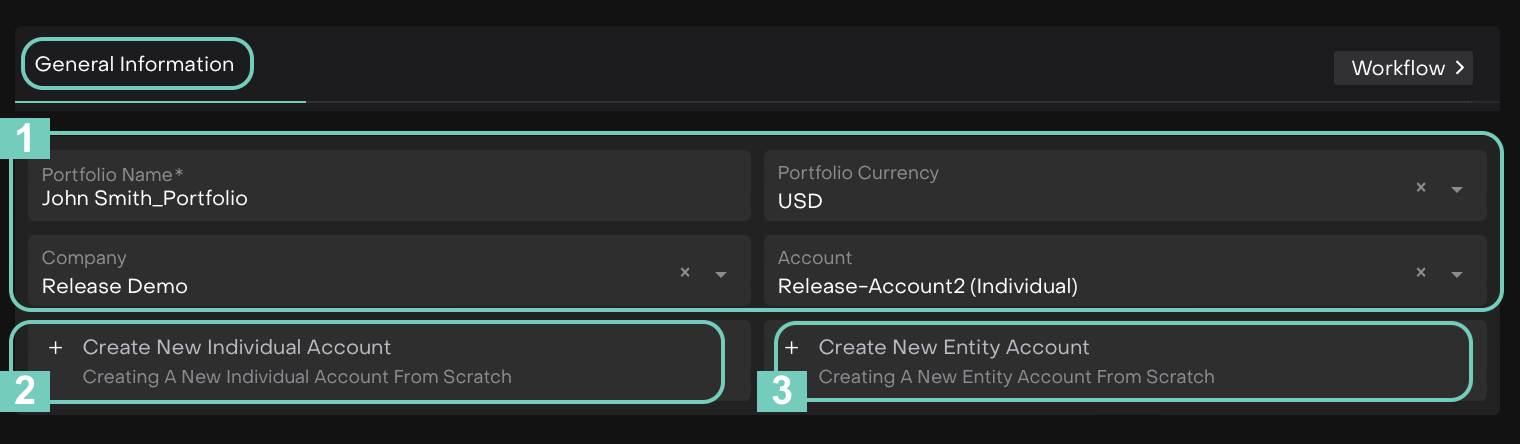

Client Portfolio Guide

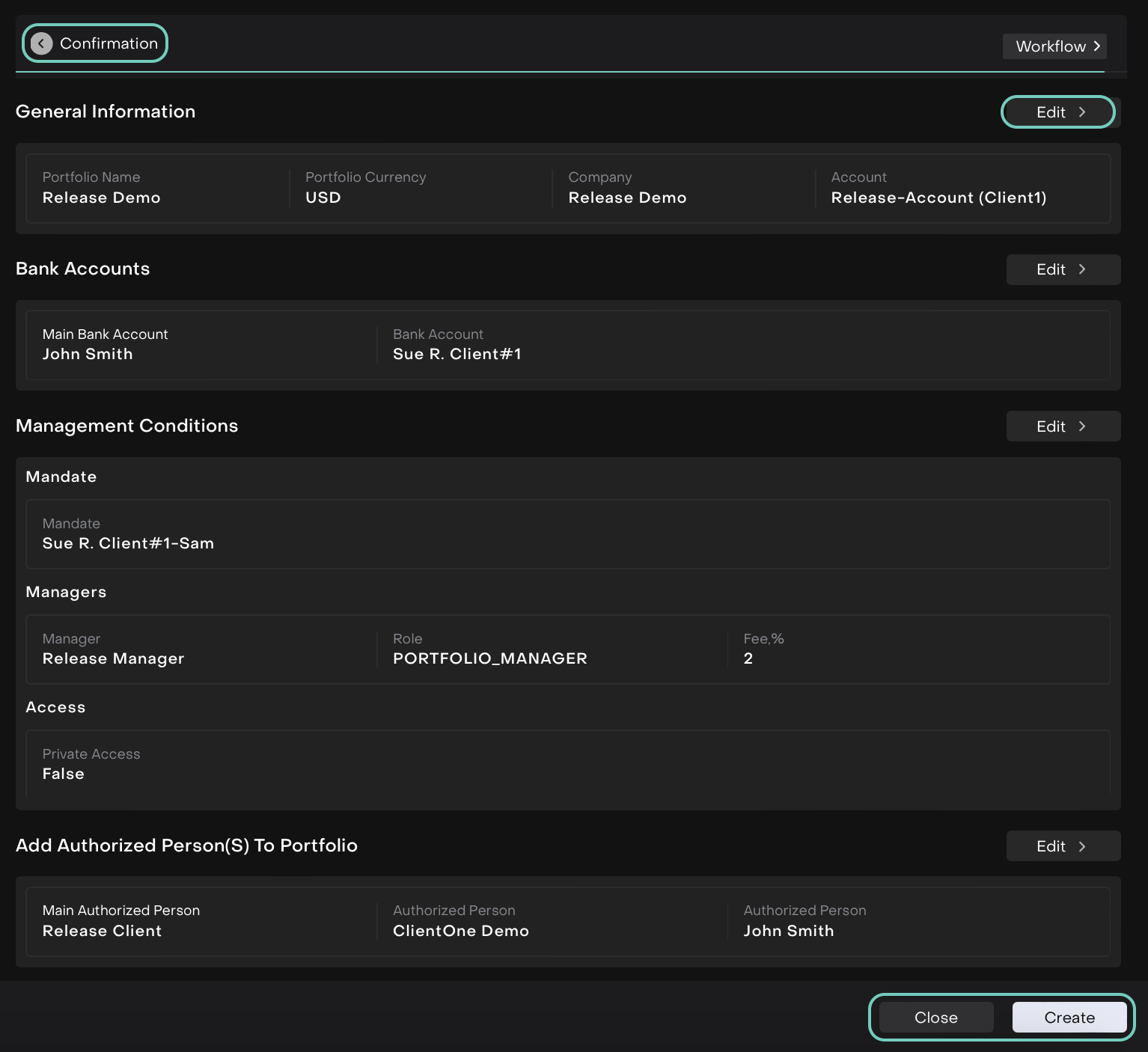

Overview

Client Portfolios allow you to manage individual investment structures, helping you track and manage an investor’s holdings in one place.

There are two main types of Client Portfolios on the platform:

Standard Portfolio: A traditional portfolio for managing a client’s standard investments.

Virtual Portfolio: A simulated portfolio designed for testing strategies without executing actual transactions.

Key Terminologies

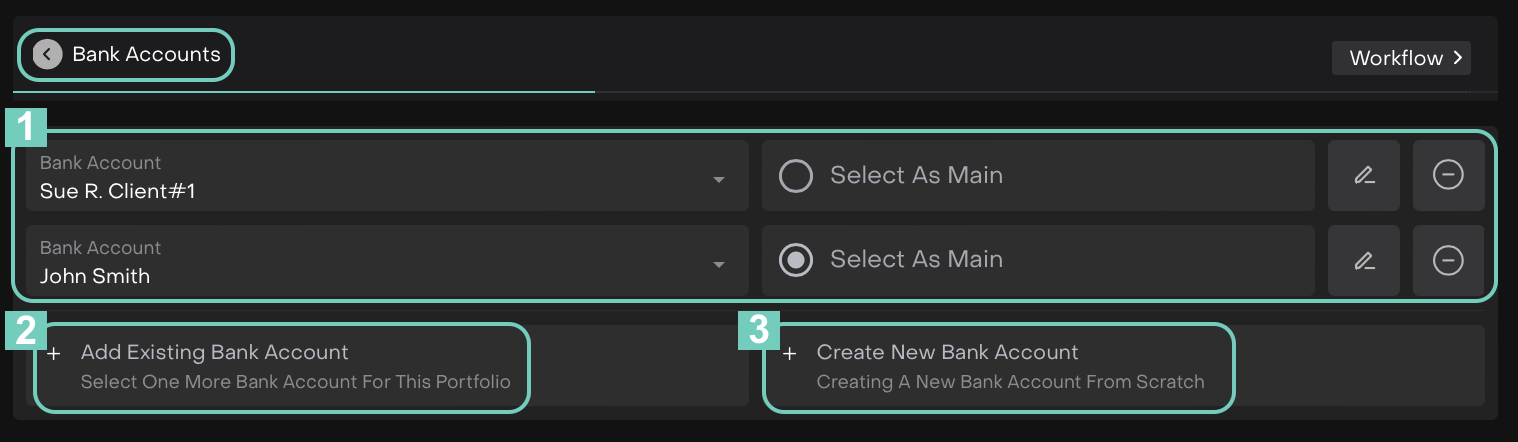

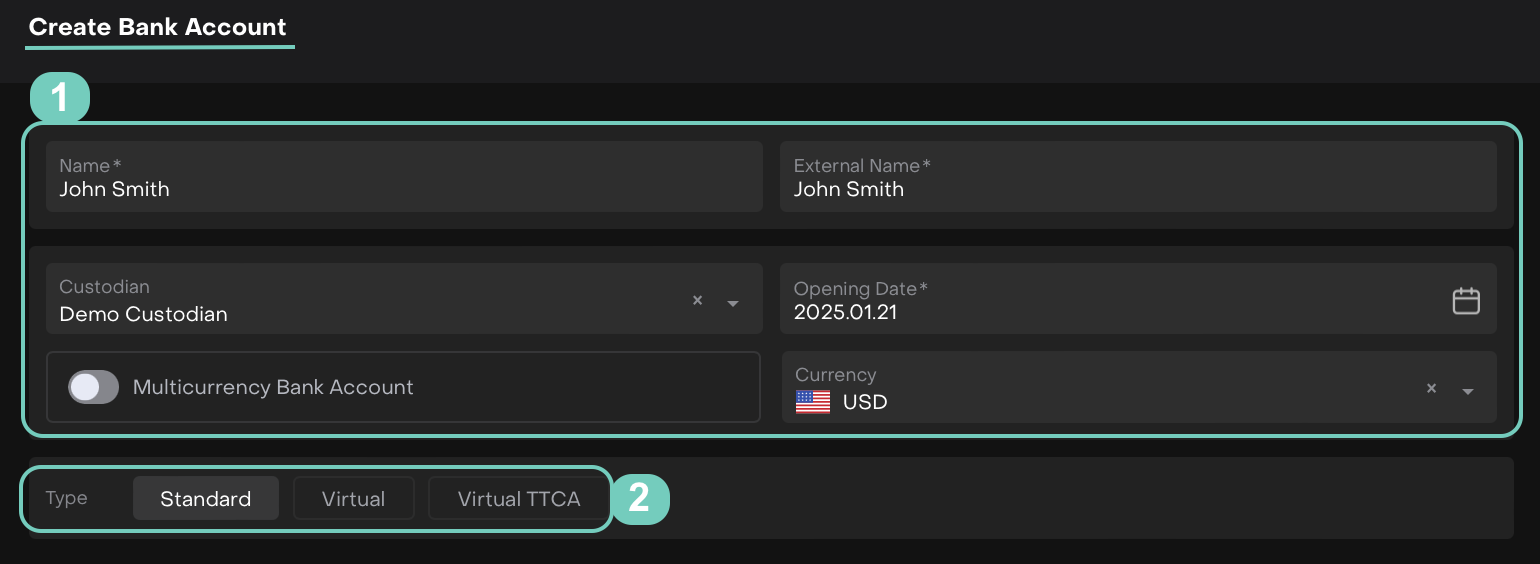

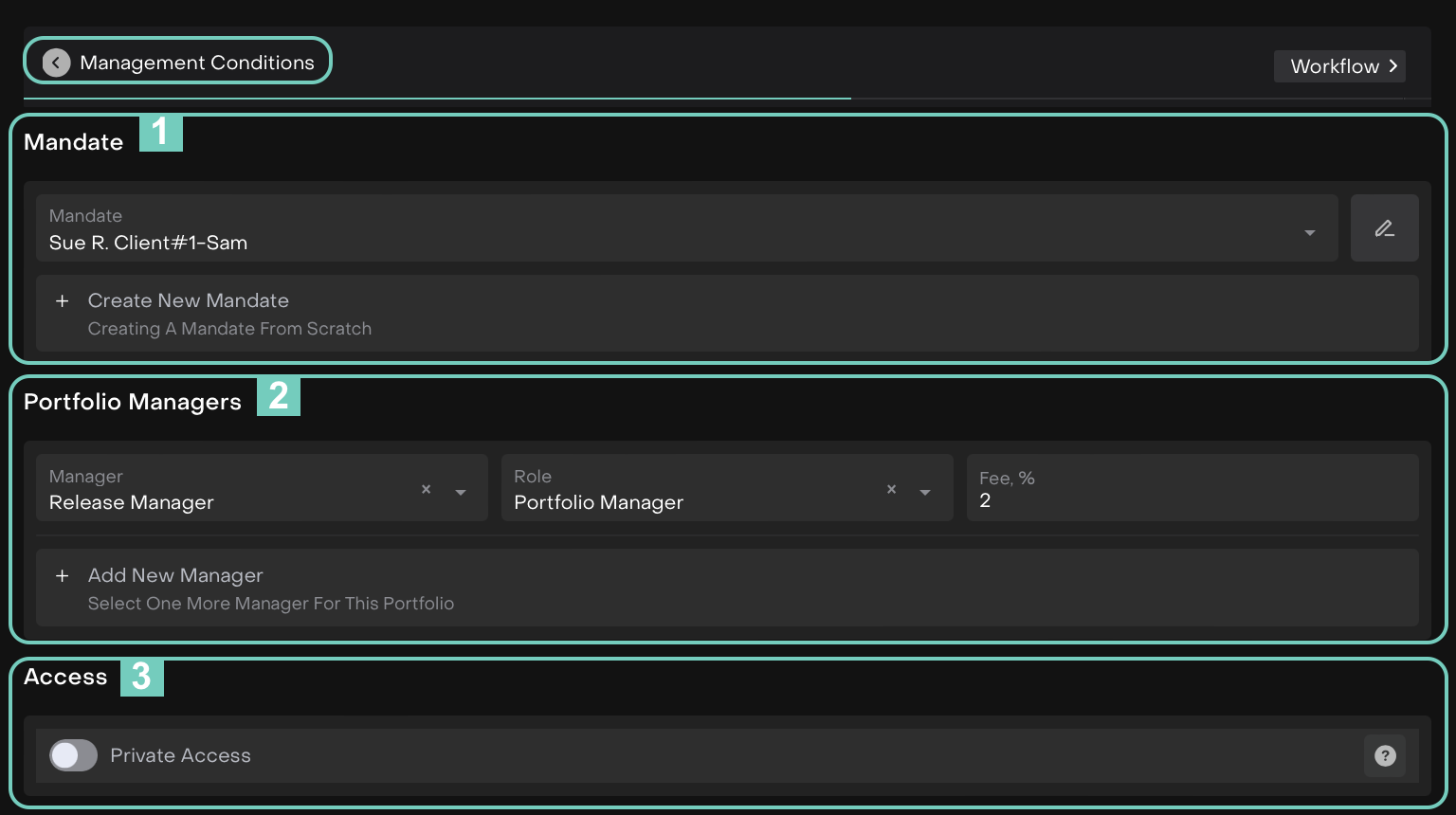

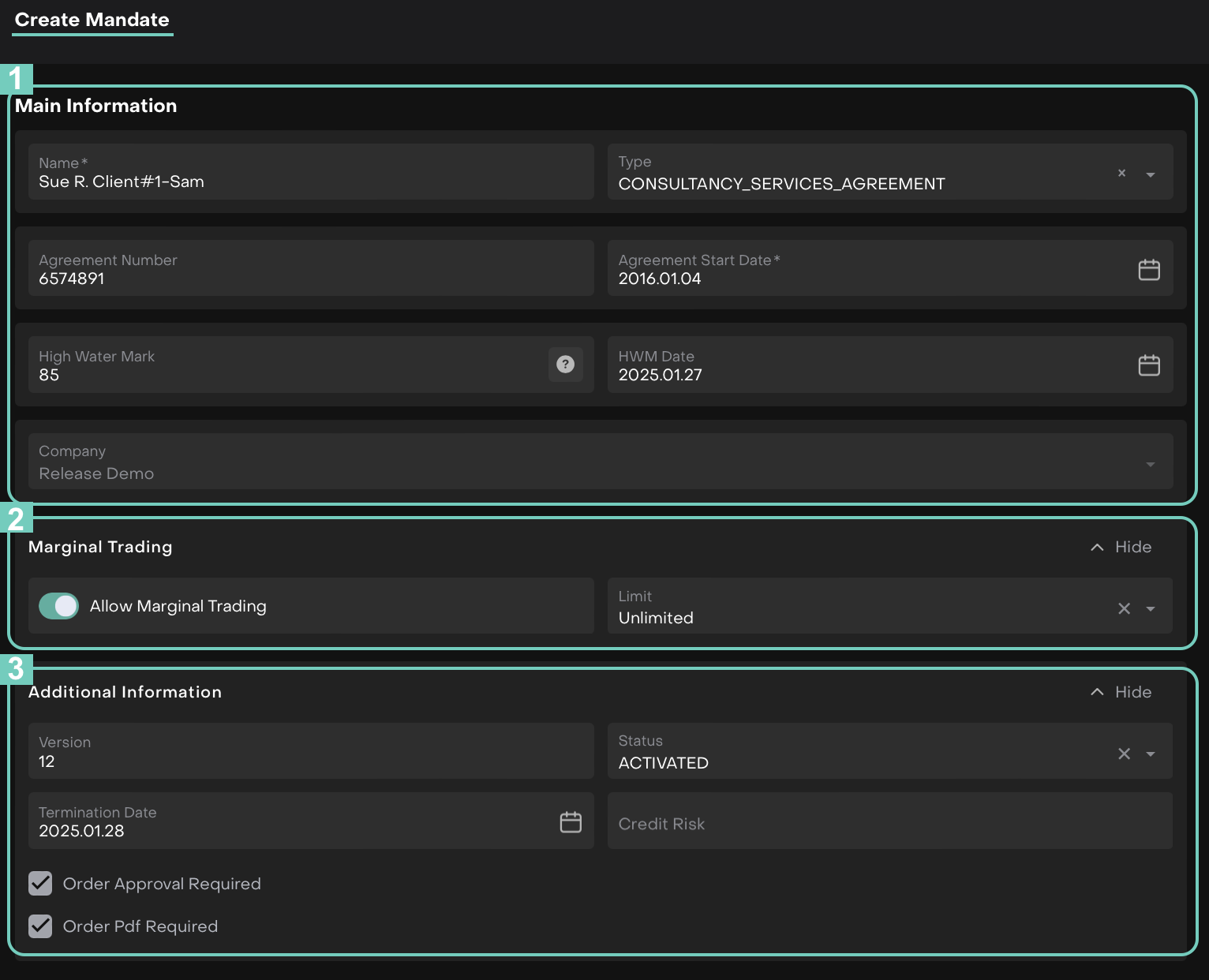

Mandate | Bank Account |

|---|---|

A contract between you and your service provider, where all terms, conditions and rates are clearly defined and agreed upon for the provision of services. | The account opened by the bank or custodian, where your financial investments are securely held and managed within your Client Portfolio. |

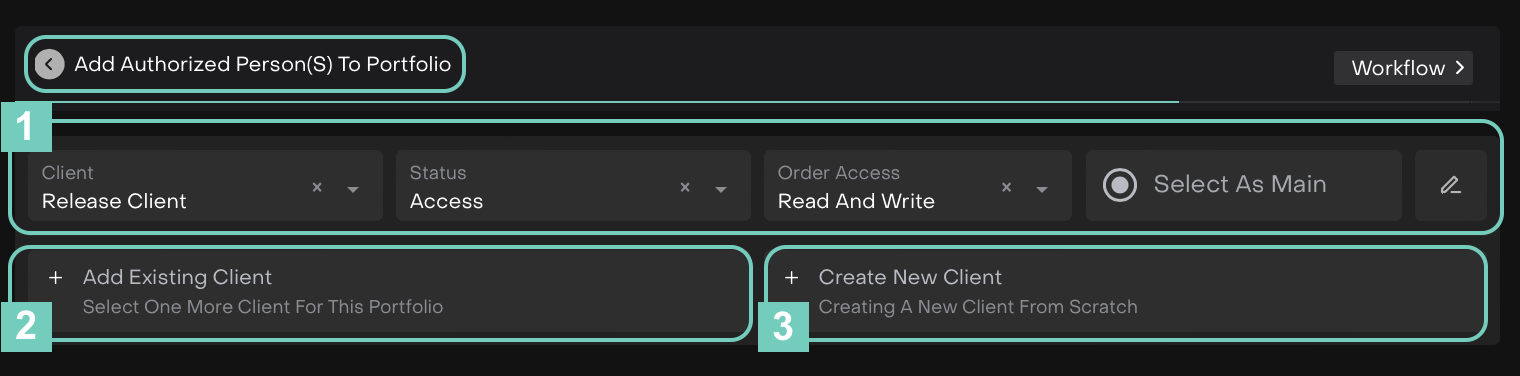

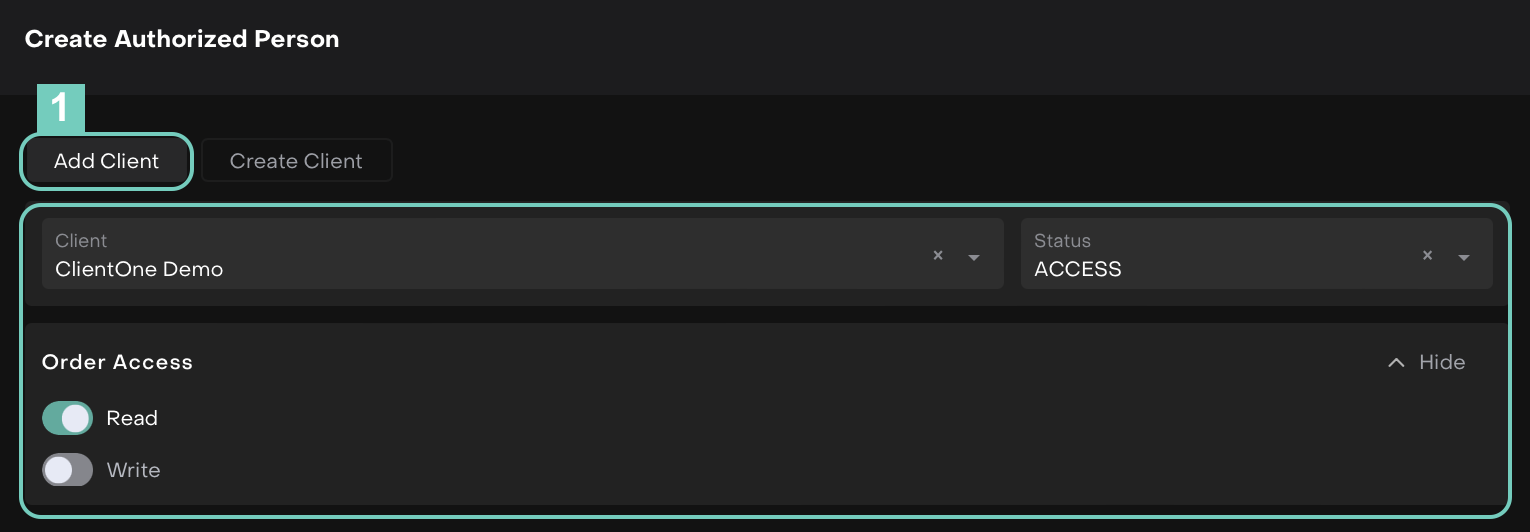

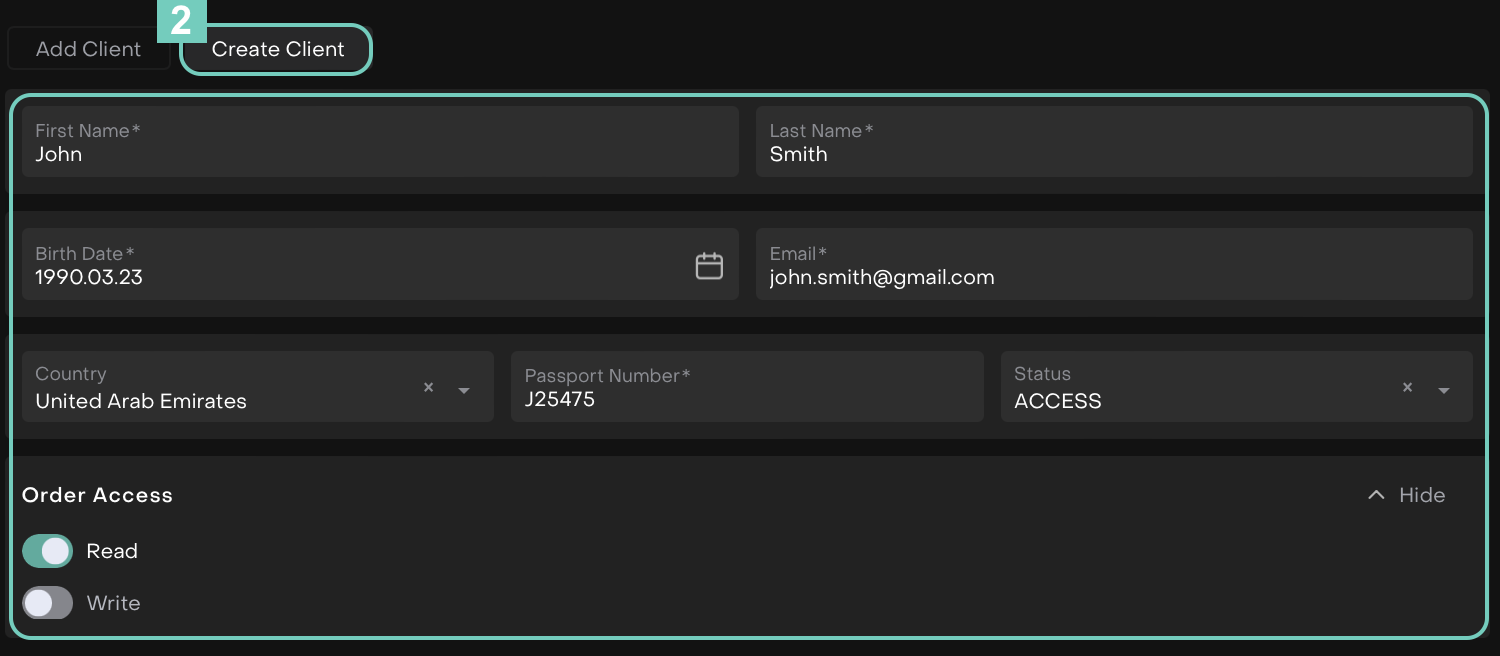

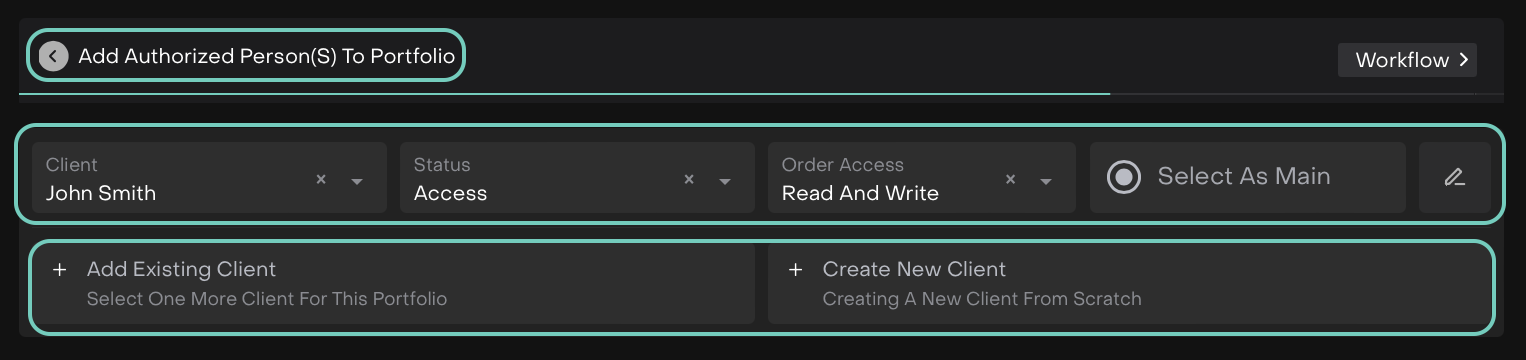

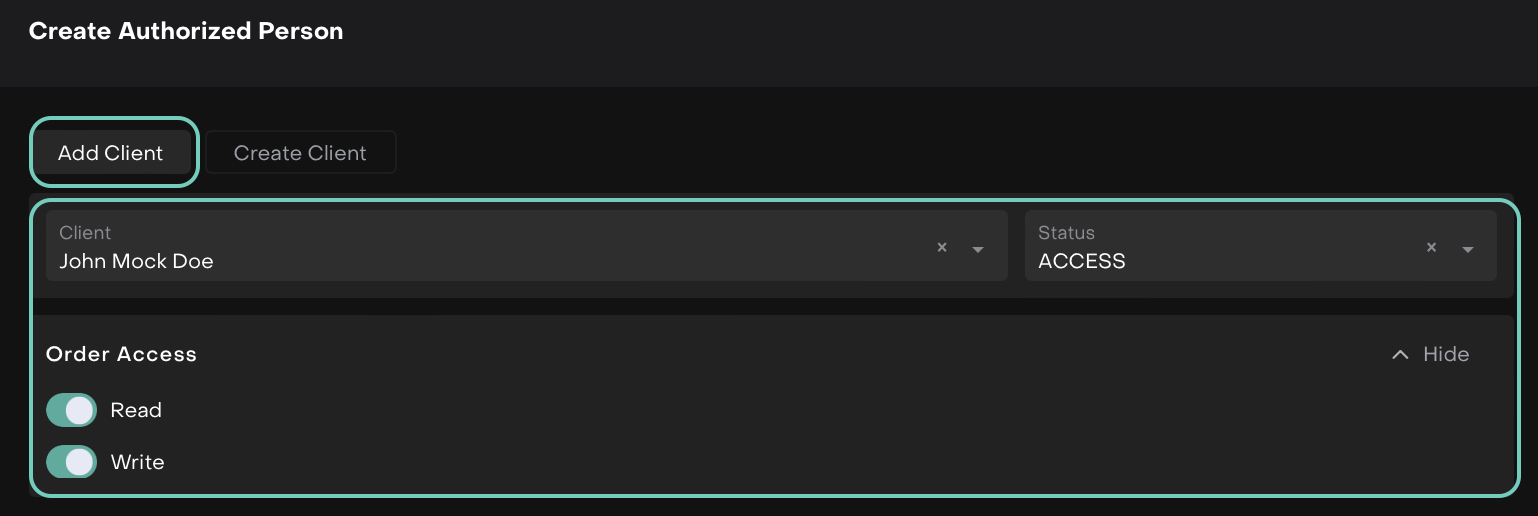

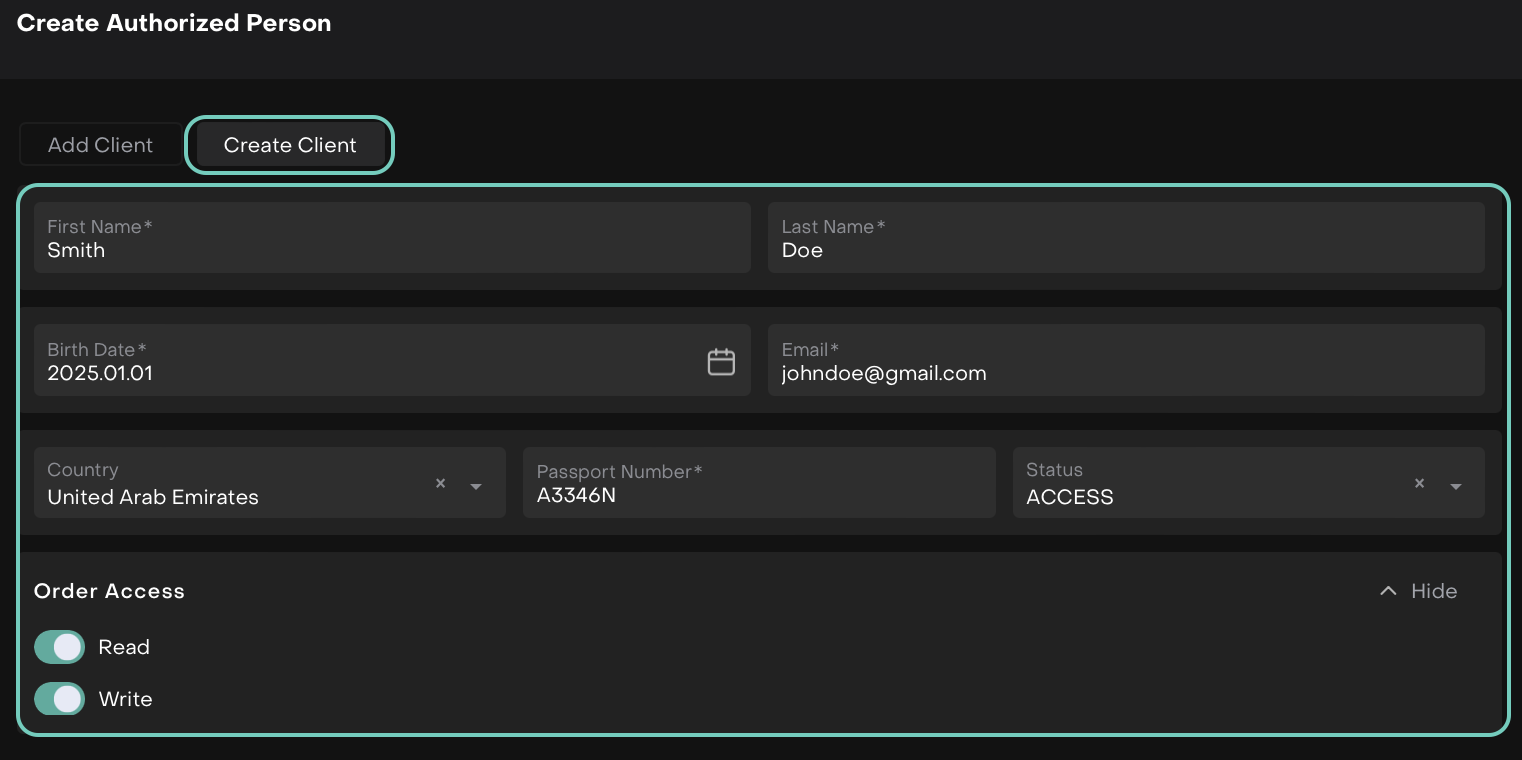

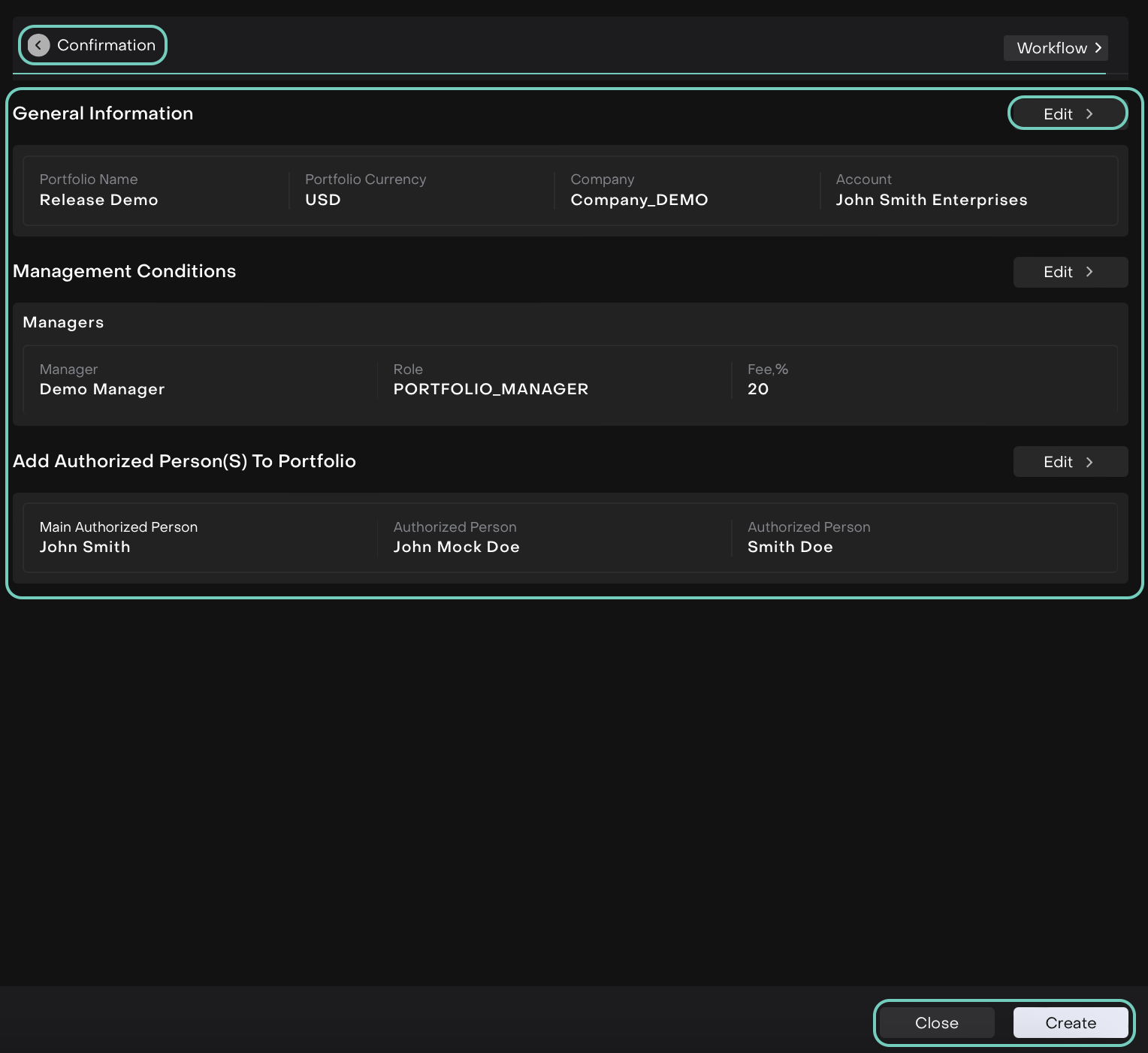

Authorized Person | Private Access |

An individual who has been granted the authority to view or manage your Client Portfolio within the parameters you have agreed upon. | This setting allows you to restrict the visibility of your portfolio, ensuring that only authorized individuals, such as the portfolio manager, can access it. |

Screen Walkthrough Video Guides

Standard Portfolio

Virtual Portfolio

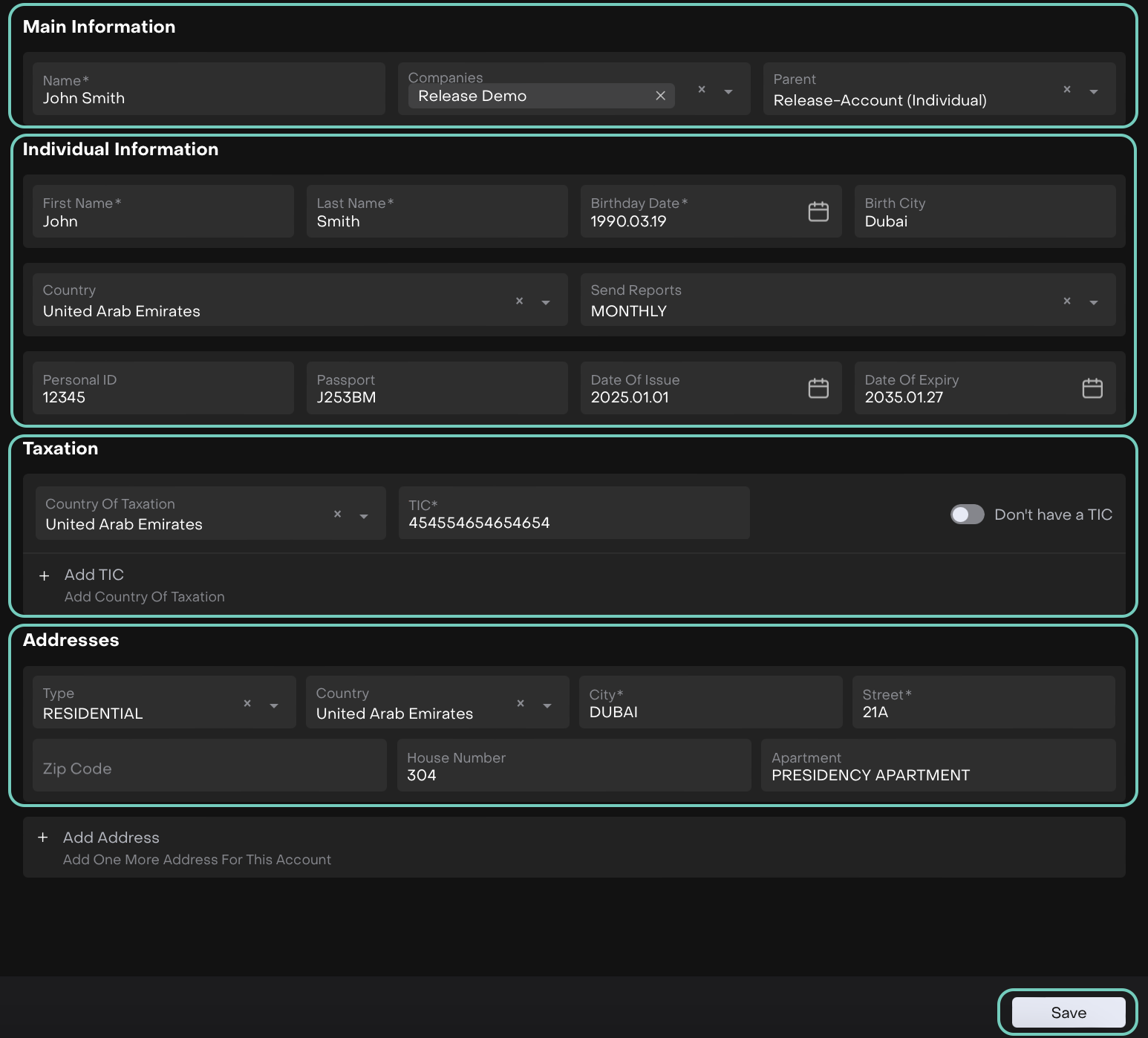

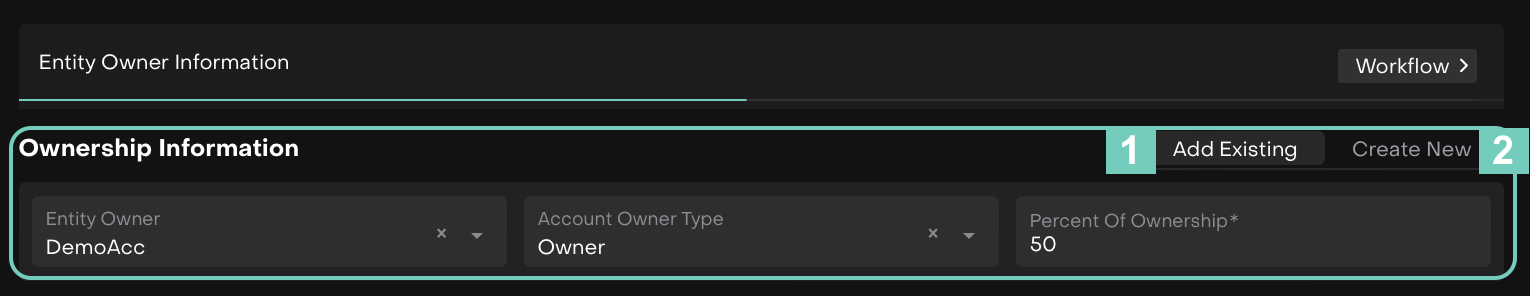

Detailed Step-by-Step Guide on:

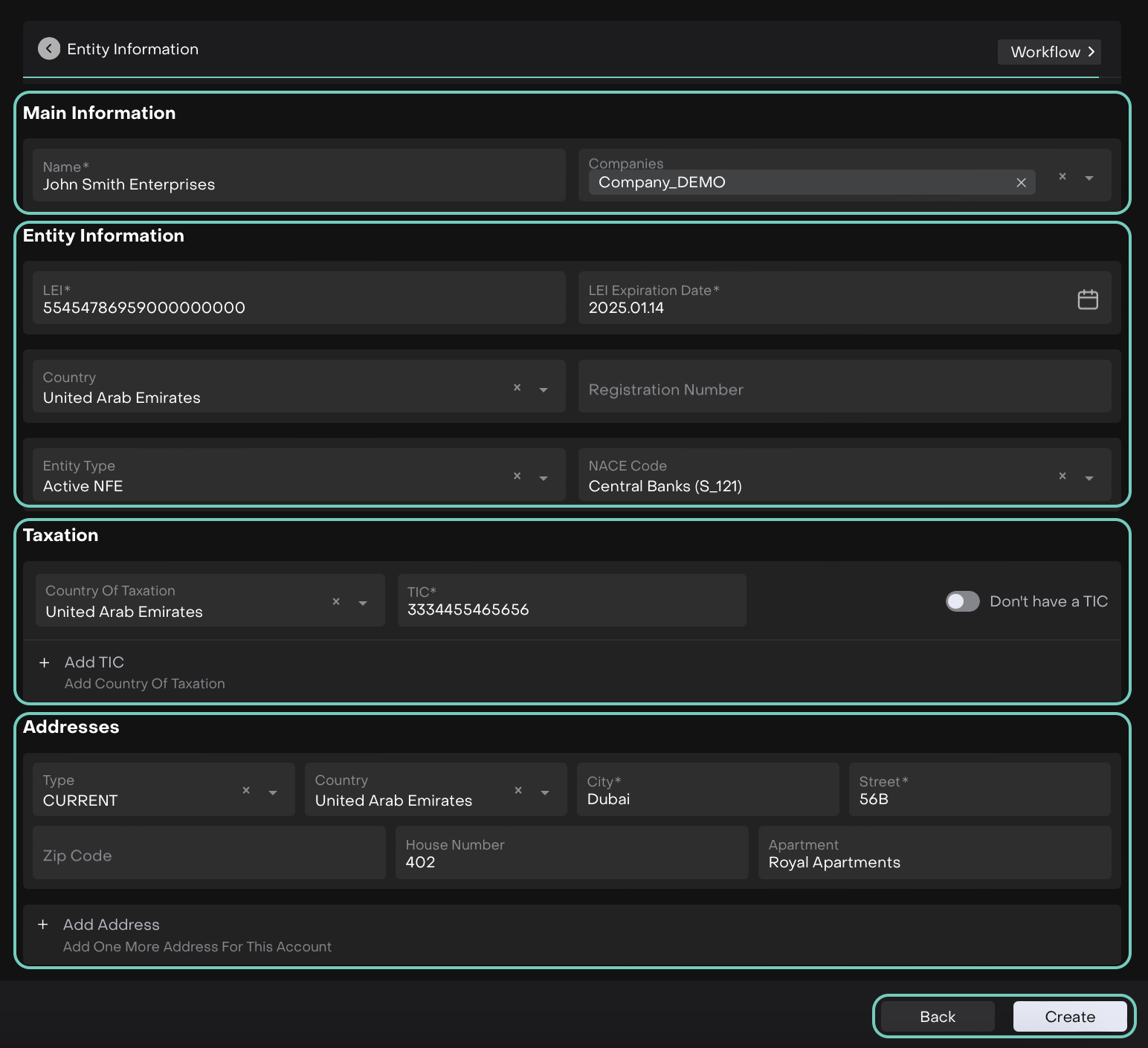

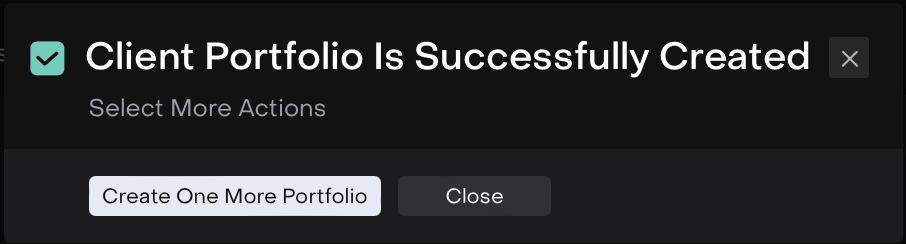

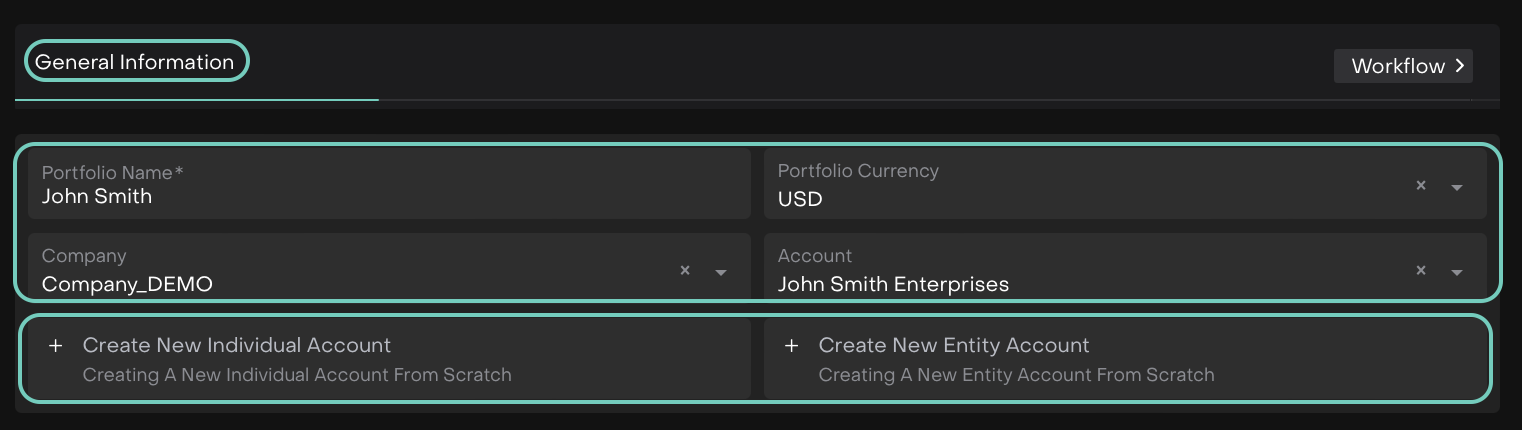

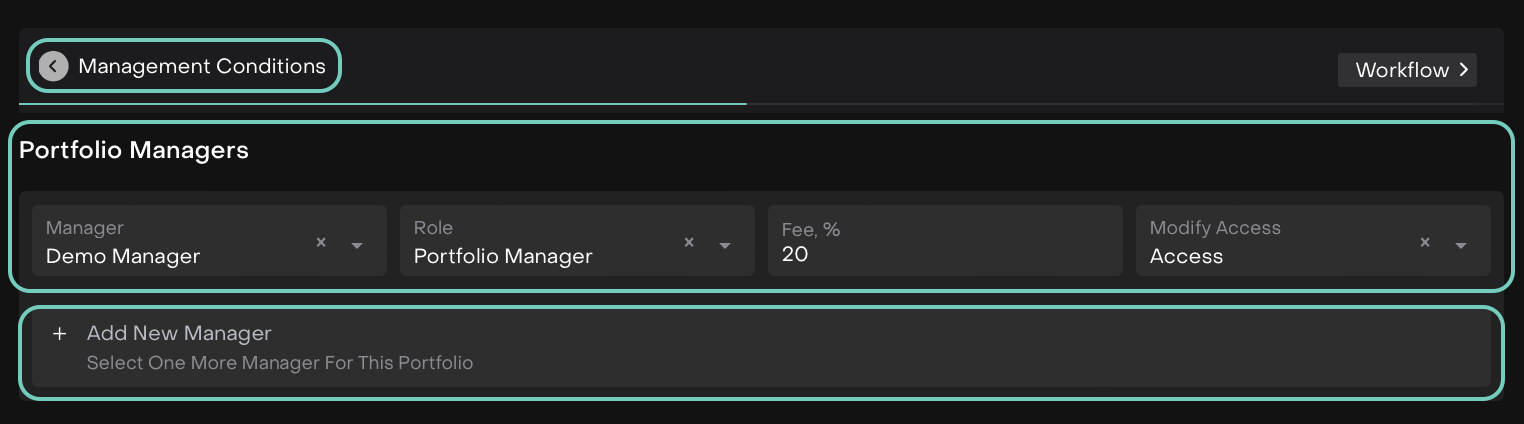

1. How to set up a Client Standard Portfolio

2. How to set up a Client Virtual Portfolio

👉 To Learn more on Portfolio types, visit the main page.