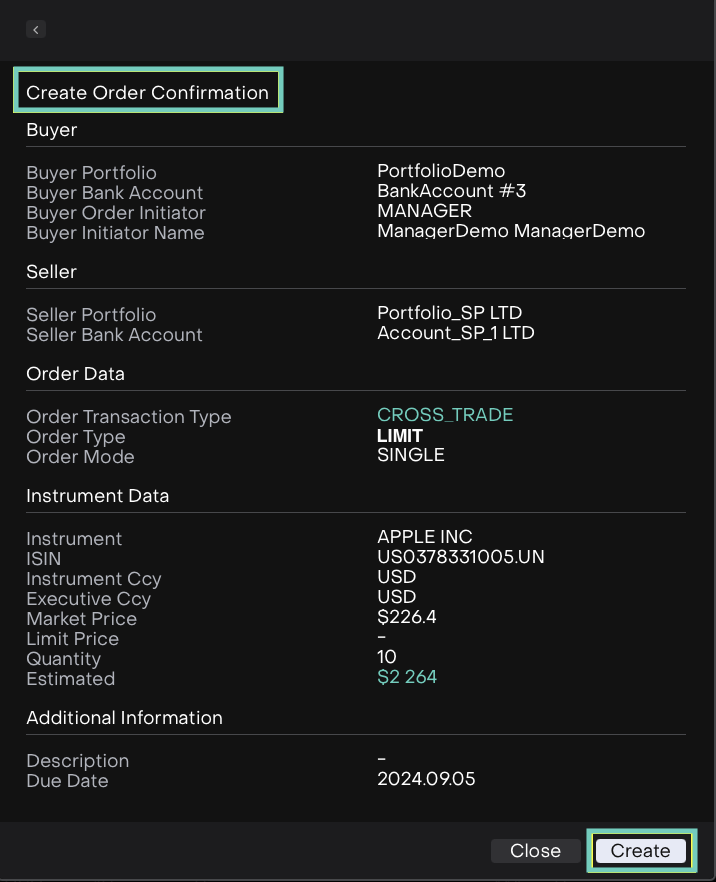

The Order Confirmation summary shows up either for Buy/Sell, click on Create to confirm or Close to go back.

Now, the Order is created.

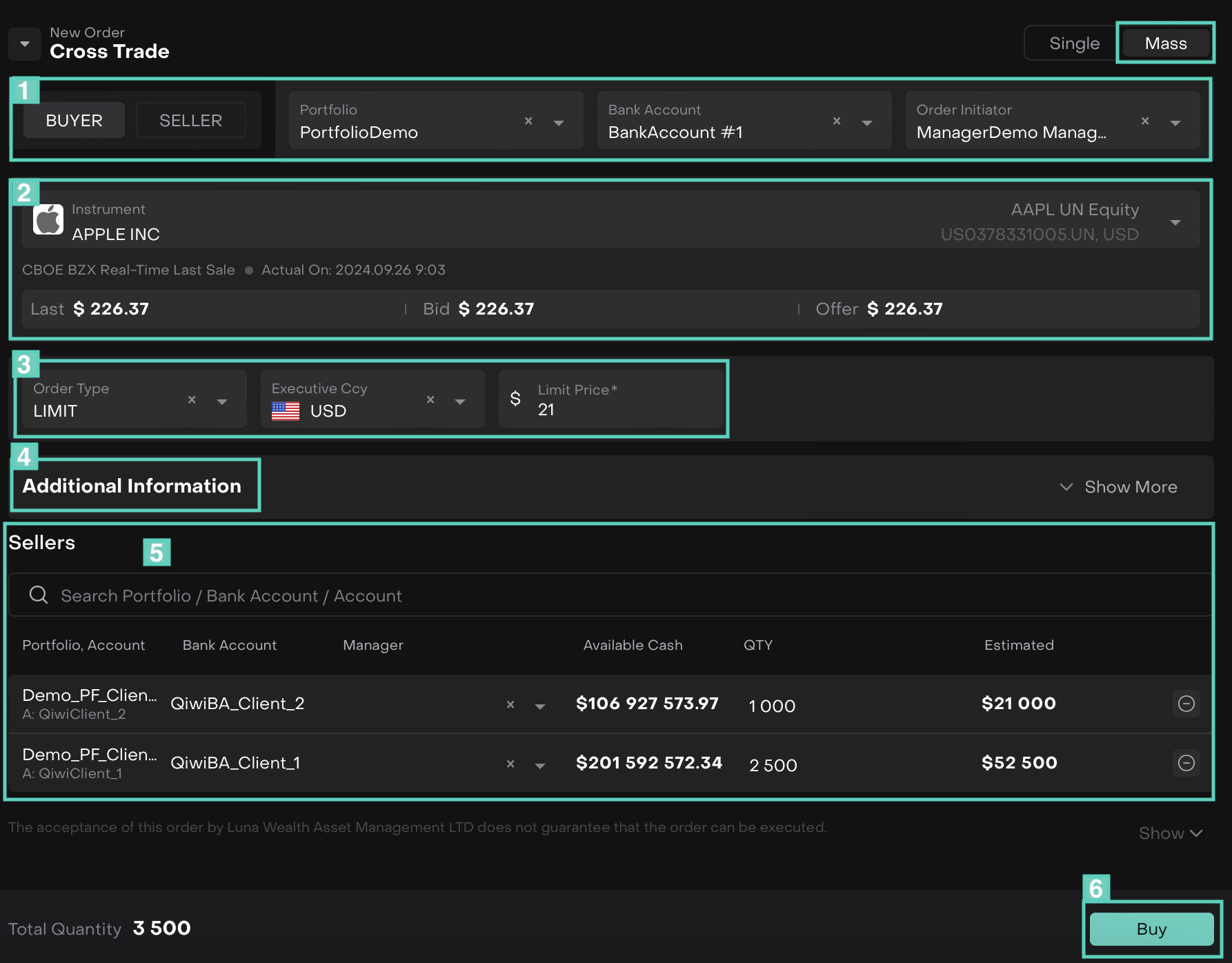

Mass Orders (Buy):

Mass Order is used to create many orders at once from one form. To create Mass order use switcher in the upper right corner of the form.

Select the Buyer category from the switch. Fill in the required details as Portfolio, Bank Account and Order Initiator.

Select the Instrument.

Cross Trades Are Supported Between Standard, Virtual, Virtual TTCA And Prop Bank Accounts.

Choose Order Type (Limit/Market), Executive Ccy and Limit Price.

Enter Additional Information with Description and Due Date

Search Portfolio/Bank Account/Account and select the related accounts to add in and enter Quantity.

Now, click on Buy button.

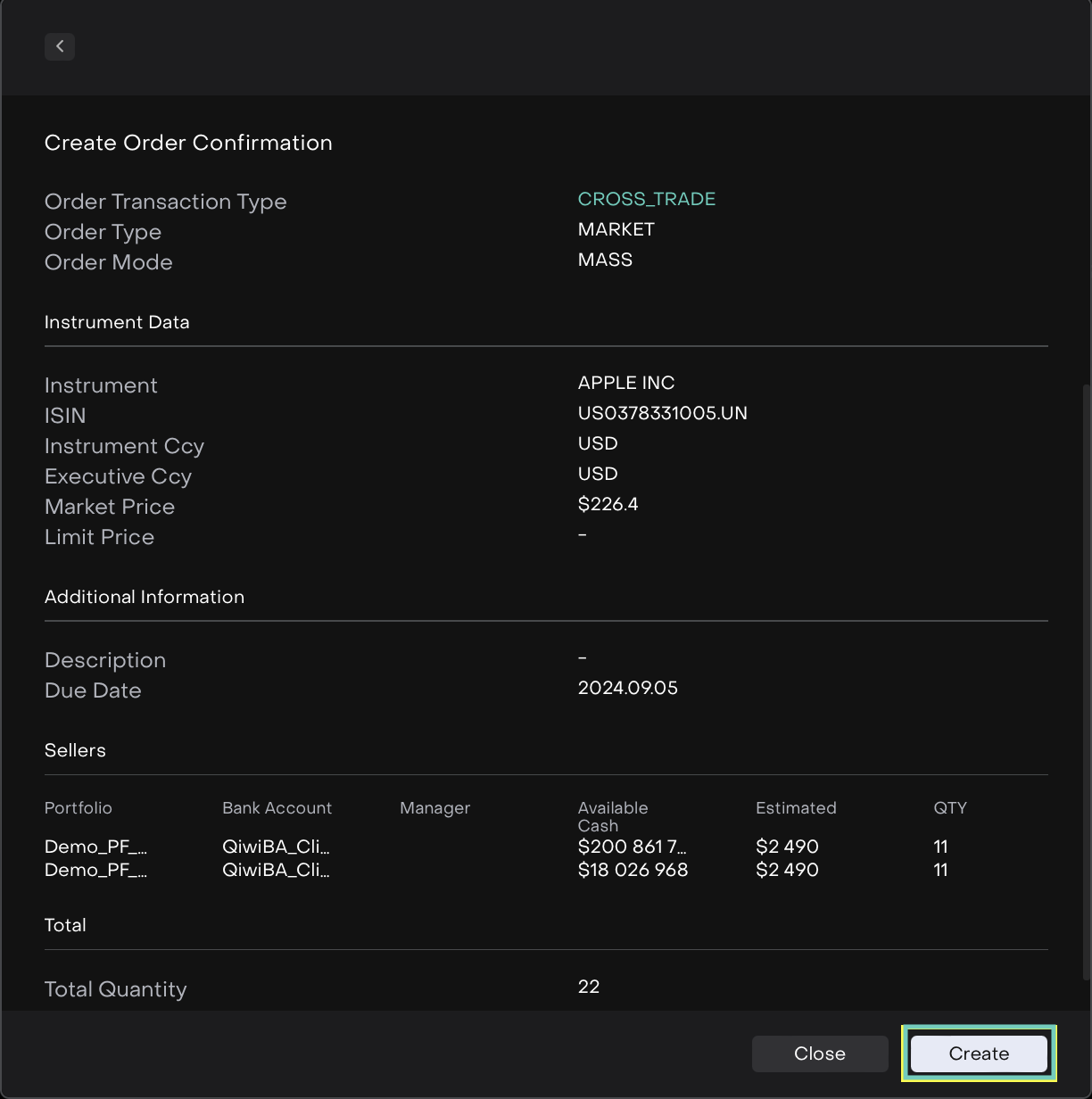

The Oder summary shows up, click Create to confirm or Close to go back.

The order is created.

Or,

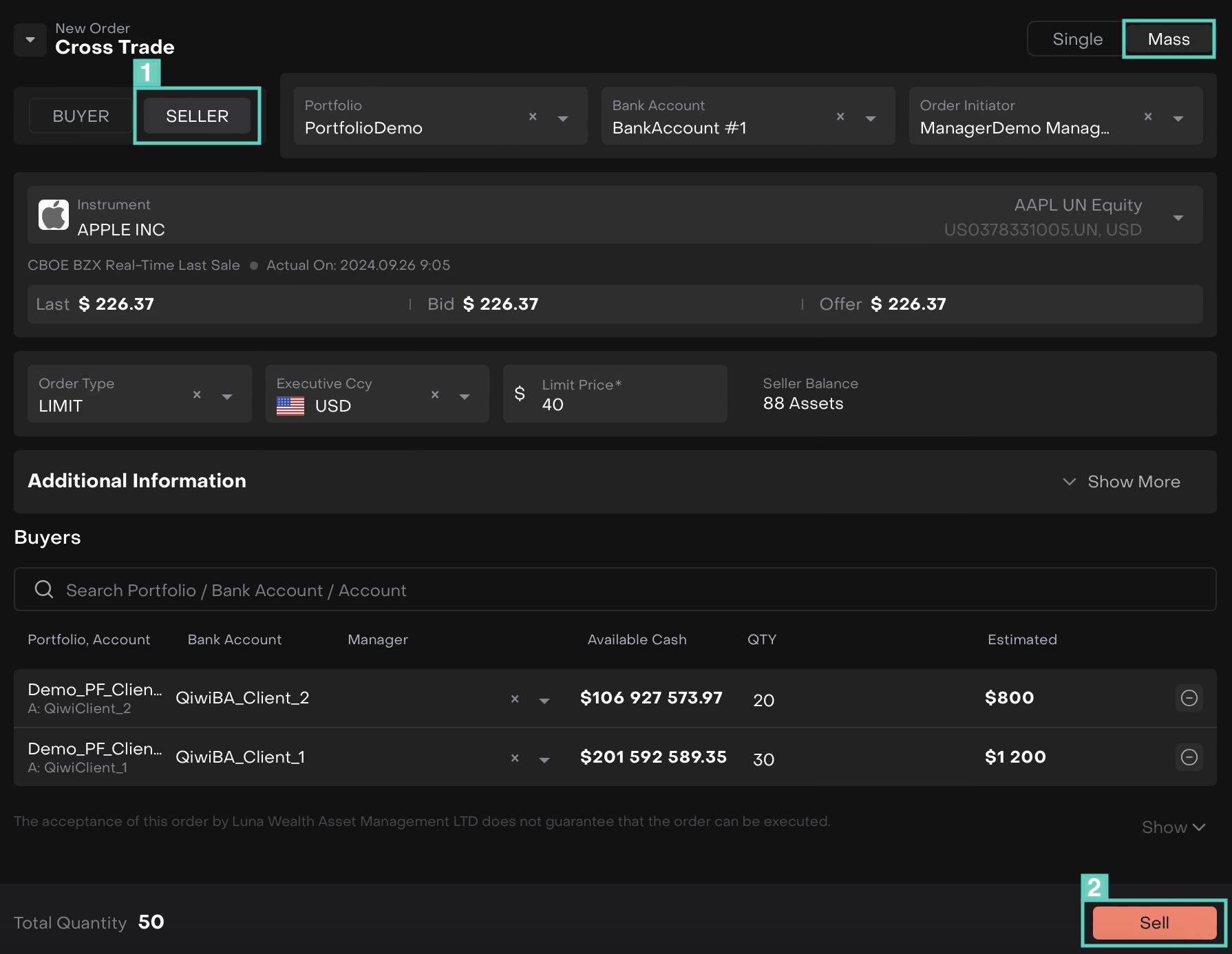

For Mass Orders (Sell):

Simply, select the Seller category from the switcher.

Fill in the required fields as shown above for Mass Order form creation.Click on Sell button.

If asset is BOUGHT/SOLD from Virtual, Virtual TTCA, the action is duplicated to OMNIBUS or TTCA related bank accounts.

Order Execution

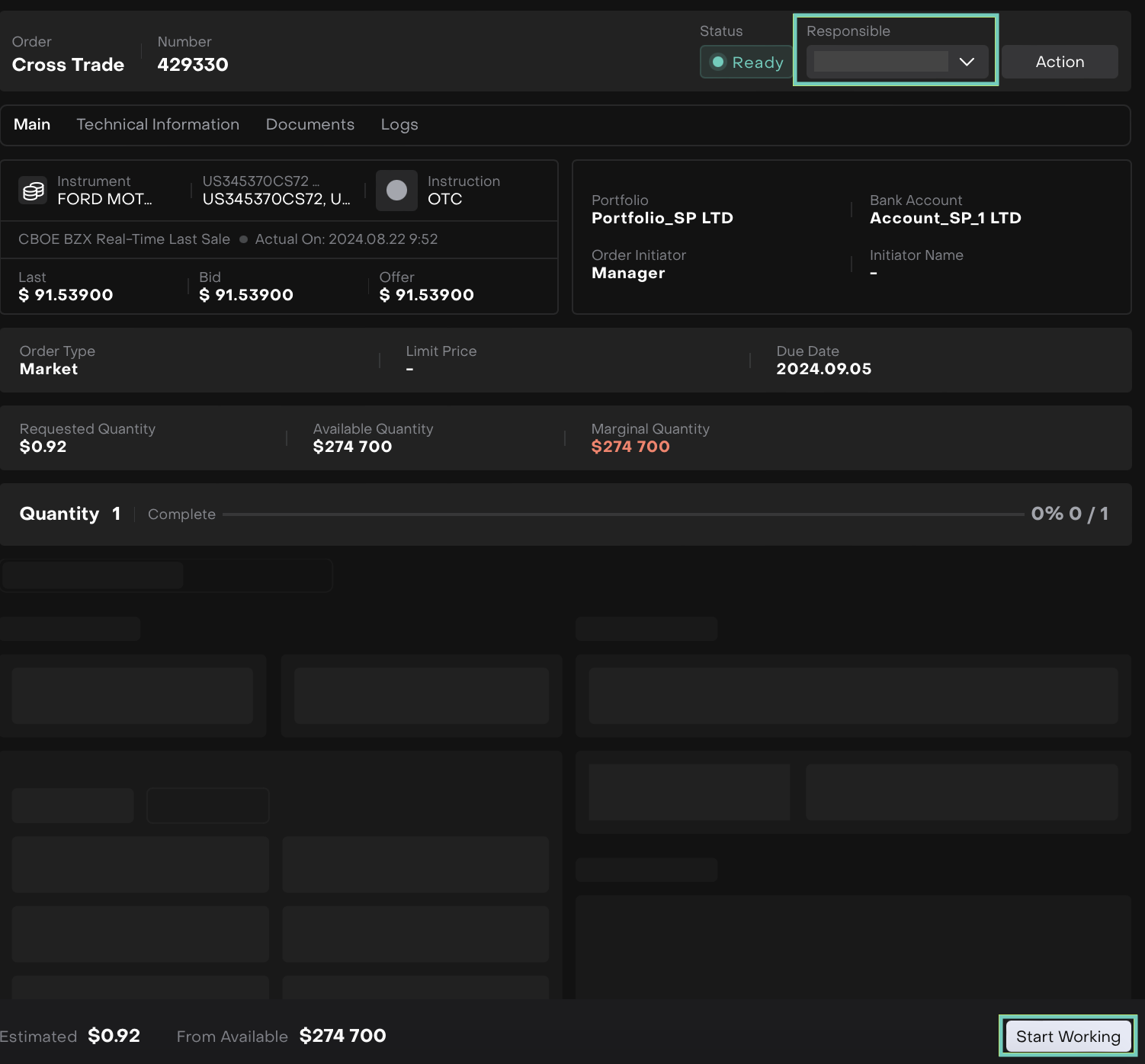

The following window opens once Order is created.

Only order assignee can take order to work.

Click on Responsible dropdown > Enable “Assign to me” to further ‘Start Working’ on the execution.

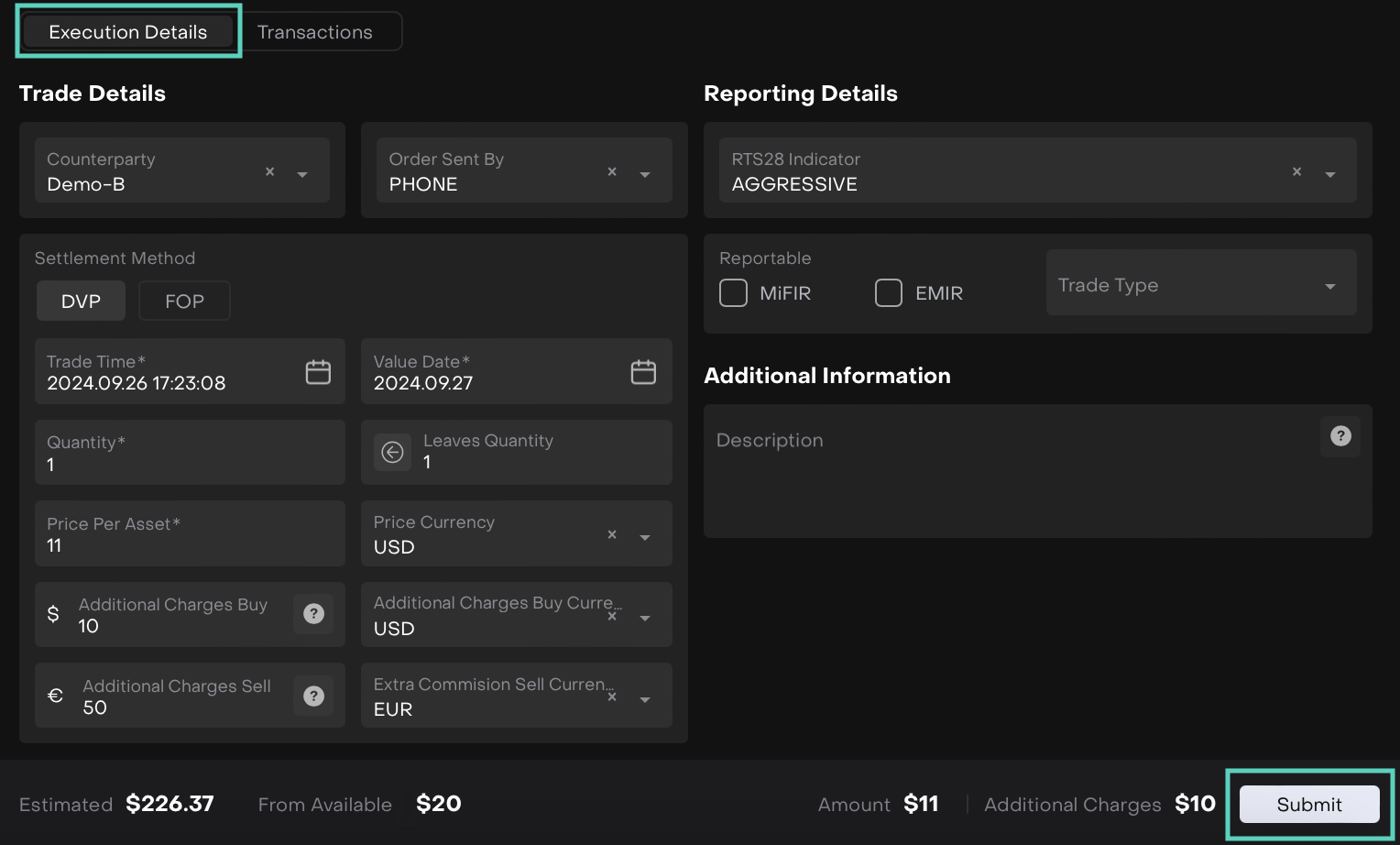

The following required Execution Details tab needs to be filled with mandatory fields(*) > Click Submit.

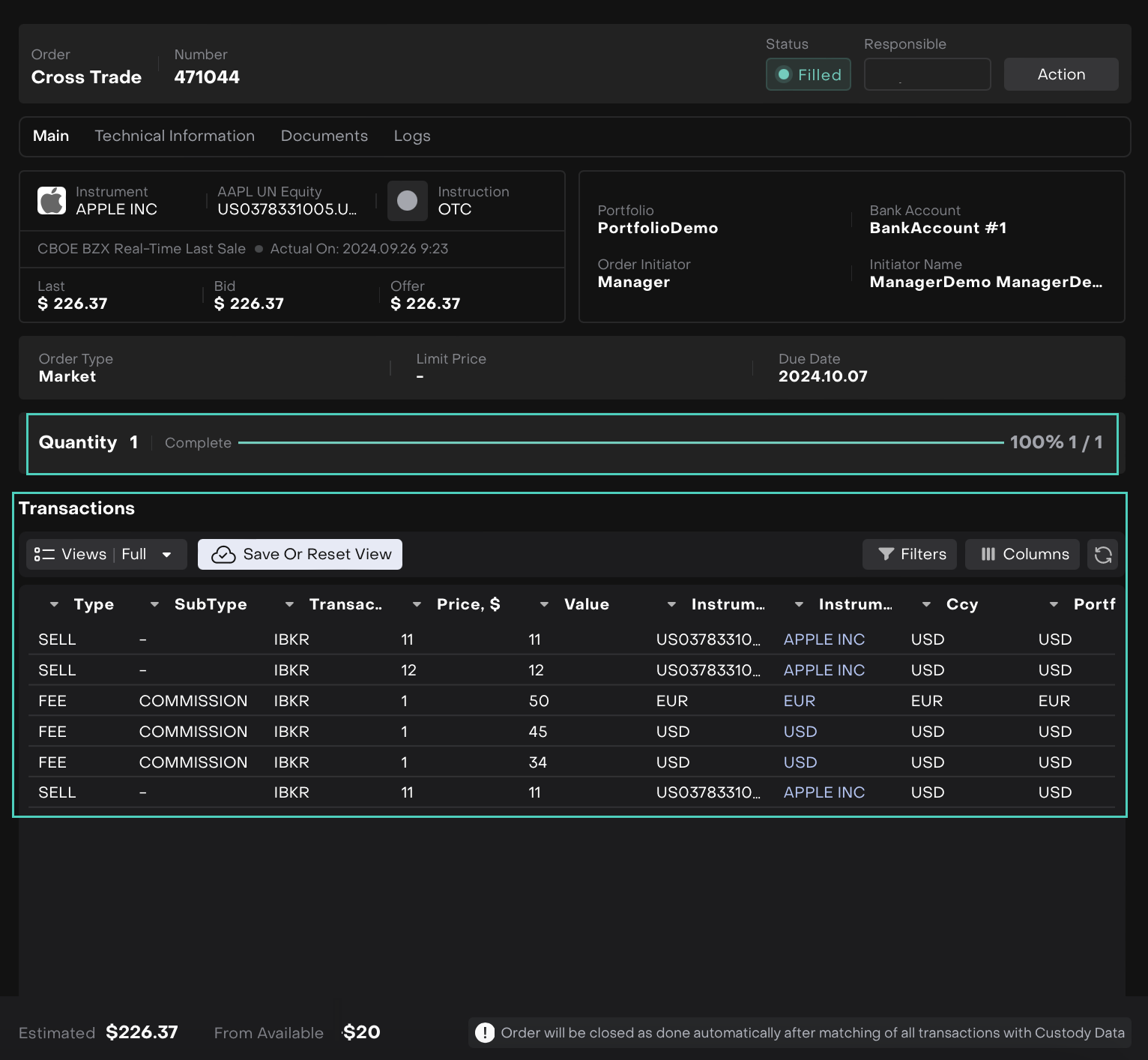

Post submitting the form, the Quantity is completed and Transactions list appears.

For Seller the system will generate a sell transaction and for Buyer side the system will generate a buy transaction. If commission was indicated for buy or sell side on the order execution form, it will be reflected accordingly as Fee (Commission) transaction(s).

Order status will be closed as Done automatically after matching of all transactions with Custody Data.